Bank of England Chief: Bitcoin Isn't a Threat to Financial Stability

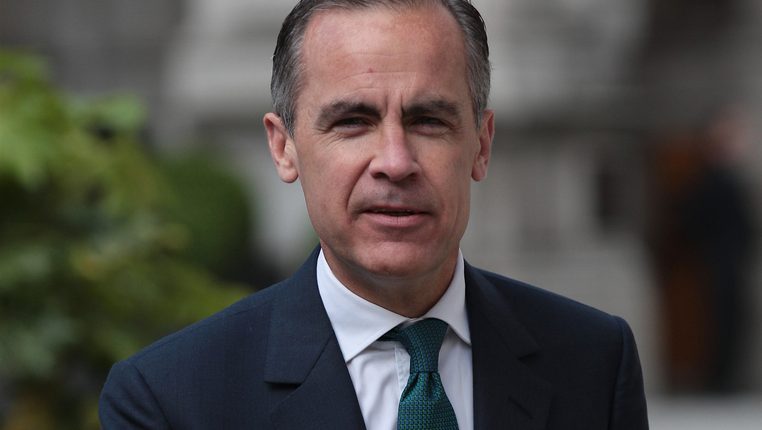

Bank of England (BoE) head Mark Carney said on Wednesday that bitcoin's meteoric price gains do not pose a threat to global financial stability.

Speakme to British lawmakers in Parliament, Carney stated that bitcoin's recent rate actions are "full-size" and more like an "equity-kind threat," Reuters reviews.

He stated that:

"At present, we don't view [bitcoin] as a financial stability issue."

Bitcoin is the number one cryptocurrency by means of market valuation, and currently reached an all-time high of round $20,000. At press time, it became buying and selling at just over $16,700.

Carney, who additionally acts as chair of the G20's monetary balance Board – a set of crucial banks and finance ministers this is additionally undertaking its very own blockchain studies – further said that the concept of principal financial institution-issued digital foreign money that may be utilized by the general public has "some essential problems" until there's a restriction in the amount that humans can keep.

The BoE governor in addition mentioned, though, that he's "fascinated" in the disbursed ledger technology (DLT) and that the central bank's very own FinTech accelerator indicates DLT's capacity. in step with a Bloomberg document, he delivered that the BoE is "energetic" in DLT, however is in no hurry to apply it to the center of the banking gadget, as any new generation has to meet a "5 sigma exceptional score."

Carney has been commenting blockchain since the begin of the yr, whilst he stated DLT has the capability to "essentially reshape banking which include by means of sharply increasing liquidity threat for classic banks."

The legitimate's statements come as worldwide central banks are an increasing number of lively of their work with blockchain and DLT.

The BoE has stated that a imminent version of its actual-time gross agreement (RTGS) systemg – which settles around £500 billion every day – may be well matched with allotted ledger technology. in the meantime, monetary government in Canada, China and Russia, amongst others, have all expressed hobby in a principal financial institution-issued digital foreign money.

I think Mark may well change his mind if the Japanese every raise rates - 40% of all Bitcoin trading is Yen denominated ...

I also agree with you