How To Make Passive Income Through Crypto

Digital currencies like Bitcoin, Ethereum, Dogecoin are warm investments proper now. While the technological know-how in the back of these tokens is extra than a decade old, the skyrocketing buying and selling expenditures is a extra current phenomenon.

But the price of rate surges is paired with large volatility. And in contrast to many stocks, crypto tokens do not pay dividends that can supply a secure profits in the course of durations when share costs are down. However, traders who prefer to make passive earnings thru crypto may also be capable to do so thru interest-bearing cryptocurrency accounts.

In partnership with Hodlnaut, let’s speak about what it potential to earn hobby on cryptocurrency holdings, how it can assist enhance long-term holdings, and what depositors want to reflect onconsideration on when choosing an interest-earning crypto account.

Table of Contents

- How Can You Make Passive Income Through Crypto?

- Why Interest Is An Important Part Of Passive Income For Crypto Investors

- Why Is It So Important To Earn Interest On Crypto Holdings?

- How To Look For A Crypto Account That Pays Passive Income

- Is Making Passive Income Through Crypto Right For You?

How Can You Make Passive Income Through Crypto?

Historically, cryptocurrency traders have made cash with the aid of buying and selling coins. Taking gain of charge swings allowed the most profitable merchants to earn excessive returns from their buying and selling activities. Of course, this kind of buying and selling is rather active.

Other “digital workers” earned tokens via mining things to do (which are required to maintain the blockchain working). But once more this requires a lot of hands-on work.

Today, there are a few necessary methods that crypto traders can earn profits in a greater passive way. These strategies include:

Air drops. Investors get hold of tokens at random. These are generally deposited to generate goodwill for a coin or a platform.

Staking. Staking entails lending tokens to a community to validate transactions inside the network. This is greater environment friendly than mining, however it can be risky. Most networks require minimal investments earlier than a man or woman can commence staking.

Direct lending. Individuals can set up direct mortgage opportunities. Other crypto holders can take your holdings and pay you returned with hobby over time.

Earning interest. Depositors put tokens into a crypto “bank” account. The monetary group lends the crypto and can pay the depositor hobby in return.

Why Interest Is An Important Part Of Passive Income For Crypto Investors

Today, Centralized Finance (CeFi) establishments are making it feasible to earn passive profits thru crypto investments. They do this through paying buyers activity on deposits held at the institution.

Earning pastime on cryptocurrency holdings mirrors the manner of incomes hobby on fiat currencies. When you put cash (US Dollars) into a high-yield financial savings account at a bank, you may additionally anticipate to earn round 1% in yield every year. The financial institution places your cash to work with the aid of lending it to certified borrowers. You make a small quantity of pastime on the cash you earn. And the financial institution earns cash on the spread.

CeFi establishments are the cryptocurrency equivalents of banks. They don’t have the identical ensures as banks (aka, you ought to lose your crypto tokens due to theft). But they function in a comparable capacity. A CeFi organization like Hodlnaut accepts cryptocurrency deposits. It lends these tokens to creditworthy parties. Then it will pay depositors an activity rate. Typically the pastime is paid in the identical token as was once lent out. But some corporations provide depositors the capability to pick their activity token.

Right now, pastime costs on cryptocurrency are astronomical in contrast with hobby costs on fiat currencies. But many cryptocurrency traders are nevertheless reluctant to savings their cash into CeFi institutions. Even although many of these groups have asset safety insurance plan policies, crypto “banking” is nonetheless a new concept. And the chance feels high.

But CeFi establishments normally compensate traders nicely for taking on that risk. For example, Hodlnaut proper now is supplying up to 12.73% APY on your deposits. That’s a strong return for truely preserving your cash in an account.

They provide exclusive payouts for exclusive crypto currencies. Check out Hodlnaut right here and see what you can earn with BTC, ETH, and extra >>

Why Is It So Important To Earn Interest On Crypto Holdings?

Over the previous countless years, many cryptocurrency traders have considered massive run-ups in the cost of their tokens. Back in 2011, Bitcoin was once really worth much less than a dollar. Today, the cost is over $47,000 per coin. With the big upswing in values, it may additionally appear like “buy and hold” is the exceptional way to reap price in digital currencies.

