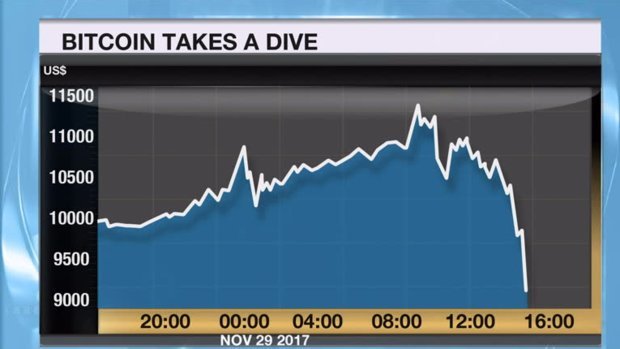

Regarding the crash in BTC yesterday, did somebody know something?

Yesterday BTC saw some pretty volatile trading, even by its standards.

After reaching a high just under $11,500 per coin, it rolled over and dropped like a rock all the way down to roughly $8,500 per coin.

A $3,000 drop in less than 2 hours from peak to trough.

A move that had to give even the strongest bitcoin bulls some pause.

The big question is, what caused it?

Was it just a market correction in a market that was likely overheated and pretty frothy to begin with?

Perhaps.

But something sparked that cascade... what was it?

There are a couple rumors floating around as to what might have caused the drop.

The first one had to do with a DDOS attack on both Coinbase and Gemini roughly at the same time, which also seemed to happen right at the same time the price of bitcoin was plummeting.

What remains to be seen is whether the price was dropping because the exchanges were shut down or were the exchanges shut down in response to massive customer activity that they simply could not handle as the price was plummeting?

Questions that we are yet to get definitive answers too.

Another possible cause could have been something a little more akin to insider trading.

You see, a potentially very important announcement came out late yesterday, especially for those who haven't been paying taxes on their bitcoin trades over the past couple years.

Check it out:

https://techcrunch.com/2017/11/29/coinbase-internal-revenue-service-taxation/

The IRS won a lawsuit against Coinbase where they are going to have to turn over trading history and tax records for accounts that have been trading amounts over $20k worth of bitcoin.

Something that could potentially be very significant judging by the number of accounts that likely have not been paying taxes the last few years.

The interesting thing about this news is that it was made public just a few hours after the big bitcoin crash, which leads me to speculate...

Did somebody know this was coming out and was attempting to get out ahead of it?

And it just so happened that all the increased trading volume was too much for the major exchanges to handle, which shut them down and only exacerbated the move?

Impossible to say for sure at this point.

Either way though, the price seems to have recovered and stabilized a bit for now.

The good news in all of this is that we finally figured out who the real Satoshi is:

So there is that.

Stay informed my friends.

Sources:

https://techcrunch.com/2017/11/29/coinbase-internal-revenue-service-taxation/

Image Sources:

https://twitter.com/TechCrunch/status/936021201138327552

https://twitter.com/ReformedBroker

Follow me: @jrcornel

I know bigger players have been trying to get it for a while and when they do, they will pull shit like this. That is why I never wanted ETF's approved. That is one of the main drivers of gold manipulation.

I never see more than 3 btc to anyone. And I get calls for 100 to 400 all the time. My resonponse is, "this is money for the little guy, not for big traders"

If they want a lot they can buy 600 per day at 600 different cafeterias, sitting with 600 people buying one at a time.

This is why it crashed...

Posted this elsewhere but relevant here:

When markets are understood, the idea that everyone can make money is not only inaccurate but impossible and laughable. Everyone making money means there is no market, because who would be taking the other side of the trade?

It is no mistake that individuals begin to like the same sorts of fashions that everyone is wearing. In a quest to change, the majority of society ends up changing together, moving towards similar desires and away from similar dislikes. Therefore, what the market is offering provides the exact thing that will lure the trader into the crowd.

For example, someone who has little experience investing wants to get involved because everyone else in their social circle is, ads are all over tv and even their nightly newscasters are talking a lot more about how the market is so good. In this environment you can be certain there will be lots of “helping hands” to welcome this investor to the crowd, teach them to be a part of the crowd and initiate them into the world of the blind leading the blind.

The market is unlikely to reverse to any significant degree until almost everyone is on one side. Which means almost everyone who joined that party late is going to lose. A bunch of people may just decide to wait, but so will the market. And if people are divided then the market will move in a ranging fashion.

People are the catalyst and without people to create an extreme the market won’t hit an extreme and reverse–remember the market does not act on its own, we…the people… are the market. In other words, the boom and bust cycles will not end. We progress and regress and then progress again.

