📰 Weekly Crypto Meta: New Announcements on Binance, Citigroup Won't Launch its Own Token (Source) And Other News

.png)

Update to the Binance Launchpad Token Sale Format

Today, Binance announced that its initial exchange offerings (IEO) platform will change the rules of operation. The next token sale on the Binance Launchpad will be held as a lottery, and not in the order as a live queue (note that many users did not receive the desired tokens and all IEOs passed as quickly as possible).

Update to the #Binance Launchpad Token Sale Formathttps://t.co/rDU7SvspXM

Binance (@binance) March 24, 2019

Accounts with a 20-days balances of less than 100 BNB will not be able to get tickets. In total, user can buy 5 tickets, which is 500 BNB (every day the exchange will do snapshot). This system somewhat organizes this process, however, also contains many risks, such as token volatility, for example. In general, investors still have the opportunity to purchase assets which soon to be announced.

Today exchange-based token sales (IEO) are in trend. The growth of native Huobi's cryptocurrency Huobi Token reached 100% in this year; the exchange will soon launch its own IEO option, an analogue of Binance Launchpad - Huobi Prime. Prior to this, Binance Coin (BNB) had similar growth.

Citigroup Wouldn't Launch its Own Coin

Citigroup concluded that SWIFT is better

Citigroup, one of the largest financial companies that recently announced testing of its own cryptocurrency, reported the completion of its digital asset experiment. Citigroup began its development in 2015, and the so-called Citicoin could be a great opportunity on the market, especially today, in relation to announced JPM Coin, for example. Curiously, but Citigroup recognized that solutions provided by SWIFT are more efficient than coins. Here is how it was said:

"Based on our learnings from that experiment we actually decided to make meaningful improvements in the existing rails by leveraging the payments ecosystem and within that ecosystem, we are considering the fintechs as well or the regulators around the world as well, including SWIFT".

In general, the main problem lies in the adoption of a new technology of cross-border payments. Citi’s current innovation lab chief, Gulru Atak explained:

"If we are talking about cross border payments, how many banks do we have across the world – and how many of them are already on-boarded on SWIFT? And how long has it taken SWIFT to onboard all those banks?"

Will crypto be used in cross-border payments?

It is likely that Citigroup has a lot of opportunities to develop and test its own cryptocurrency (although there was no official data on the test). If so, what would JPM Coin or even Ripple do in this market? At the moment, the global financial system still prefers to use the most common solutions in the form of SWIFT, although it is obvious that there are some alternatives, such as cryptocurrency, which in theory can be even more efficient. Coins/tokens related to cross-border payments may experience some stagnation due to such claims.

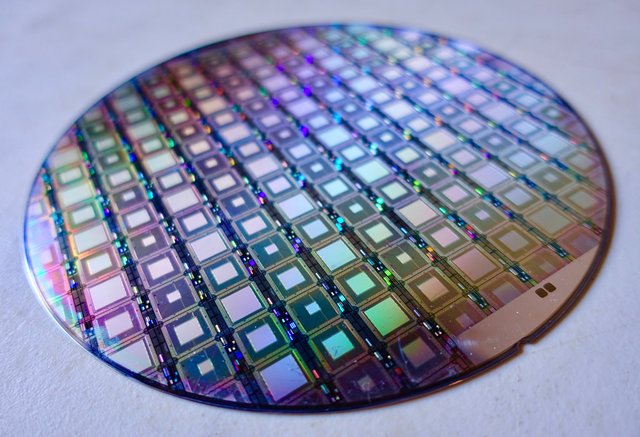

IBM Thinks That Quantum Computing is a Threat to Cryptocurrencies

The technology that "hacks" the most secure encryption

Blockchain? Quantum computing? One of these 2 should definitely win, and top managers of the technology giant IBM believe that quantum concept will definitely overtake encryption mechanisms (perhaps even any of the existing ones). At the very least, this new technology threatens Bitcoin, they say.

Nev Zunic, chief technology officer for IBM data security services said:

"Companies need to be aware of quantum and the potential risk that it will bring so they can take actions today so that they are not hackable at some point in the life cycle of their products."

Rational concern?

What is important, even today, quantum computers have significant power and if technological development continues at a rapid pace, the new computing mechanisms will definitely surpass the old ones. So the probability that all sha256 objects will be decrypted exists. However, at the moment we are probably too far from this point.

There is also a theory that Bitcoin was created specifically to prevent The Machine Uprising (quantum probably), knocking down these ruthless devices with its excellent encryption. At least, this is why BTC may have a high price in the future (in general, Satoshi Nakamoto himself became a messenger from the future).

Rumors: Binance Intends to Launch Margin Trading

Capturing markets

According to unknown sources of TheBlock, Binance can provide retail investors with the opportunity of margin trading. So far, these are only plans to include the new offer in the exchange's global market, however, it has already attracted enough attention from interested parties.

"A spokeswoman for Binance did not respond to messages seeking comment. To be clear, the firm is in the early stages of supporting margin and it might not fully roll out for months. Internally, there have been talks about requiring BNB, Binance’s native token, to stake in order to unlock margin."

According to the source, for the time being margin trading cannot be provided by the exchange due to regulatory restrictions. And it is quite obvious: margin trading contains great risks; it is also risks that can occur fairly quickly. Margin could be also used by Binance to strengthen his position in the market (quite influential at the moment).

