COVID-19 and your Financial Well-being

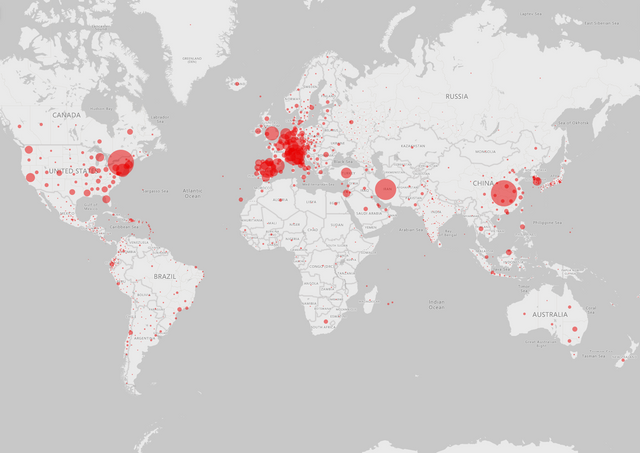

What a month. It feels like we’ve been in March 2020 forever. As COVID-19 ravages the world, most people are understandably worried about the physical safety of their families and loved ones. Given that there is no dearth of Tech Entrepreneurs chiming in on Health, Epidemiology, Probabilities and Statistics of the ongoing crisis (most without any expertise in the area), I’m going to focus on the other area of crisis we are facing: Our financial well-being.

The realization that this stoppage of the world economy that was already teetering on the edge of economic depression (read more on this here and add the Coronavirus to the list of crises mentioned) will have long lasting and far reaching consequences has not dawned on most people.

The tectonic shifts that are coming are nothing short of the changing of the World order post World War I & II. The economic impact of this crisis will be similar in magnitude to a real world war, when this is all said and done. The order of the day is for people to keep what they have aka capital preservation.

For the more aggressive amongst you, there are massive opportunities to position yourself and come out ahead, as is the case in every crisis. As with all posts of this nature, this is not financial advice, one size does not fit all, and your individual circumstances will vary based on your current financial situation, age, geography and so on. Having said that, let’s dive in.

The state of the market

Many of the world’s stock markets have benefited from easy monetary policy and the lowering of interest rates to the 0 bound for the last 12 years since the ’08 financial crisis. Every correction was met with central bank action to ensure a steady rise up and to the right. This has resulted in a high level of calm and complacency amongst investors. It did appear for a time that the party would never end.

The fact that trillions of dollars of bailouts were needed worldwide to keep the system propped up tells us just what a house of cards the economy is, thanks to Keynesian economic policies.

A lot of US dollar liquidity flowed offshore over the years in search of yield, to Emerging markets as interest rates were lowered to 0, giving the US the option and the luxury of printing money to solve domestic problems while exporting inflation worldwide. Some of this inflation has been beneficial as it resulted in rising stock markets in other countries as well. However, these US dollars have now come flooding back to the US in search of a 'Safe Haven'. This has been a painful unwind that has crushed Stocks in Emerging markets like India.

The world also finds itself in a lot more debt than it did during the '08 crisis and may find that this time around there is not enough ammunition to bail everyone out. When a Bank fails, the Government bails it out. What happens when the Government fails? We may unfortunately have to find out the answer to this question in the middle of this pandemic.

While the powers-that-be have found a scapegoat for the ongoing financial crash in the Coronavirus, it must be stressed that this crash was coming, one way or another. It does appear to have been put on an accelerated timeline though. The pain is far from over. COVID-19 is the pin that pricked the Bubble. The Bubble was inflated and ripe for bursting long before the world learnt the words ‘Coronavirus’.

The economic shock

Our economic system is fragile. It was not built for the kind of stoppage we are witnessing. The wheels need to keep turning in order to keep the system going. This disruption is going to cause immense economic suffering and many small businesses are going to be shut down. The government response the world over is going to include a combination of money-printing, bailouts and bail-ins all mostly going to their favorite constituents (hint: it’s not the poor or middle class).

