Golden Cross Or Another Selloff: what's round the Corner For Bitcoin?

The inability to remain higher than $8K threshold resulted in a very Bitcoin drop of $1,400 in barely some hours. Over twenty-four hours, the primary cryptocurrency lost over ninth to $7,300, solely partly sick from a decline to $6,600. Apparently, some players set to quit Bitcoin, considering the rally to be exhausted. Market watchers noted that the decline was caused by an oversized, by many thousand Bitcoins, order available on Bitstamp. It conjointly became a trigger for value correction for the most altcoins, most of that lose over tenth against the degree of the previous day.

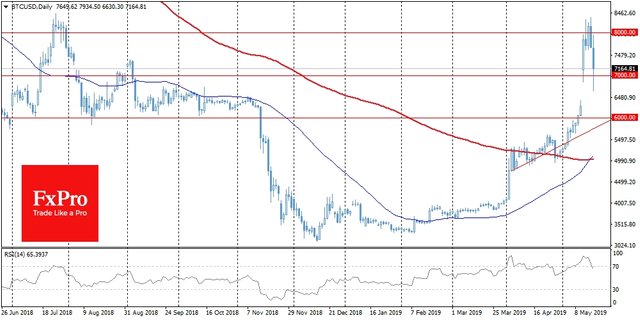

As for technical analysis, Bitcoin stumbled over the resistance level close to $8,200, that in July last year conjointly stopped the expansion. The relative strength index RSI on the daily charts marks a divergence as new value highs don't seem to be confirmed by new index highs. Even additional horrendous, the RSI fell sharply within the region below seventy, most likely marking the start of an extended correction.

Interestingly, the sale occurred simply the day once the 50-day average crossed the 200-day bottom-up. In technical analysis, this is often thought of a powerful obtain signal referred to as the Golden Cross. If the correction doesn't receive Associate in Nursing impulse below $6,000, then new patrons might rush to the market, obtain on a pullback.

Against the background of hyperbolic volatility, the United States SEC delayed thought of Associate in Nursing application to launch Bitcoin-ETF from Bitwise. Such a protracted expectation will increase the market reaction within the event of a positive call at some purpose in the future.

The approaching weekend might confirm the any direction of the BTC value dynamics and also the entire cryptocurrency market as a full. For the nonce, there are additional signs that the pullback will be transitory, holding the widely upward bias of the bitcoin value for the approaching months.