The price of Bitcoin hasn't been fun, but have some perspective

Over the last 3 months it has been downright miserable owning bitcoin as well as just about all cryptocurrencies.

They have fallen from a high of around $900 billion in market cap to where we stand currently around $260 billion.

That is roughly a 70% drop, ouch!

However, if we zoom out a little we can see that things are not quite as bad as they seem.

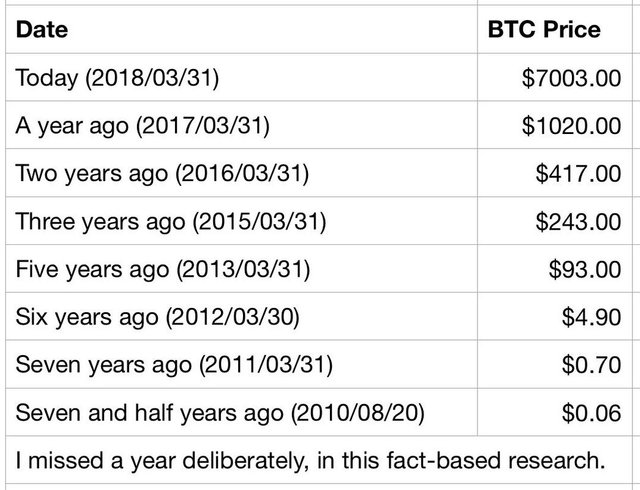

Take a look at this chart put out by the CEO of Binance:

(Source: https://twitter.com/iamjosephyoung/status/980089115294121984)

It's a price history of bitcoin on March 31st over the years.

As you can see year over year over year, prices have mostly trended upwards (though a few years have been omitted to help make a point).

Now for some perspective...

I think this quote sums it up perfectly:

"Never have I seen a market wherein investors cry over a 600% annual gain."

So yes, over the last 3 months, the price action has been downright miserable, but for those that have held on for more than a year, they are still enjoying a 600% gain.

Hang in there, once we get passed tax day things should start to turn around. Plus there should be some nice catalysts in the second half of this year in terms of more clarity on regulations and also with the lightning network being implemented.

Not to mention Steem finally launching SMTs as well as communities.

Better times ahead.

Stay informed my friends.

Follow me: @jrcornel

If you haven't studied finance and don't know what the "efficient markets hypothesis" is, then you should not be speculating in cryptocurrencies. Your approach to cryptocurrency speculation should be patterned after your approach to taking your life savings to Las Vegas with dreams of striking it rich.

The fundamentals of the determination of the price of capital assets like cryptocurrencies is not yet well understood even by mathematical economists who have studied the theoretical issues for years.

Good points. It is all based on supply, demand, and hype. Though some technical and seasonal patterns do tend to repeat themselves, though not always.

Technical analysis was completely discredited in the 1970's by the emergence of the efficient markets hypothesis and dozens of empirical tests published in refereed journals such as the Journal of Finance. I am not current in that literature, but when I studied the field at the University of Chicago, the empirical work revealed some minor anomalies but otherwise failed to reject the hypothesis that all available information is quickly (nearly instantaneously) incorporated into the current price.

The "chartists", as they are called, are making a comeback in places like steemit, with analyses that are laughable to people trained in finance but who appear to have large followings in places like steemit.

The basic problem with technical analysis, and in particular with analyzing charts, is that if it worked, the smart money (institutional investors) would within minutes move massive amounts of money into or out of a particular asset in order to exploit the opportunity. Such actions would immediately eliminate the opportunity.

This is an example of a general proposition in economic theory, which is that there are no unexploited profit opportunities.

If you want to gamble with your money, take it to Las Vegas. At least there you can stay in a nice hotel, eat good food, and gawk at pretty women who smile at you while you throw your money away.

Laying down the cold hard truth. I like it.

"Get rich quick" schemes usually work very well... for the people who sell them or have a stake in promoting them. Fools rush in.

I'm not making a prediction. Just commenting on the current character of the market.

@ideafarm

Although I'm in agreement with most in your statement I cannot agree with leaving your money in the hands of "financial professionals".

