Why Timing the Bitcoin Market is a Useless Pursuit

There are some who think that the easiest road to earning money in Bitcoin is by trading back and forth, timing the market. They assume that they can outsmart the market.

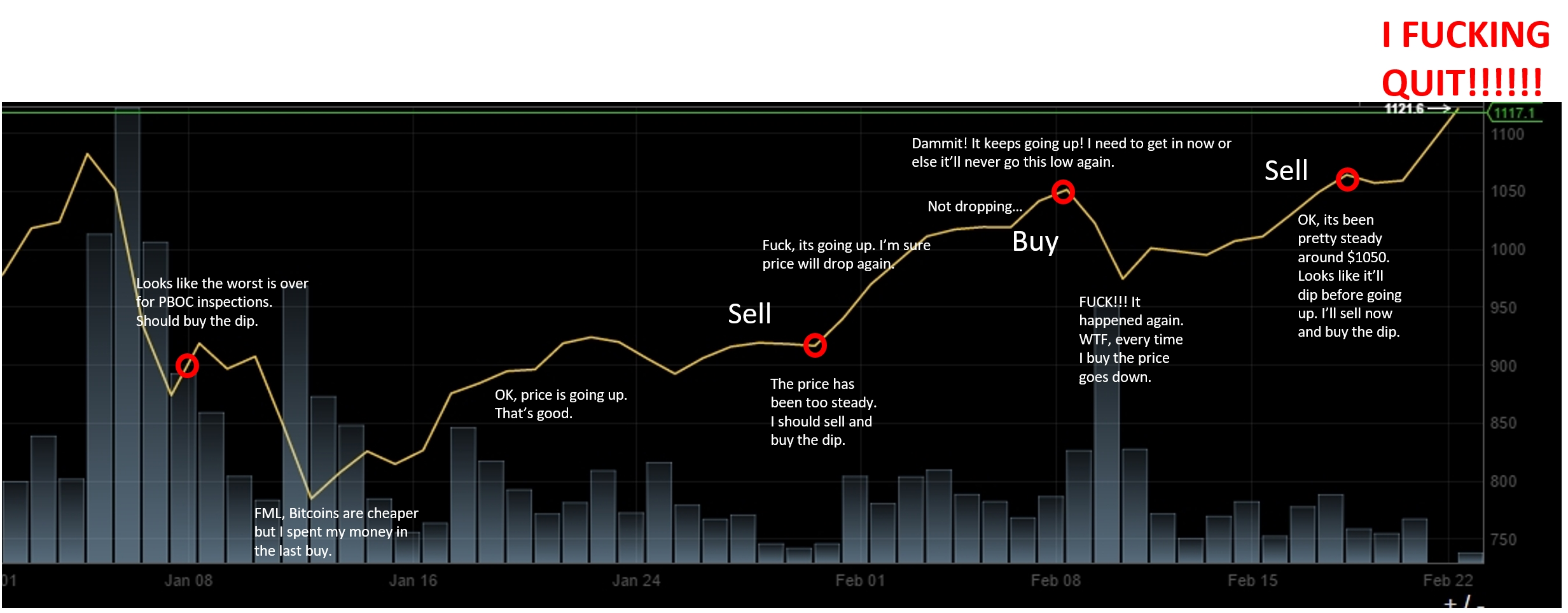

I spotted this chart yesterday afternoon on /r/bitcoin, and it reminds me of the struggles of the big spike in 2013.

credit: /u/zldtpwjd

The problem in volatile markets is that there is no guarantee that you will be able to get in a trade at a target price. When markets are flat, you can target a certain price for a trade in or out and count on the market hitting that price eventually. But once the train leaves the station, it's gone and you missed out on that price move. If you jump back in and try it again, you're dooming yourself to a cycle of misses like this guy.

I definitely advocate a steady buying position, setting a budget and buying the same amount on a schedule. For me, I've been buying $20 a day for about a week and a half. It has obviously worked out for me in the short term, but this method should ride out the volatility through the ups and downs. My long-term goal is just to amass a decent position in BTC and hope for an upward trend in value and utility.

So take this as a PSA. Don't play with trains when they're headed to the moon.