The Downside of Democracy (and What it Means for Blockchain Governance)

Taylor Pearson is the author of "The End of Jobs" and writes about entrepreneurship and blockchain technologies at TaylorPearson.me.

Following acrimonious debates within the bitcoin and ethereum communities over the past few years regarding governance decisions that ended in forks, there has been a wave of projects offering on-chain governance.

This is a system for deciding on changes to public blockchain protocols using formalized governance mechanisms encoded in the blockchain, rather than informal discussions offline. Prominent examples of protocols with on-chain governance include Tezos, EOS and Decred.

While these projects may have some value, I believe the push for on-chain governance is, in large part, the result of an intuition carried over from environments like nation-states and private companies, both of which are very different from crypto networks

Implicitly, their belief is that we are seeing too much exit and not enough voice and we need to build better mechanisms for voice via formal on-chain governance.

Let's step back a bit. What do I mean by voice and exit?

Members of an organization, be it a nation, a business or a crypto network, have two possible responses when they're unhappy with its governance.

They can exit – leave the relationship – or they can use their "voice" to try to improve the relationship through communication.

Citizens of a country can respond to political repression by emigrating (exit) or protesting (voice). Employees can choose to quit their unpleasant job (exit), or talk to management to try and improve the situation (voice). Unsatisfied customers can opt to shop elsewhere (exit), or they can ask for the manager (voice).

In crypto networks, users can try to change the way that the protocol operates through governance (voice) or they can choose to exit by either leaving the network or forking.

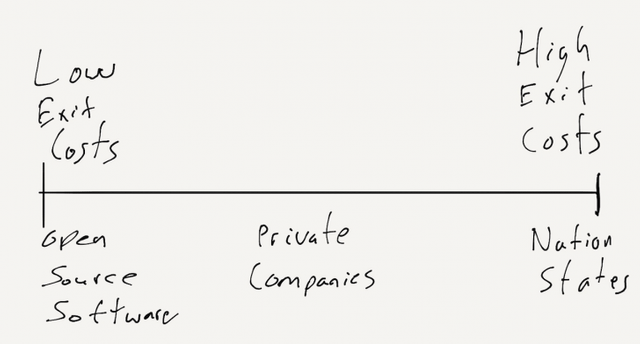

Spectrum of governance

The relative merits and drawbacks of voice and exit depend on the cost of exit.

For example, it's important that countries are democratic and have (on-chain) voting that allows citizens to formally express their opinions because the costs of switching your citizenship (exit cost) are very high.

The tradeoff of prioritizing voice over exit is that democracies tend to be very inefficient compared to more technocratic forms of governance. This is epitomized in moments such as Alaska senator Ted Stevens describing the internet as "not a big truck, but a series of tubes." Despite being the head of the committee ruling on net neutrality, Stevens displayed a very low level of understanding about how the internet actually worked.

Democracy fundamentally operates at the median of society, not the edge. It does that in order to maintain peace and allow for economic prosperity. On the whole, this has worked better than any previous governance system.

Private companies are more technocratic than nation-states. A relatively small group composed of top management and large activist shareholders effectively control the institution. This allows them to be more efficient but also makes them more prone to disgruntled stakeholders – be it shareholders, employees or customers.

This is less of an issue because, compared to changing your citizenship, it's much easier to change your job or sell your stock. That is, the cost to exit is lower so you're less likely to "revolt." If you don't like how Apple's key decision makers are behaving, you have the option to quit your job or sell your stock.

At the far end of this spectrum is open-source software. The governance of open-source software is captured in the phrase "rough consensus and running code."

Open-source software governance tends to be technocratic with a relatively small group of stakeholders controlling the project. The broader stakeholder community has very little voice. Even fairly large bitcoin holders and miners have almost no say over bitcoin core's development roadmap.

However, if the technocratic rulers go in a direction you don't like, you can much more easily "revolt" by forking the network. Facebook's employees and shareholders can leave but they can't take the database with them. In open source software and blockchains, you can.

It is the opposite of democratic nation-states in this sense. You have very low exit costs and so you can get the efficiencies of a technocratic system without the threat of revolution. The revolutionaries can just start their own competitor.

From a top-down perspective, this technocratic, fork-prone governance is uncertain and hard to predict, which is often perceived as an inefficiency. To the contrary, this uncertainty is a necessary pre-condition, a fertilizer, for opportunity.

Bloodless revolutions

Open-source source software (and software more broadly) is the source of so much innovation because it so uncertain and loosely governed.

It is prone to frequent "revolutions" but those revolutions do not end the same way as real-world revolutions because information is a non-rivalrous good. The revolutionaries can walk out the door and build the future they believe should exist.

Physicist Max Planck is frequently paraphrased as saying that "Science advances one funeral at a time." Democracies tend to be no different and organizations often advance one retirement at a time.

By contrast, open-source software advances one fork at a time. It is not bounded by biology or geography but only by non-rival, infinitely replicable information.

These forks may ultimately be proven as worthless by the market, but the dissatisfied faction need not wait to try out the approach they perceive as better.

Returning, then, to blockchains, introducing on-chain governance to crypto networks is likely to make them more like nation-states with the inefficiencies that entails. Is that the right tradeoff?

There are certainly some exit costs associated with crypto networks. Forking a blockchain is easier than forking a nation state, but still requires sufficient scale in terms of users, miners, and broader tooling (wallets, exchanges, etc.).

Network effects related to brand and real-world integration points are other important sources of friction that discourage forking. I suspect for specific circumstances, that some form of on-chain governance proves more efficient.

But for a technology with comparatively low exit costs, forking is more feature than bug. Many projects with strong technocratic leaders practicing loose consensus and running code form a robust and competitive ecosystem. While many individual projects will fail, it's more likely that more optimal approaches are found by one of many forks.

Off-chain governance may seem more unpredictable, but may prove more fertile ground for innovation for just that reason.

https://steemit.com/christianity/@bible.com/verse-of-the-day-revelation-21-8-niv