Most of the youngsters that made millions in bitcion did it without any advice from a financial professional and most financial professional out there won't give you sound advice or make you money. If you know of one that actually makes you money let me know.

Agreed. I don't even open posts like that.

And do a lot of research. One of the best posts I've seen is one by @lukestokes - Did You Know You're Part of a Financial War?

The most interesting part for me in that post is a source article that was written by Super Crypto on the Medium platform - 4th Dimension: Bitcoin-Manipulation-Cartel — Price-Suppression is their Goal which explains the dip and pulls it through to Gold in Silver. This, for me, is by far the best explanation of the current situation because in the real world (one outside the programme) Gold & Silver is the only true money out there.

Very interesting read if you have the time.

Sorry for being unclear. I was saying that you should not be speculating in cryptocurrencies if you have not been trained in finance and you do not know what the "efficient markets hypothesis" is or what the Sharpe-Lintner capital asset pricing model and the Black-Scholes options pricing models are.

I'm not making any predictions here. Just warning people to not get suckered. I haven't yet seen a single analysis here of cryptocurrency market prospects that is worth the paper that it's printed on.

History tends to repeat themselves forming trends over time. Bitcoin has fallen 80% on five seperate occasions, there is no reason to believe there will not be a 6th and it’s time to load the boat because then there will likely be another 50X gain again.

Headed lower still.

If you're not a financial professional, you should not be speculating in cryptocurrencies (or in any other asset). Persuading amateurs who do not know what they do not know to purchase substantial amounts of, say, Bitcoin, on the expectation that they are going to get rich, is just as much a sucker's game as the promotion of penis enlargement cream (and the many other scams) is on Fecesbook.

What? Non-financial advisors speculate everyday and do quite well, in fact some outperform major “financial advisors”

I’m not sure what you are getting at, basically your saying people who arent financial advisors shouldn’t buy stocks, which is dumb.

Very well said. The crypto market is fairly new to understand this its behavior, which is what makes it even more unpredictable.

I am excited by the emergence of this technology and see nothing wrong with holding small amounts of crypto in your portfolio, mostly just for fun. Rather than investing MONEY in this technology, the real payoff will come to those who invest TIME to study its emergence and development. Being involved early, doing your homework so that you have a thorough familiarity "from the inside", and having the intellectual aptitude to really understand what is being done, can give you access to "inside information", which you can then use to speculate successfully.

Successful speculators don't follow the herd. They lead the herd. To do that, they must somehow acquire inside information that has not yet been incorporated into the market price.

The thing is that the majority of the people currently invested in cryptocurrencies probably got in over the last 6 months or so, and most of them now have a loss - and probably a very large loss.

Thos are the people who are "crying", not the people who bought 1+ years ago, and that's what sets the market sentiment.

Yep, very good point. That is why it is important for those people to see numbers like the ones posted above.

I completely agree. It’s easy for those who have held for years to say that we are still 600% up over12 months, butso

Many people jumped in at the end of last year and then got scared by the drop so dumped, locking in their losses. They will prob buy back in near the next top and repeat the process next time but that’s why there is so much negativity!

Probably? They will definitely be chasing it higher next time after selling for a loss and or puking the low. That is how markets work lol

Exactly. Some things never change!!

WoW jrcornel, this kind of rubs in our face that we all missed the boat. LOL

you are right its just i am new to crypto but still in profit so lets hope its price rise.

Hi @jrcornel

It is the #warofthecurrencies and the more we make people aware of this the more we, as crypto investors, will gain. The onslaught continues!

( )

)

Agree with you! We should stay informed.

I wonder how FED decision to stop quantitave easing and start clearing its balance sheet at 10 billion USD per month (in a beginning) will influence cryptocurrencies. Were cryptos overvalued asset due QE and will drop to pennies or will they rise to the moon because of FIAT superinflation and money running into cryptos via ETFs?

Altcoin market is flying! But the alts do look very over extended. Seems like many just trying to catch a wave on them and making some overvalued currently. Just my two cents tho.

inetersting thank you...

what you mentioned is all right, I think BTC could drop ore than 20%,, there should be a time for BTC to get down a bit so lots of buyers who are waiting to buy in the right time will enter the market

I am starting new investments I am new little new

I will consider your suggestions