Breaking Bitcoin With a Quantum Computer

By JEFF JOHN ROBERTS January 6, 2018

Alex Beath, a Toronto-based physicist and pension fund analyst, is skeptical about Bitcoin but sees one useful purpose for the crypto-currency: It may detect when someone creates a working quantum computer.

“The second someone creates a viable quantum computer, the NP-complete math problems at the heart of Bitcoin mining tech become instantly solvable,” Beath notes. “In other words, one answer to the question ‘what’s the first thing you’d do with a quantum computer?’ is ‘mine all of the remaining Bitcoin instantly.’ Until that happens, nobody has a quantum computer.”

Beath’s off-the-cuff observation, which he made in response to a Fortune query about the security of bitcoin, is amusing. But it also underscores a serious problem: Namely, a new era of computing is fast-approaching and when it arrives, the system that gave rise to many crypto-currency fortunes will collapse.

This threat to Bitcoin and other software systems that use the same underlying encryption technique—a technique likely to crumble in the face of a quantum-based attack—is not new. Indeed, it was predicted decades ago, and Ethereum founder (and former journalist) Vitalik Buterin wrote about how to defend it in 2013.

The difference today, though, is that companies like Microsoft, Google and IBM are making rapid breakthroughs that could make quantum computing viable in less than 10 years.

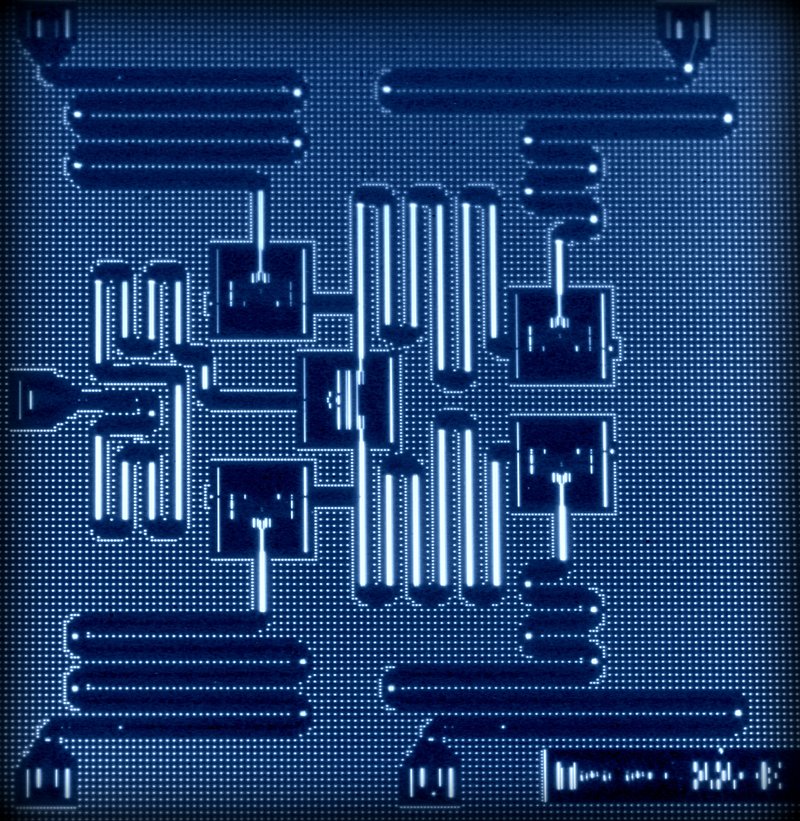

Right now, engineers are stymied over how to deploy enough “qubits” (a quantum version of the binary bit system used in traditional computers that lets a unit be a 0 and 1 simultaneously) in a stable fashion.

According to CEO Louis Parks of SecureRF, which is developing quantum-resistant security systems, the number of qubits in a machine has recently soared from 16 to 50. This is far from the 4,000 to 10,000 that would likely be needed to crack Bitcoin’s cryptography but, at this point, Parks says quantum computing is now at stage akin to when the Wright brothers began showing airplanes were viable.

In other words, it’s not too soon for crypto-currency “hodlers” to worry about the security of their fortune. The good news is that both Beath and Buterin think it will be possible to modify digital wallets to defend against quantum attacks, though doing the same for mining will be a bigger task.

The bigger issue in all this, however, is Bitcoin’s future vulnerability is just a microcosm of what the entire world will face when quantum computing arrives. That’s because the same vulnerabilities are present in our online banking and shopping systems, and in many of the computers all around us. As chip maven and Fortune alum Stacey Higginbotham put it when I asked about the threat to digital currency:

“As for the end of Bitcoin, I’d worry more about the end of cryptography and AES [Advanced Encryption Standard] encryption itself.”