Bitcoin Price Analysis From a Long-Term Perspective (English/Turkish)

As the oldest crypto currency, Bitcoin is the flagship of crypto world. Bitcoin still accounts for 41.7% of the total value of the crypto currency market. Therefore, the price of Bitcoin is dominant on cryptos. Crypto currency prices are moving together under the leadership of Bitcoin. The price of Bitcoin does not determine the price of other crypto currencies, but it is clear that there is a high correlation between the price of Bitcoin and other crypto currencies.

We are interested in the price development of Bitcoin and try to understand the price dynamics.

The main question in my mind is: how much Bitcoin's "real" value is?

I can't really rely on technical analysis methods that try to predict prices through the acceleration of demand for a financial asset. Of course, I do not argue that these methods are completely invalid, but I can see that they are quite fragile.

There are basically two types of investors: investors who try to catch the trends and those who seek to buy financial assets when they are respectively cheap.

Investors who try to catch a positive or negative trend and make money from it are not interested in the "real" value of the asset they invest in. Regardless of the price level, they try to make money by moving according to the trend. Their motto is: "Trend is your friend".

So, for example, they hope to profit buying Bitcoin when the price is 15.000 USD. If they manage to get out at the right time, they can accomplish their goals or they can do great damage. The traders who are betting on trends take intensive advantage of technical analysis methods.

The second ecole try to buy a financial asset when it is cheap and hold it for a long time and sell when it is valued assuming that it is more than "real" value. I'm one of those investors.

The most popular fundamental analysis methods for determining the "real" value of a company are the price-earning ratio and the market value book value rate. The price-earning ratio refers to how much percent of the company's invested capital is earned in a year. Market value book value ratio compares the book value of the company assets calculated using the accounting methods with the market value of the company. When you invest in a company, you can understand more or less what you are actually investing in through these ratios.

It is not possible to use such methods for crypto coins.

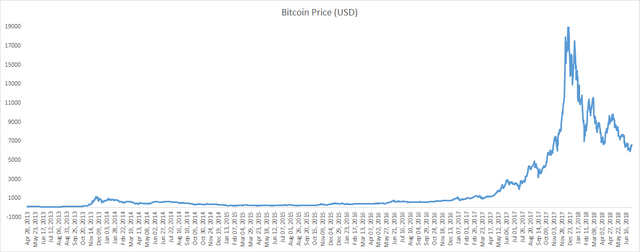

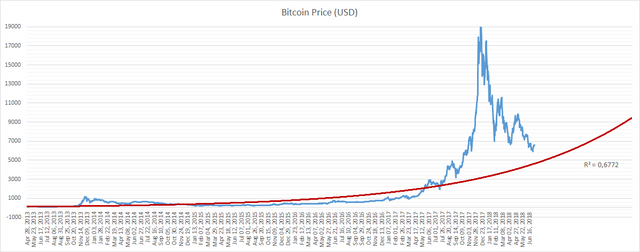

In this context, looking on historical prices seems to be the most logical solution. If people assume that the value of an asset is at a certain level for a long period of time, we have to rely on that value. The oldest price data I could find on bitcoin belongs to April 2013. Since then, the daily development of bitcoin price is shown in the chart below.

Looking at this chart, we want to estimate the future bitcoin price. For this reason, we want to establish a model that will best explain this data. After setting up such a model, we can estimate the price by extending the relevant trend line to the future. First, we try to place a linear trend line.

It is obvious that the graph does not explain our data set very well. The fact that the R square value represents the description of the data set is 0.4316 confirms the weakness of the model. It is interesting to note that the trend line starts from the minus, but I do not apply a correction because such a correction will reduce the predictive power of the model. According to the model, the price of bitcoin should be 5.765 dollars and expected to occur 7.233 dollars after a year.

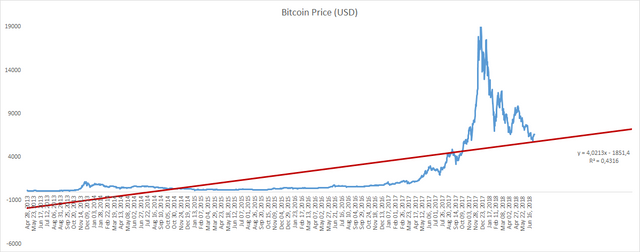

The actual price values shown in blue show us that prices have developed exponentially. So we draw a new graph with an exponential equation.

We see that the new graph we draw better explains the data. The R-square value, which shows the success of the model, has reached 0.6772. According to the model, the price of bitcoin today should be around 4600 USD, 1 year later, we can expect the price of Bitcoin to rise above 9400 USD.

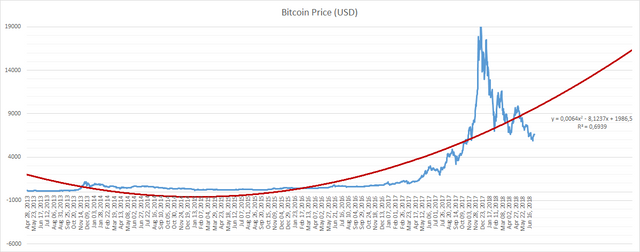

We see that our chart does not explain the last 1 year data very well. We use a second-order polynomial equation to better explain the last year's data.

We see that the graph reveals the last period data a little better. The R square value has risen to 0.6939. According to this model bitcoin's expected price today is 9.558 USD. A year later, we can expect the price to be 16.294 USD.

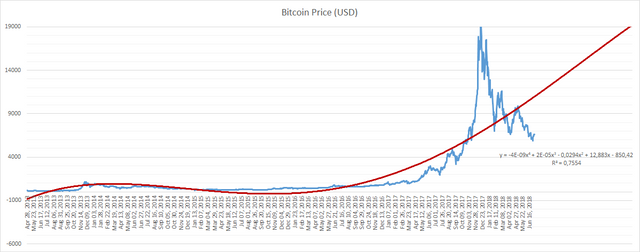

By increasing the degree of polynomial equation, it is possible to build models that explain data much better. For example, when we experiment with a polynomial equation of four degrees, we get much better results. The R square reaches 0.7554. The model shows that after 1 year the bitcoin price can reach USD 19,000 again.

According to the principle of "Ocram's Razor ", the more simple a model is, the more likely to be true, as the model is more adapted to the data as it becomes complex. This is called over-training in modelling terminology. In this context, I think the most reliable model is the linear model shown in the first graph.

CONCLUSION

According to my analysis, I have achieved the following results.

The price level of Bitcoin reached at the beginning of 2018 was a financial bubble.

I think Bitcoin will be a permanent financial asset and its price will increase in the future. There is no need to panic in price declines.

I think that best models to estimate the price of Bitcoin are the first model with linear equation and second models with exponencial equation.

I suppose the Bitcoin price will be higher than the price shown in the first equation and lower than the price shown in the second equation.

When we take average prices of the first two models, we conclude that Bitcoin's current expected actual price is USD 5.182 and the expected price of the next year is USD 8316.

In the next 1-year period, prices are likely to be out of the forecast, but in the long run, prices are likely to follow the trend shown in the first two equations.

The opinions I mentioned in this article are not investment advice, but the personal assessments of an author who is not an investment expert.

Thanks for reading.