Highest Risk Time To Long Bitcoin, and Why

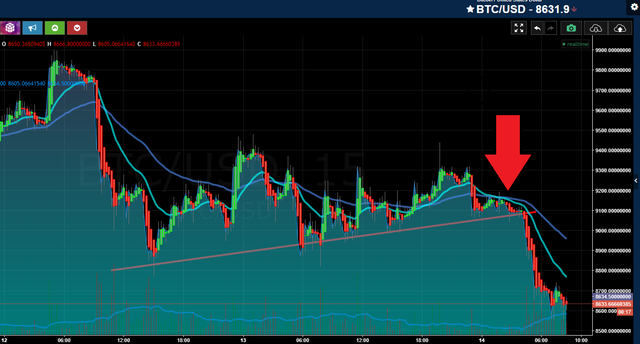

This morning we can see the perfect example of how new and inexperienced bitcoin traders can really get nailed.

Last night, Bitcoin was making a potential 1-2-3 bottom formation on the short term charts, and the chart pattern was looking bullish. Many people may have jumped in at the moment that prices appeared to be surging higher.

Artificial Intelligence Bots Hunting Noobs

Lets make an example, and say 10,000 people bought one bitcoin each on that trading signal. We can now see that prices have gone down more than one thousand dollars overnight. If our example crowd each lost $1000, that would equal ten million dollars.

So it is very worth-while for the Artificial Intelligence Bots to be 'looking' for developments like this - watching for these chart patterns and anticipating when the excited crowd will be putting on long positions, at a time when they are likely to have their stop-losses set too close to the market prices.

To hit all those people, is a quick $10,000,000. And it's worth it to have 100's of millions sitting there waiting for just the right moment to NAIL all of the new traders.

So there is a Bitcoin price manipulation conspiracy theory for you. And we are going to be seeing a lot more of these moves, now that we have Bitcoin Futures Contracts. Traders can put on $1 million trades and highly leverage it, it turns into 100 million dollars - and the high frequency trading AI Bots can really manipulate the cryptocurrency markets.

How Do Experienced Traders Approach This Risk?

Bitcoin prices are still within the longer term 1-2-3 bottom, and with the perspective that you need risk control rules, then an experienced trader may have also seen this chart pattern and tested it with a very small bit of their position

As soon as they are not proven correct - does not matter if the prices are going sideways, it has to prove you correct... if not, the experienced trader will close their position. And so they would protect themselves against this devastating loss.

Knowing how risky trading always is, and especially nowadays with the artificial intelligence BOTS - all markets are very much more risky.

New traders especially, need to step back and take an investors approach with a very small amount of money - so that you can let it ride over a longer period of time, without sweating about these kind of AI Bot driven moves in Bitcoin, and in Silver Hedge Funds and other computer trading effecting world commodity markets as well.

A SHORT Is As Good As A LONG

Another important fact, is that an experienced trader does not get married to one side of the market or other - they are not just buying low and selling high... then waiting for the next low to come along...

They are quite willing to flip the chart upside down, to re-do their Technical Analysis, and trade from the signal on market direction - be it up, or down.

In this chart, we can see in hindsight, the crossover of this moving average was the right time to go short.

If we zoom the chart out, we can see in the 1 month view and the 3 month view - that we are still in a down trend. There has been no trend change reversal that is strong enough to show that it is time to go long.

In fact history shows that these kind of 'pumps', usually retrace to the 50% level where we are now, and it may be going down for quite a long time - just as long as it took to go up, it could be going down the same amount of time. The prices could remain flat for a long time before we see the moving averages crossing over and momentum changing.

But for now, the moving averages are no where near showing us that the momentum has changed to be back into a bull market.

Here are more examples of the 'moment' that a potential 1-2-3 bottom breaks out... and it turns out to be a fakeout breakout...

If you are trading 1-2-3 bottom formation, you will lose money if you are not following the correct risk control rules. View on Imgur