Until almost everyone is in the trend, it won’t stop. The trend will keep going, enticing more people in, and when it reaches critical mass (which it can’t do without pretty much everyone on board) a reversal occurs. This change in fortune (for the worse) causes concern and then panic as a full reversal occurs. And as the mood of society continues to grow darker people feel more hopeless and give up fanciful notions of making money with crypto and so it will continue to drop.

In other words, the very thing which lures people in droves (big returns) ironically means that most of those people will be on the losing end of that exchange. In another ironic twist, when people clamor into the market all at once out of greed and a belief that a new era has begun, they bring about the exact opposite. @pawsdog

Wholeheartedly agree with this. But the question is, is now the right time to be applying this graphic? Now, this picture of "valuation phases" has been circulating around internet/reddit since BTC hit 1700 for the first time. 2000 for the first time. 4500.. etc.

And even then, the same reasons as you've outlined have been used to explain the correction. I'm by no means discounting the merit of what you're saying. It's 100% true. But I guess the conversation of "who is everyone in the trend?" is a matter of perspective. And the answer to this question, is really what drives your forecast of when this party will be over.

From the loosest understanding of investment participation, there's only a small fraction of people who have heard of, no less, invest in crypto. So there's lots of room to grow. Now if we minimize our window of "everyone" to the financially literate? People who like speculative investments? People who just like to gamble? Then I think we are definitely approaching the mania phase - though I certainly don't hope so.

It would seem that the IRS is going back as early as 2013 to look for capital gains taxes to apply to the Bitcoin community. I believe that is where the crash came from .

Here is a link to my post https://steemit.com/tax/@sponge-bob/first-they-laughed-then-scratched-their-heads-then-banned-it-now-can-we-please-tax-it

Great words. Ironic the power of bitcoin in the hodl perspective. Non traders represent quite a large part of the crypto market. Mostly they are those who bought early for a laugh, or on the almost gen x premise that as governments probe lives more and more, peoples desire for anonimity increases.

I bought myself 30 000 bitcoins for my 30th birthday on october the 8th 2009.

My shots at the first bar that night cost more.

I wrote down id details on a scrap of paper and chucked it in storage. Imagine my surprise in june when i cleaned out my storage and found that paper and keyed in the wallet address to my computer! Your comment hits home to me because the frantic flat earthers who see great returns as the power of crypto currencies are those who diminsh its nature and its power. Greed and desire to be on trend for trade returns now are causing rapid measures by ass holes to regulate something that, by virtue of its inception, is an altrustic technological caveat to privacy.

Things like hyip and mining scams appeal to these quick fix "get in before the bubble bursts" luddites. While forcing even more scrutiny, they are getting shafted of their dividends. Creating the bubble they fear most.

I have no computer coding knowledge but have spent 2500 btc purchasing scripts things from the scammers. The algorithm and strategies, without the ponzi menalities are brilliant. My goal is to build a blockchain "social protectorate" for people to generate enough passive income anonymously to address their traceble government or corprate debt.

The transfer of digital asset to cash is so easy now, they can direct debit their debitors and gradually gain happiness.

I need help to develop this further. But ill find it. The anomaly in the 300 or so people that are doing this is that they are aware of the value of the concept, not the trend.

As traders give away their satoshi for a grab at a quick fix when the price dips. The HODL crowd are storing en mass knowing that their privacy in the future will mean more than a buck on a trend.

Simple maths, lack of greed and patience may finally be the traits that change the world. If the collateral damage is trend jumping regulation magnets, perhaps their will be calm.

I really thank you for your post.

I actually had a great idea about such a coin this week which would generate passive income each month for the holders and would make sure everyone who joins new will have passive income in the next month. Like a huge open source ponzi that last for ever where everyone, EVERYONE can prosper easily at any time...

Well i have made a it student interested who will be doing project work about this with a few other students the next months. I plan to rejoin the evolution mid march, when i will be back from my meditation trip to nepal, stay tuned for more ;)

(DMD)

brilliant, and the current pattern and chatter on the streets is exactly that. I'm a firm believer in the technology, and been onboard for years, but when the fella changing your car tyres is telling you to buy bitcoin, mania has arrived.

yeah!!!

Totally agree, I was reading an article on a forum wherein users were asking if it was a good idea to take out second mortgages, or other low interest loans in order to buy BTC and then just use the profits to pay back the loans. At that point I know the the cult is enticing a bunch of people to drink the Kool-aid in order to ascend to heaven. Talk about being fucking irresponsible with your finances. Unless you have nothing to lose, are terminal and have no intentions of paying it back then I would not embrace getting loans to buy BTC.. lol

That is exactly what was being said during the dot.com bubble. Word for word.

https://steemit.com/bitcoin/@foxyfire/how-to-make-money-from-the-falling-bitcoin

Well said. A majority of the people who have invested or are interested in investing don't understand what they're getting themselves into.

