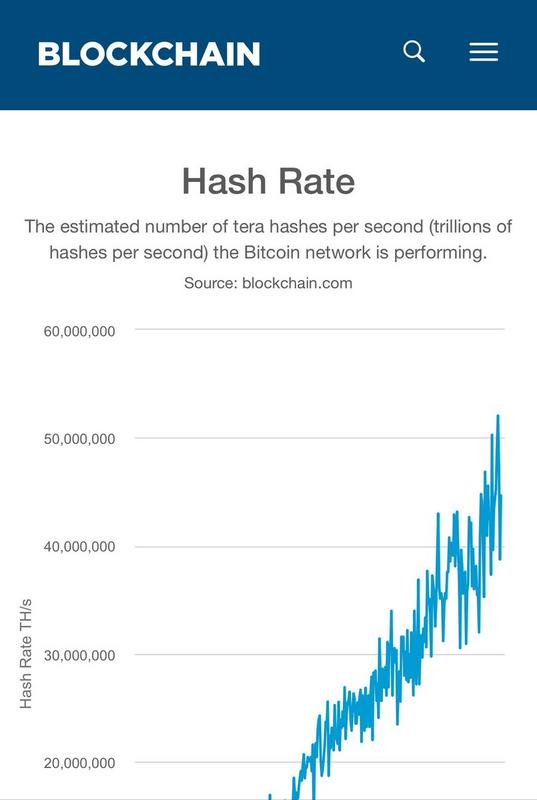

Bitcoin Hashrate hits another all-time high, will prices follow?

The hashrate continues to climb for ol bitcoin.

We are approaching levels not seen since, well, ever.

We are now over 80,000,000 TH/s.

That is getting close to 3x where we were in December.

Our friend Max Keiser says that prices will follow the hashrate.

(Source: https://twitter.com/maxkeiser/status/1027323211720151040F)

Why is that?

According to Keiser the price of bitcoin will follow the hashrate.

The hashrate is a sum of all the computing power being put in to mine and secure the bitcoin network.

According to him, as those resources continue to go up, the price will go up as well.

Right now, prices are playing catch up.

As the network becomes more and more secure, that will increase investor confidence, which will help people feel better about investing in bitcoin.

Again, this is all according to Max Kesier.

Is this really true?

I am not sure, I am having trouble finding any compelling evidence to suggest that bitcoin prices follow its hashrate.

However, if you look at a chart of the hashrate since inception, and the bitcoin price chart, they both pretty much trend from the left to the right in a 9 year bull market.

The only question is whether hashrate causes prices to go up, or whether prices going up causes the hashrate to go up.

I would actually argue the latter makes more sense.

As the price goes higher the more profitable it becomes to mine bitcoin. For that reason, more and more miners show up thus driving the hashrate higher.

I actually think the hashrate is a lagging indicator and is playing catch up to the price.

Hopefully I am wrong and ol Max is right.

Stay informed my friends.

-Doc

totally agree hasrate goes up when the price of bitcoin is rising

i like max but i think he has got it wrong here

cheers JR

Max Keiser is wrong. As you point out, it makes zero sense to flip the correlation to causation.

However, if people think he is right, it will become a self-fulfilling prophecy that will add even more volatility to the market; Fulled by analysis rather than fundamentals.

Yea, I mean it makes a lot more sense for higher prices to cause increasing hashrates as opposed to the other way around as the higher prices simply attract more miners.

It would be interesting to see where he got his data from. I can't find much.

If you're going to mine BTC, you're approaching BTC as a mid to long term investor since it generally takes at least a half of a year to pay off the cost of miners. So it wouldn't surprise me if a big portion, if not the majority, of the mining community are trying to time bottoms (before they buy miners and start operating them), when they perceive the best risk/ reward setups, giving themselves the best chance to come out profitable at the end of the expected profitability window (> 6 months).

If this is true, then more total hashpower joining the network is an indicator of a growing number of "a specific type" (the type who'd ever consider something like mining BTC, which is a very unique type) of people expecting bullishness in the mid to long term (6 months to a year/ year and a half...ish), which COULD be useful as a leading indicator of where price is going in the future, depending entirely on how accurate the aggregate (of those type of people) is as timing the bottoms.

My guess is that those who're interested in mining BTC in the first place are generally more forward thinking than your average BTC owner, more likely to see the bigger picture, probably more studied on what BTC is and where it is heading (technologically), etc, but does that equate to the aggregate of miners being a reliable indicator of where price is heading in x amount of time? I lean towards "probably", but I'm not aware of a way to reliably quantify whether or not that is actually the case (determining the strength of correlation between hashrate increase and price performance x amount of time beyond that point could be a starting point...).

Interesting take. Thanks for the input.

There are a number of miners that have already paid their upfront costs and simply turn the machines off and on depending on prices. Though as you noted there are certainly new entrants that may be trying to time things a bit more like you alluded to.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Thanks.

#newsteem

Awww, he missed one.

Actually, I see he missed several. Damn, that self-vote game is weak.

WRONG. He still has 6 hours to snipe them. :)

Nah, I heard he is jumping on the newsteem bandwagon. That stuff doesn't fly anymore.

Nice. Sounds like a stand up guy! I'm a sucker for a transformational story.

Haha well hopefully we can turn steem as a whole into one of those!

Let’s all hope max is right.

I sure hope he is. He is a bit crazy at times, hopefully he's crazy like a fox.

The combination of hash rate and the next halvening will be a coil to prop up prices for sure as supply will not only be limited but more difficult to mine!

Posted using Partiko iOS

The only question is... does hashrate lead prices or follow them???

I agree with Keiser, mostly because anything that requires more resources usually gets more expensive, and this is not different, the price will eventually have to reflect those extra resources being spent...

While certainly possible, I feel like the resources are just chasing the 'free money' in terms of bitcoin mining. The higher the price goes, the bigger the spread between the cost to mine and the coin itself which encourages more people to show up to play.