Understanding the Bitcoin Halving

If you're in the cryptocurrency space and maybe even if you're not, you're likely aware of the recent Bitcoin halving event that took place on May 11th 2020. It's the 3rd such event in Bitcoin's history and occurs every 4 years or so. In this post we attempt to demystify the term and explain what some of the implications of the event may be.

The most important feature of Bitcoin is it's hard 21 million supply limit. It is far more important than any technical advancements or features that one can build on top of it. It is the core of the thesis, that much like Gold, it is a store of value deriving from it’s scarcity. This feature is monumentally important in the current political and economic environment, as we’ll see.

Bitcoin Monetary Policy

With the COVID crisis, fiscal and monetary policy around the world that was already monumentally bad and headed into a brick wall has been kicked into overdrive. Governments are engineering bailouts and an expansion of credit and the money supply that has made the post 2008 expansion go parabolic. As one economist noted, we rushed instantly into the era of Modern Monetary Theory (MMT) and there never was a discussion about it.

Unlike the arbitrary policies of central banks, Bitcoin's monetary policy is set in stone, in the code, and public for everyone to see. It is this predictability and the hardening of already hard money that give it it's allure and attractiveness as a hedge against worldwide turmoil.

We, in fact, have a ring-side seat to witness one of the truly amazing monetary phenomena in the history of the world. The quantitative hardening of a capped-supply asset on the one hand, Bitcoin, versus the unlimited and unrestricted quantitative easing by central banks of their national currencies on the other. While they work post haste to trash what's left of the monetary value of their currencies, one has an option to protect themselves by either moving their savings into Bitcoin or Gold. It's going to be fascinating to watch how this unfolds.

Block rewards and Block times

We've often heard that there will never be more than 21 million bitcoin and that the supply is capped. How exactly is this made possible?

When Bitcoin was first released, the block reward to a miner for successfully publishing a block that got accepted into the blockchain was a whopping 50 bitcoin.

The algorithm tries to ensure that roughly one block was produced every 10 minutes. How was this achieved? By setting the difficulty of mining the block higher or lower depending on the average block time in the previous period. So for example if a set of blocks was mined at an average time of 7 minutes, the algorithm knows that it must try to increase the difficulty of mining to get to the 10 minute target. Conversely, if the average block time in the previous period was 15 minutes, the difficulty adjusts downwards.

Note that the above logic beautifully captures the entry and exit of miners from the Bitcoin network i.e. if 50% of the miners stop mining, block times get lengthier during the current period, as the difficulty was previously set assuming a certain network hashrate (total capacity dedicated to mining Bitcoin), which is no longer the case. To compensate, the next difficulty adjustment adjusts downwards and makes it easier for miners to mint blocks, thus returning the block times to the targeted 10 minutes.

Difficult adjustments occur every 2016 blocks (2 weeks approximately). This feedback loop is how Bitcoin deals with sudden spikes and downward movements in price and keeps the cost of mining Bitcoin in line with it's price. It goes somewhat like this:

Bitcoin price dives -> Some miners are no longer profitable and stop operations -> difficulty adjusts downwards making it more affordable to mine Bitcoin. Block time maintained at 10 minutes.

or

Bitcoin price spikes -> New miners enter the network to make profits at the elevated price -> difficulty adjusts upwards in the next period to make it more expensive to mine Bitcoin. Block time maintained at 10 minutes.

It's due to a lack of understanding of this mechanism, that critics of bitcoin have always wrongly predicted mining death spirals and such.

Bitcoin halving

So what are Bitcoin halving events? As mentioned earlier in the article, the Bitcoin emission schedule gave out a 50 bitcoin block reward to miners for successfully adding a block to the Bitcoin blockchain. With a target of 10 minutes per block this worked out to an emission schedule of 300 bitcoin per hour and 7200 per day.

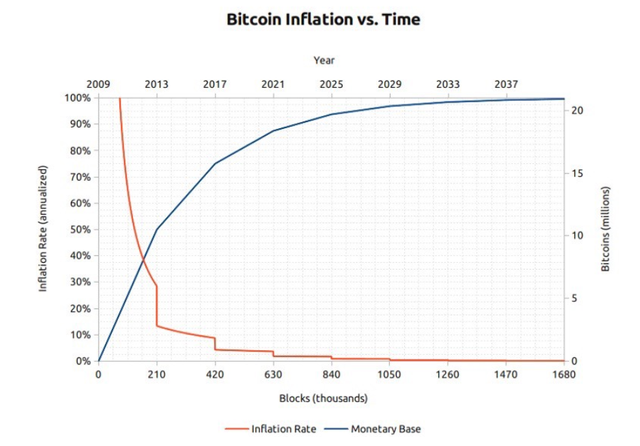

So how is the 21 million cap on Bitcoin achieved? The answer is by lowering the block rewards once every 4 years, also known as halving events. Bitcoin has had 3 such events since its inception, that have seen the block rewards go from 50 to 25 bitcoin on the first halving, from 25 to 12.5 bitcoin on the second halving, and most recently from 12.5 to 6.25 bitcoin.

This means that Bitcoin is getting harder to produce and scarcer with each passing moment. Engineering the emissions curve algorithmically in such a way ensures that with a halving every 4 years, the Bitcoin supply approaches 21 million total asymptotically, by the year 2140.

Stock-to-flow

What impact does the emission or production rate of a commodity have on it's value? This has been studied for many years with traditional commodities like Copper, Silver, Gold and even Oil using what is called Stock-to-Flow ratios. In simple terms, the Stock is the total quantity of an asset in existence e.g. 18 million-ish for Bitcoin and the Flow is the rate at which it's being produced. In the case of Bitcoin it just went from 1800 to 900 bitcoin per day.

Commodities with high stock-to-flow ratios tend to be more valuable than ones with low stock-to-flow, as in a sense it models the difficulty of producing more of the same stuff. As you might guess Gold has a much higher stock-to-flow ratio than Silver or Copper. With the Halving event on May 11th 2020, Bitcoin has now surpassed Gold for the first time in it's stock-to-flow ratio.

So what does this mean for the price of Bitcoin? Well, historically Bitcoin has gone up by an order of magnitude with every halving in the 8-18 month period following the event. If this time is the same, we could be seeing Bitcoin in the lower six figure range in the coming months.

Of course, nothing in life is certain or easy. The only thing certain is that there will be turbulence ahead. To get a more analytical treatment of the question of bitcoin pricing as it relates to stock-to-flow ratios, these 2 articles (here and here) on the Stock-to-flow model for predicting price by @100TrillionUSD (PlanB) are highly recommended reading.

One piece of advice: Ignore anyone who says the halving ‘failed’ because the price of Bitcoin did not skyrocket. This was never the intention of the halving, nor the expectation! All the action is in the coming months as miners and the rest of the ecosystem make adjustments to adapt to the now dwindled supply.

Interesting times ahead. Buckle up!

Dear @indracrypto

Solid read. It's clear that we're sharing similar interests towards blockchain technology and crypto.

Perhaps you would like to check out this contest / challenge done by my good friend hardaeborla: "What is Bitcoin Halving ?".

Enjoy your weekend,

Yours, Piotr