Currencies will continue to be devalued. Some may even enter into hyperinflation. Some like the US dollar may actually become stronger in the short term as the world's currencies flee to relative safety. This too will end though. As hinted earlier in this post, the final outcome is likely to be similar to the Post World War II rearrangement of the world financial order and currency system, similar to Bretton Woods II.

What can you do

This is probably one of the most difficult investment climates we have ever faced. We may have to go through massive wealth destruction and rebuilding it post-crisis. This is tragic for those on fixed income and people who are of retirement age. However, giving up is not an option either. Here are a few things we can do

Learning and knowledge is something that cannot be inflated, destroyed or confiscated from you. Retool yourself for the new world that is coming. It will be decentralized (Blockchain will play a huge role), tech-oriented, and local (growing a garden, securing your water supply).

Multi-generational homes: The financial turmoil will be great, especially with those who have large mortgages and are over leveraged on debt. Parents will have to move in with their kids and vice versa. While this is nothing new for countries like India, it may well become the new normal for the developed world.

Understand counterparty risk: Citizens of Cyprus, Greece and most recently India have had their first taste of this, being unable to withdraw money from their banks. Money that they thought was theirs was no longer accessible. This was due to the risk posed by their Counterparty, the Bank. When the FDIC (Federal Deposit Insurance Corporation), the entity that provides insurance for the largest banking industry in the world, the United States, puts out a video like this, it's time to run not walk away.

The need for assets without any counterparty is self evident at this point. What are those assets? Gold, Silver and Bitcoin (in your non-custodial wallet, not an exchange)

Get out of the everything bubble: There have been large bounces during this drawdown in most markets. To the extent possible, sell some if not all of your stock market and fixed income holdings, especially if you’re overstretched financially in other areas. Things are about to get a lot worse.

Currency devaluation: The timing will vary depending on where you are located, but make no mistake. Every currency is going to go into massive devaluation as countries do whatever they can to shore up their systems and bail out people. Maybe some of that money will go to the good purpose of helping people during this crisis, but the destruction of a currency’s value does not discriminate based on the intentions of the money printers.

Emerging markets like India will suffer first as has already been the case. The Eurozone will likely break up and never be seen again in its current form. The chickens will come home to roost in the US as well, last but not least. The need for scarce assets that will do well against this form of theft and destruction of currency values has never been greater: Again, Gold, Silver and Bitcoin, all stores of value.

A word of caution: Things are going to be zigging and zagging as things move at breakneck pace. Markets will rally, correct, appear to be dying before they start recovering and so on. It’s important to keep a cool head through this crisis, understand what your theses are, and execute them.

I want to benefit from this crisis. How can I do that?

Congratulations. You’re amongst the very small percentage of people who can not only keep their head during this crisis, but look for opportunities to survive and even thrive in the post-corona world.

Downsize: Live within your means. Keep your personal runway high. Although, an argument can be made that debt is good in this era of currency devaluation, I prefer having none at this time. This is the only way you will operate from a stable base and make aggressive moves without being paralyzed by fear and anxiety.

Keep an eye out for opportunities: Eventually Real estate (Apartments, Farmland), Stocks, Fixed income investments and Distressed Businesses will provide fantastic opportunities for those with the dry powder (you can deploy into these from the stores of value). Just not yet.

I’m personally extremely bullish on the Indian economy. We’ve been relatively unscathed by this crisis and I hope it remains that way. The stock market collapse has been driven by the exit of foreign investors. Once the froth settles and we have some stability, we can finally become value investors again, a species that had largely vanished since the beginning of the current bubble in 2008.

Most importantly, Stay safe, Practice social distancing and protect your family. We shall get through this.

CEO / Founder, Indra Crypto Capital

P.S. Enjoyed the article? Don’t agree with some of our points? Either way, join the discussion over at our Telegram group