Hyperbitcoinization

As bitcoin becomes more helpful as cash and is expendable in additional and more places, it's straightforward to urge excited. Let's perhaps not get anxious although.

Yes, bitcoin is healthier than credit cards in several respects, as Bitpay's CCO identified during this interview. However, for those thinking that bitcoin is on the point of replace all cash on the earth, I'm not thus certain that.

First off, there merely aren't enough units. There'll solely ever be twenty-one million coins. Of those, many won't be deep-mined for an extended time and plenty of a lot of are lost permanently. however, even a larger range of coins are presently being control by holders World Health Organization won't be willing to spare them for any worth. Realistically speaking, there are most likely but five million coins really current at the instant.

Yes, I'm aware that every coin is divided into one hundred million satoshis. (you'd be stunned what number folks on social media assume I don't understand this.) Still, it merely isn't enough units to utterly replace the just about $100 trillion price of act currency current at the instant.

Now, some have expressed that we will more divide bitcoin into milli-satoshis, that leads ME to my second purpose. Such AN action might solely be taken by employing a second layer trusty answer or by dynamic bitcoin's code through a tough fork. Neither possibility looks terribly realistic to ME.

You see, being a suburbanized network, bitcoin's financial policy is improbably inflexible. The foundations are rigid and arduous to vary.

Central banks have a bonus during this case as they'll modify interest rates and monetary resource to satisfy the inflationary desires of their native economy. An element that varies wide by geographical location. A village in continent encompasses an immensely totally different economic structure and wishes than say Berlin, for instance.

My last purpose is one that I hope will amendment concerning bitcoin. The fees are just too high for smaller players. Nearly 0.5 the globe living on but $2.50 per day cannot afford a median group action fee of $3.50. In this, I'd say, Roger Ver encompasses a purpose, while he lost the bet.

Traditional Markets.

May has not been kind to the stock markets. Wherever many indices started the month near their all time the highest levels, we're currently seeing a pullback of concerning sixth.

Now, sixth isn't plenty for the securities market. It might terribly simply create this back in an exceedingly week or perhaps one day if the conditions were right. However, it looks that the intensifying tensions between the US and China are commencing to become a difficulty.

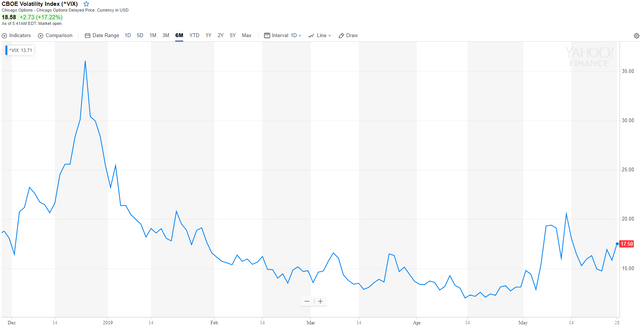

Here we will see the VIX volatility index obtaining a small amount of an increase yesterday. although it still is pretty tame compared to historic levels indicating that concern isn't prevailing.

A lot of telling indication is also enjoying come in the bond market at the instant because the yield on the US ten-year Treasury bond looks to be slippy quite systematically since Gregorian calendar month.

Even though they will not specifically be afraid without delay, investors are actually rearranging their portfolios to a lot of safe assets. Wait until somebody tells them World Health Organization the biggest holder people treasuries is.

IOTA Commits Coordicide

One crypto that's been chop-chop gaining in quality latterly is IOTA. Presently stratified at range fifteen by market cap, IOTA was the most effective acting altitude yesterday out and away creating some unlikely headway on every day once crypto performance was otherwise comparatively lackluster.

In a market update one month a gone (titled: Smashed Growth), we have a tendency to mention the announcement that IOTA is partnering up with panther Land Rover by employing a machine to machine microtransactions to boost the expertise of motorists.

One criticism that the project usually receives from crypto enthusiasts is that IOTA isn't terribly suburbanised. Well, it looks that they're taking an enormous step towards the goal of decentralization with their latest update that they've with competence dubbed Coordicide.

Without obtaining too technical, IOTA coordinators are presently chargeable for securing the network. With this upgrade, they're killing the coordinators to create it a lot of suburbanised.

As way as I'm involved, whether or not this step goes way enough towards final decentralization is beside the purpose. This project is commencing to look a lot of attention-grabbing by the minute.

Bitcoin Volatility.

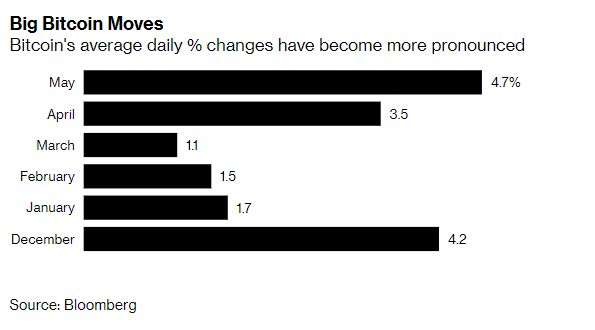

As we've expressed before, bitcoin's volatility is will act sort of double-edged brand. It's not nice for adoption as a store useful however it positively grabs headlines and brings awareness.

Daily worth movements are currently as massive as they've been since the capitulation section of mid-November.

It would appear that alternative indicators agree. The LXVX bitcoin volatility index provided by LedgerX has seen a pointy increase since the start of could. (Wish that they had this chart on a extended timeframe.)

Despite the intense volatility, it looks as if this market is very fearless. As we have a tendency to consolidate close to the highs, {the fact|the terribly fact|the actual fact} that every try at a pullback is MEt with a fast recovery tells me that sentiment remains very optimistic and momentum is sustained. Let's simply hope blue blood Simpson doesn't show up.

In the in the meantime, while past performance isn't a sign of future results, those 2 white lines appear to ME sort of a classic optimistic flag pattern.