However, one Bitcoin in 2011 is nevertheless well worth one Bitcoin today. While the price in fiat has grown exponentially, the underlying asset stays the same. In this sense, digital currencies don’t “grow in value” the identical way that most traditional investments (like stocks, ETFs, bonds, or even actual estate) grow. All the traditional investments have some issue of compounding boom (such as compounding hobby or compounding cost will increase over time).

Unless a digital token earns interest, the price of the token is decided totally via demand. Since 2011, demand for digital tokens has extended at an exponential rate. But there is no assurance that the fee of boom will continue.

Earning activity on digital currencies ensures that the underlying price of the asset continues to develop over time. For example, if you have 1 Bitcoin incomes hobby at Hodlnaut today, 1 yr from now you can assume to have 1.06 Bitcoin. By incomes interest, you’re growing the underlying cost of your investment. Regardless of the contemporary buying and selling charge for Bitcoin, you personal greater of it when you earn pastime on the token.

How To Look For A Crypto Account That Pays Passive Income

Cryptocurrency buyers who aren’t used to working with CeFi establishments might also be cautious when they think about the concept of placing tokens on deposit. The hesitancy makes sense.

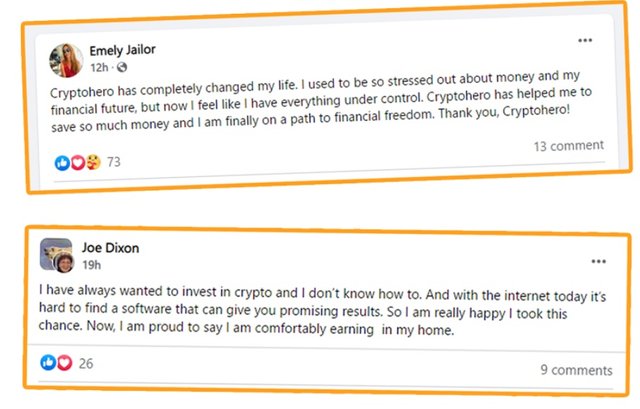

Scammy agencies posing as CeFi establishments can trick buyers out of their holdings. Additionally, CeFi establishments are a goal for hackers searching to steal digital currency.

To mitigate the threat of inserting tokens on deposit, it’s necessary to learn about the platform and the business enterprise first.

Who borrows from the institution? Lending to institutional buyers is much less volatile than peer-to-peer lending.

What protection measures are in place? CeFi establishments are targets. They need to have sturdy safety which includes non-public identification and multi-factor security. It ought to additionally have strong lending insurance policies that make it greater possibly that loans will be repaid.

Does the organisation provide insurance plan policies? Insurance insurance policies guard the underlying fee of belongings on deposit. CeFi establishments aren’t FDIC-insured. But personal insurance plan insurance policies can shield depositors from hacks or theft.

How do charges evaluate to different platforms? Platforms are competing for tokens from depositors. It’s vital to keep round for the fine rates.

Can I earn hobby on tokens I already own? Many CeFi establishments pay activity on a restrained vary of tokens. This isn’t a terrible element if you’re invested in some of the extra famous tokens. However, you may additionally locate that your “up and coming” token doesn’t earn hobby on many platforms.

Are there any lock-up periods? If your tokens are locked up for a positive duration of time, you need to acquire greater compensation for that. Lower yields are anticipated if you can right away withdraw deposits.

Is Making Passive Income Through Crypto Right For You?

Decentralized Finance (DeFi) is the predominant style in cryptocurrency today. Most traders favor to maintain their tokens secure inner hardware wallets. When you hand over your keys to a CeFi institution, you lose manage of the keys. But the danger comes with a magnificent upside. Earning activity on your tokens skill that you get to journey the advantages of compounding growth, no longer simply adjustments in demand.

As cryptocurrency turns into greater mainstream, it might also be well worth thinking about whether or not a CeFi strategy suits with your funding philosophy. Depositing tokens at a truthful CeFi group like Hodlnaut offers you the advantage of investing in blockchain science and the gain of a extra holistic method to digital forex management.

![Untitled.jpg] ( )

)

Start earning passive income through crypto with here >>> https://bit.ly/cryptopassieveprogram