Another marketing boost for BNB?

Based on such obscure data, it is difficult to say whether the BNB token is involved here. Definitely, BNB can also be used in financial mechanisms of the exchange, such as trading of various kinds, including margin. It is also impossible to say for sure whether the BNB's stakeholding will increase the price of the token (soon).

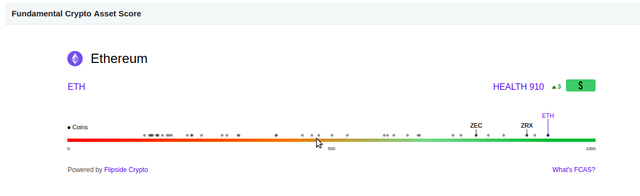

CoinMarketCap Adds Fundamental Crypto Asset Score (FCAS)

The popular service will provide not only asset prices, but also their rating

One of the most popular cryptocurrency tracking services CoinMarketCap has added support for the Fundamental Crypto Asset Score (FCAS) rating system proposed by Flipside Crypto. Here's what it looks like:

Evaluation occurs using 1000-point scale. It takes into account such properties of an asset as the activity of developers and the activity of market participants. According to these selected features, it can be said that FCAS is rather intended to give a general assessment in order to identify unequivocally illiquid cryptocurrencies.

Is this a positive change?

The practice of creating ratings for assets is quite wide. There are many different types of asset valuation systems in the world to either force people to buy this security, or these ratings indicate the actual control of the company in the market, or it is an attempt to give an objective assessment (which is fundamentally impossible at least in cryptocurrency markets).

Accordingly, the Coinmarketkap rating may embarrass users in their choice to buy or not to buy any asset. Again, CMC is still one of the most popular resources that are used to obtain data on prices by users of very different levels.

Bitwise Kindly Warned the SEC that 90% of Trading Volumes on Exchangesi Is Fake

The real crypto exchange market is smaller, but Bitcoin is generally stable

Bitwise Asset Management, a provider of index and beta cryptoasset funds, which belongs to Bitwise (the one that applied for the launch of Bitcoin ETF at least) told SEC that current crypto exchange volumes is fake. The company has prepared a presentation for the US Securities and Exchange Commission (SEC), which states that 95% of trading volumes on unregulated platforms can't be perceived as true data. According to the company, these data do not represent economic utility.

Several different studies tell at once that the volumes in cryptocurrency markets are overestimated up to 70% -80% -90% (here the minimum estimates of global lies, of course, vary). Moreover, incorrect data provided by both large exchanges, which actually balancing the market of digital assets, but relatively small platforms also do it. In this report, Bitwise insists that $ 6 billion from the daily trading volume of cryptocurrencies on the spot market is a fake. Fake deals cannot be perceived in any economic sense, the company said.

Further, according to Bitwise:

- The Bitcoin market is more "regulated", its size is estimated at about $ 273 million.

- Binance market is estimated at $ 110 million.

- With all this, futures are more noticeable and make up a large part of the market, not in the way that was previously assumed. Approximate volume is $ 85 million.

This company is still targeting Bitcoin ETF

Bitwise is one of those few, but at the same time quite big companies that wanted to compete with US regulators and try to launch a cryptocurrency ETF. ETF is one of the existing financial products that could, in theory, increase crypto prices, according to optimists. So this report is primarily aimed at justifying the company's claims and showing the regulator the possibility of working with the market.

Chicago's Mayor: the Cryptocurrency Adoption is Inevitable

Once again at the official level: Chicago's mayor Rahm Emanuel highly appreciated cryptocurrency capabilities at a March 18 meeting in Chicago Illinois connected to the city's FinTech movement. He said:

"falling apart, or receding. City states are emerging, so the political structures we all grew up under are changing. One day, somebody's going to figure out - whether that's Argentina, ten years from now, five years from now - how to use cryptocurrencies to stay alive when their facing a financial crisis, and then you're going to find out that this moment has arrived."

Today the market is at the point where, it would seem, all the pamphlets are already sung, and it only remains to observe the long downward trend. Perhaps this is a move to $3 thousand and so on. However, many people are confident that the restructuring and transition to new financial assets can be global. It is also possible that fair trade will appear because of blockchain.

Almost every industry in modern society is mindbogglingly complex with many unseen layers, mostly so that the rent seekers can hide. And no, blockchain isn't the solution, sound money which encourages honest trade is.

Jimmy Song (송재준) (@jimmysong) March 18, 2019

All judgments are subjective. We also do not recommend buying any assets on the basis of its mention in the news. Bye!

🏁 Binance will open trading for CELR/BNB, CELR/BTC and CELR/USDT at 2019/03/25 4:00 AM (UTC)

💱 KuCoin launches

KuCoin Spotlight, the new IEO platform | Huobi Prime, the new IEO by Huobi will be launched on March 26 | Hacked exchange Cryptopia will warn customers about compensation payments

🏛 Interested in cryptocurrency trading in Japan? Now the cap leverage in crypto margin trading can be no more than 4 times higher than initial deposits

👁 The capitalization of Bakkt is estimated at $700 mln as a result of Series A financing | Reddit user aims to give an objective assessment of the news sites writing about cryptocurrency

📢 CZ (Binance): "Many (not so small) businesses already don’t use banks, and they work just fine. JPM just don’t get it, yet"

@icotelegraph purchased a 12.49% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com