This is true, its vicious in this market

@pawsdog, where do you think we are at overall for bitcoin and altcoin? My opinion we are no where near the steep climb. More likely around "media attention" for bitcoin and "take off" in altcoins. However outside forces like government enforcing taxes will definitely create blips along the way.

I think thee is still a lot to occur. I think we have to have a few catastrophic events along the way. Government crack down, price of mining and transaction fees, crack down, closure or some large conspiracy around Bitfinex.. There will be much more than hiccups along the way.. We are still in our infancy.. I'm not even sure BTC as we know it will be the dominant coin of the future. That said there is still plenty of opportunity to make money in this market, up down or sideways.

Where did you get this data. According to coin desk it did not fall below 10k

$10,977.69

1.09%

Today's Open$10,859.56Today's High$11,156.15Today's Low$10,705.13

Change$118.13Market Cap$0.184TSupply16,715,863

Comment is 2 days old.. not sure which data you are referring too..

Brilliant! Thanks for sharing, namaste :)

It's obvious that collusion and market manipulation goes on within bitcoin trading so I would not be surprised whatsoever if what you're implying in this article is true

Wait. Was there really a Ddos attack on Coinbase/Gemini? To my understanding it was just unprecedented organic volume they were experiencing that caused the crash.

Great question ...also the fact the a lot of new people are coming in buying buying in FOMO and then more advance investors start cashing out all at once

Finally! We've found Satoshi! lol

The simultaneous Ddos attacks are very interesting as I think we can expect to see an increasingly amount of manipulation / attempts at manipulation of BTC as it continues to threaten the established financial system.

Will be interesting to see if any big investors swooped in after the fall in price and maybe give us a clue as to what may have transpired here. The quotes by Jamie Dimon effecting the price of BTC and the subsequent purchases by JP Morgan certainly spring to mind.

Thanks for this post, very interesting

I just knew Satoshi was hiding in plain sight ;)

Bitcoin is just an absolute Beast. This coming year is going to be such an enjoyment to watch. With wall street creeping in this is going to go down like a bad prom date I can see it from a mile away. I don't know how much I will buying after the first couple months of the year. I've been buying at the beginning of each year for a few years now and it hasn't failed me yet.I use all that christmas money on crypto. It last me all year that way!

The truth behind the price falling was nothing....

People got scarce of price rising suddenly and they got panic of price falling then they began to sell some of bitcoin which was cause of fall graph. Now price is picking on average range nothing to panic or another bubble story. Bitcoin will live long. Bankers are crying they are panic they falling. ✌✌

Lot of people probably just taking out the gains they earned from buying last year or earlier. I can see if a bunch of people decide to sell to buy something that it could look like a fix... it could just be a bunch of profit being taken out and when that volume sold off the price jumped back up. If you bought at under $1,000 and sold at $11k then again it is this up and down that lets the day traders play. I feel sorry for they guy who just bought at $11k and then looks again and price dropped oh man that would have sucked but as we know it went back up so they will have to get use to the tide or jump off the boat.

The coinbase situation doesn't affect everyone trading more than $20k on coinbase, it is specific to those users trading above $20k between 2013 - 2015. Only about 14,000 accounts will be disclosed. Doubtful that this was the cause, especially since it is actually more of a victory for coinbase than loss when you think the IRS initially wanted access to every account that traded between 2013 and 2015.

Yes good points. I didn't go into the exact details in my post, but left the link up there for anyone that wanted to dive in. I did read that Coinbase felt it was a partial win for them, though I am not sure I would go that far. I don't think they were ever in danger of having to turn over ALL records... but maybe that is just me being optimistic. :)

Thanks for pointing these points out though!

Figured I would help out those too lazy to click the link ;)

Yeah, the IRS trying to get access to every account was a BIG reach for sure. If the courts allowed that to happen they would have opened up a huge mess for every single exchange, crypto or fiat, in the US.

Personally I think this could be a big move in furthering the legitimacy of Crypto in the eyes of everyday people. At some point regulation is going to catch up and I think it is going to give a lot of people that are wary of crypto a better feeling that this is a legitimate asset class.

Yep, my thoughts exactly as well. :)

There are so many weird things that happen in the crypto world. Like STEEM Dollars spiking to over $2. Was that a semi retarded whale who didn't know the difference between STEEM and Steem Dollars or what? And now it has stayed well above $1.

sometimes I feel like we can't predict we just have to react to the madness.

I think that spike in SBD was due to Upbit adding both Steem and SBD to their exchange. My guess is that since SBD has a smaller float, it popped the price more when they filled their inventory coffers than it did for steem. Regarding the many other times SBD popped... I have no idea :)

That right there got me cracked up :D thank you

I wonder if the maintenance performed on Coinbase - the largest exchange for new buyers entering the market with fiat - had anything to do with the lull.