Startup Tezos ICO. $232 million – poof?

Tezos, a blockchain technology company, raised $232 million earlier this year in what was the biggest Initial Coin Offering (ICO) at the time. Reports on Wednesday of management infighting are now threatening the deal, spooking investors and raising concerns about cryptocurrencies.

What Does This Mean?

An ICO is an event where a business issues a new cryptocurrency to fund its operations and invites investors to buy it (analogous, in some ways, to an IPO), although the investors typically do not get an ownership stake in the company (instead they get tokens that can, in theory, be used as currency in the future).

The acrimonious dispute pits Tezos' two young founders – Arthur and Kathleen Breitman – against Johann Gevers, the president of a Swiss foundation the couple helped establish to handle the coin offering and promote and develop the Tezos computer network.

Under Swiss law, the foundation is supposed to be independent. It holds all of the funds raised, which have mushroomed to more than $400 million in value because the contributions were made in two cryptocurrencies – bitcoin and ether – that have appreciated sharply. But the Breitmans, who still control the Tezos source code through a Delaware company, are seeking to oust the head of the foundation.

An attorney for the Breitmans sent a 46-page letter on Sunday to the two other members of the foundation's three-person board, calling for Gevers' prompt removal and seeking to give the couple a "substantial role" in a new structure that would limit the foundation's responsibilities. The document accuses Gevers of "self-dealing, self-promotion and conflicts of interest." According to Gevers, the two board members later suggested via email that he step aside for a month while they investigate.

In the case of Tezos, the founders set up a separate, independent company designed to act as a guardian of the funds raised. But the founders, essentially, allege that the head of this independent company is not disbursing the funds to foster product development and that he is acting in his own interest. The battle has resulted in a delay of the launch of Tezos’ technology – until the launch, investors will not receive their tokens (“tezzies”).

Why Should I Care?

For markets: Tezzies fell as much as 75% in a matter of hours following the news!

Tezos raised money in July, but investors may not be able to trade the tokens until next year (they can trade them informally on exchanges where they trade future promises to buy or sell tokens). Based on those transactions, tezzies have lost a lot of value. Investor contributions to Tezos are technically considered a “non-refundable donation” to the foundation – which means investors have a lot to be nervous about!

Hundreds of millions of dollars are at stake: The Tezos digital coins, called "Tezzies," are already priced at a hefty premium in futures trading even though they don't yet exist. The launching of the Tezos network, which will trigger the coins' release, has been delayed. Until the network launches – and no date is set – contributors to the fundraiser will receive nothing.

Under the terms of the Tezos coin offering, there's no guarantee participants will ever receive a single Tez. Participants agreed to accept the risk that the project "may be abandoned." Despite the feud, Gevers said he remains committed to resolving the feud so that "this project succeeds."

For you personally: ICOs are risky business.

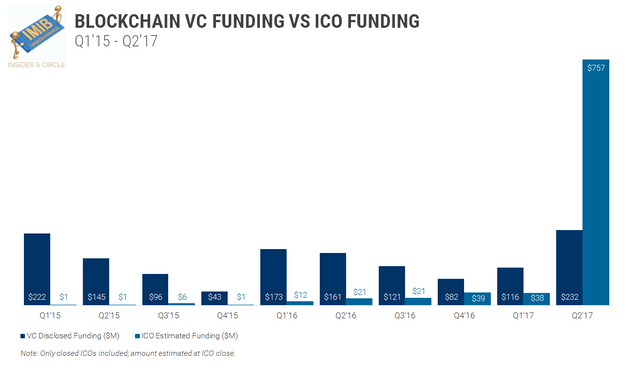

ICOs have raked in $3 billion this year despite the lack of transparency in their operations and little protection offered to investors. With so much money going into cryptocurrencies, regulators have started to take note (e.g. the US regulator cautioned against their use). This week’s events are a reminder for the ordinary investor of just how risky such investments can be.

Most ICOs are bought by people looking to 'flip' their tokens to a greater fool for a quick profit. More than 90% will fall to have a near-zero value in time.

P.S.

Follow, Resteem and VOTE UP @imib

Very informative statement :) Resteemed and Upvoted.

Yes, thank you. Adequate :)

@minnowpond1 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

@reported has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

Hi Denis...I saw your comment on drevon's video

Like and follow back man :)

Ok )

This post has received a 1.18 % upvote from @booster thanks to: @imib.

This post has received a 7.69 % upvote from @sleeplesswhale thanks to: @steem-buzz.

This post has received a 0.82 % upvote from @buildawhale thanks to: @imib. Send at least 0.50 SBD to @buildawhale with a post link in the memo field for a portion of the next vote.

To support our daily curation initiative, please vote on my owner, @themarkymark, as a Steem Witness