Trump Rattles Stocks With His Tweets

Donald Trump’s got the stock market on a string, but investors are less sure of the game he’s playing.

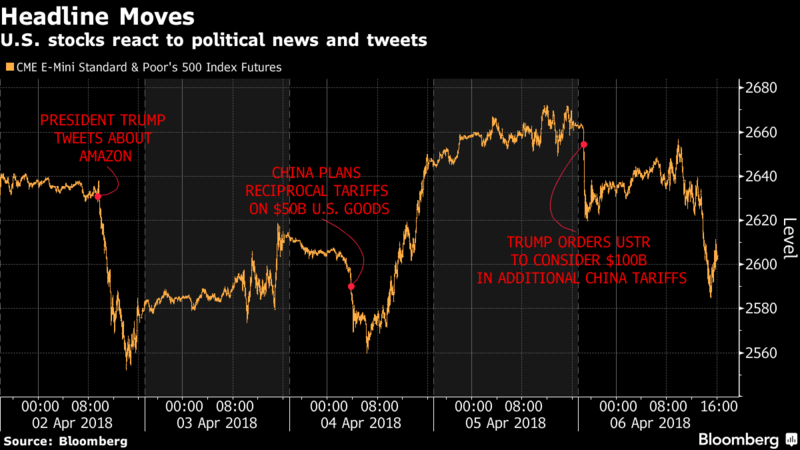

The Republican president’s renewed ramblings on trade dominated U.S. equity markets this week, with a tweet-induced swoon on Friday leaving the S&P 500 Index 1.4 percent lower than where it started on Monday. The gauge swung wildly, notching four moves of at least 1 percent in the five days, and the Cboe Volatility Index spiked above 20, nearly double its level for the past year.

All of which has dented Trump’s reputation as the stock market president.

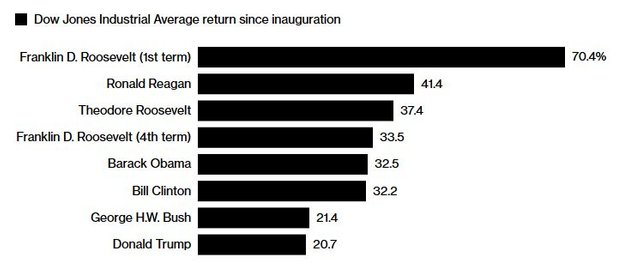

Fallen Ranking

President Trump's ranking when it comes to equity returns has slipped to 8th place

“It’s exhausting, it’s draining for a lot of people,” Henry Peabody, a Boston-based portfolio manager at Eaton Vance Management, said by phone. “The fashion by which it’s done is certainly unorthodox.”

Trump’s rattled markets before with his tweets, with blasts on everything from the size of his nuclear button to the fate of Nafta raising investor anxiety. But those episodes passed quickly during his first year on the job, when a steady stream of pro-business policies smoothed any market dents.

Now, the White House is tackling areas where there’s far less consensus support from Wall Street. For example, on Friday Treasury Secretary Steven Mnuchin acknowledged there’s “a level of risk” that the tariff dispute between the U.S. and China will erupt into a full-scale trade war -- something investors clearly don’t want.

“From the market’s perspective, it was all a constant stream of lollipops,” Kevin Caron, a senior portfolio manager at Washington Crossing Advisors, said by phone. “You’re going to cut the taxes, you’re going to have a pro-growth policy, the federal government is going to invest a little more -- all of that is happy stuff. Nasty, contentious trade negotiations? That’s a more dissonant kind of message.”

The turmoil has damaged Trump’s ranking when it comes to equity returns. The Dow Jones Industrial Average’s 32 percent rally during his first year gave him the third-best start by a president going back more than 100 years. But tack on the turmoil since January and he drops to the middle of the pack, behind former Presidents Barack Obama, Bill Clinton and George H.W. Bush.

Trump’s impact on the market was on full display over the past five days. The week began with a 2.2 percent tumble after Trump battered Amazon.com Inc. on Twitter, exacerbating a selloff in megacap tech shares. It didn’t help that China put out a list of products it would target with retaliatory tariffs after the White House issued its own the night before.

A three-day rally of more than 3 percent followed, as White House officials insisted the trade bluster was a negotiating tactic. But Trump upended that notion late Thursday, ordering a review of even harsher tariffs that sparked a bookend rout.

“Is the president adding a level of volatility with his tweets and with his statements?” said Joe Kinahan, the chief market strategist at TD Ameritrade. “Absolutely.”

Trump’s tweets dominated markets this week to such an extent that a normally closely watched jobs report barely registered Friday. The data showed a slower-than-expected rise in hiring, but investors speculated it would do little to deter the Federal Reserve from its gradual pace of tightening.

Instead, the focus remained on the policy signals coming from the White House. Just as he did earlier in the week, head of the White House National Economic Council Larry Kudlow on Friday tried to tone down the harshness of Trump’s latest trade statement. Judging by the market’s plunge, he’s losing his effectiveness.

“The problem for investors is that there isn’t any consistency in the messages, we have no idea what to expect next,” said Ian Winer, co-head of equities at Wedbush Securities. “We are getting in an area we haven’t been in a long time. Portfolio managers have no idea what’s going to happen over the weekend.”

— With assistance by Lu Wang

Source link: https://www.bloomberg.com/news/articles/2018-04-05/stock-rally-to-extend-in-asia-dollar-strengthens-markets-wrap