The Greater Fool's Theory: Crypto Edition

There is a big cognitive dissonance within the crypto community. The dream of decentralization and censorship resistance is dominated by big centralized exchanges centralized empires like Binance and Coinbase.

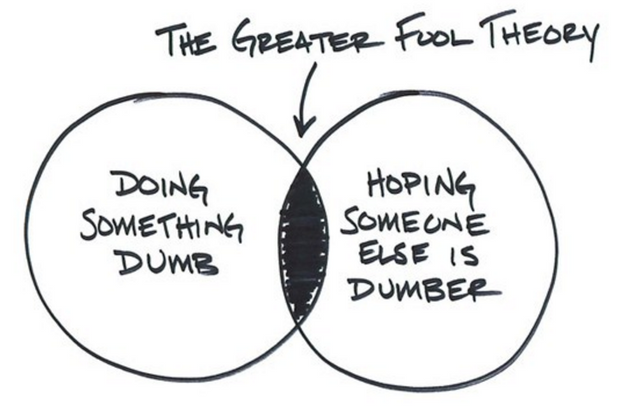

Speculation still drives the market and fuels the continued growth of centralized exchanges. One of the leading factors fueling the revenue stream of exchanges is new coins, namely ICOs and in future STOs. ICOs became nothing more than a way of Flipping Tokens. Most ICOs used and continue to used Proof of Greater Fool to push forward their blockchain.

People invest in something that they know is probably worthless and extremely overpriced, hoping that they can sell that worthless overpriced digital token to a "Greater Fool". In the end, all ICO investors are fools because even if Fool #1 manages to Flip the token at 3x the price he bought it at, he is still the fool compared to the ''ICO that now holds millions** collected by all the #1 fools.

Essentially ICOs that list on exchanges right away that have nothing to offer and no product are basically Ponzi schemes, with ICO team at the top, ICO Buyers second Layer and people on the exchange at the bottom of the pyramid.

The IEO (Initial Exchange Offering) is a natural evolution of this Ponzi scheme: Now with ICO and Exchanges working together to pump up the price, being able to freely manipulate the price of the token and print free money. As Cryptocurrencies are a totally unregulated market they are pretty much free to do whatever they want.

Cryptocurrency exchanges basically became empires fueled by greed, trading fees, listing fees, and so much more. These empires have no interest in changing the system, similar to how banks do not want to give away power.

It is expected of anyone in power to be very corrupt in a totally uncontrolled market.

BUIDL VS Initial Exchange Offerings

In 2019, for the first time in 3 years, projects that focused on tech, product, and business development came out of the darkness.

Most people pretended to work to look good to raise money, however, some actually worked to solve problems. 2019 was also the year that we started to see Initial Exchange Offerings. ICOs conducted on exchanges compared to publicly.

The original purpose of ICOs was to take away the monopoly of fundraising away from stock exchanges and brokerage firms. An IEO is well explained in that scene of Wolf of Wall Street, when they opened an IPO for Steve Madden shoes. Remember when a centralized entity is responsible for issuing a new stock? It probably has a vast interest in pumping that price, but is it legal in the traditional financial space?

Well, it is in crypto.

ICOs that are actually working hard to build their product also understand that in order for their projects to become successful they need to become decentralized. They need to get their tokens in as many hands as possible. Of course, the person that is attached to that hand should also bring value to the project.

The best example of the power of useful decentralization is Bitcoin. Bitcoin has a pretty old tech, had a few bugs in their source code, is super slow, but yet it has by far the best community and strongest social consensus. Hashrate doesn't mean much, after all, Bitcoin Cash had a bigger hash rate for a brief while, but it was the social consensus of the mining community that decided not to implement the new changes introduced by Rodger and Bitmain. Now BCH is less than 96% of the market Cap it used to be.

The value of cryptocurrencies is defined by nothing more than censorship resistance, game theory, and token holders. In the long term, these three factors will be decisive determining which coin will have the biggest market cap. Bitcoin has by far the most censorship resistance, probably one of the best game theories and by far the best community.

The value of a coin is pretty much all about: how hard it is to change the information saved on the block * (sum of all useful skills and influence amongst all token holders) that can be leveraged by game theory within the ecosystem.

Best case vs Worst Case outcome for an ICO

An ICO that is used for its actual purpose and not as a vehicle to facilitate scamming, can be seen as the big bang of any new blockchain ecosystem. Successful ICOs understand that they need to act like economies, not companies. Usually, economies filled with smart people that can utilize their skills to push their ecosystem that is also run by the good government (good game theory) do very well, compared to economies that have a very small set of inhabitants that can bring economic value for influence and skill sets.

The optimal scenario for an ICO would be if the tokens were magically distributed among the best developers, business integrators, influencers, politicians and basically anybody that would be willing and capable of bringing value to the new blockchain ecosystem.

Bitcoin’s mechanism to achieve this magical community was via mining and its 4-year reward halving cycle. It takes a great deal of passion and technical skills to start mining. Also, the low token price during the first few years motivated the best developers, who are also deeply interested in the technology, to jump onboard and help on its development efforts. This also allowed them to acquire a lot of tokens in the process.

The 4 year Bitcoin Pump and Dumps enable very smart individuals to join the bitcoin ecosystem every 4 years and accumulate at low prices. Regulators love crypto once they’ve also bought a bag.

Therefore the best outcome is the magical distribution of tokens to all the best developers, business integrators, influencers, politicians and basically anybody that would be willing and able to help that new blockchain ecosystem.

The worst case would be an ICO whose tokens holders are mostly speculators, also known as an initial Exchange offering.

ICO DOG offers a different path: Social Mining

We have been very busy for the past few months to build an IDK (ICO Development Kit) for the cryptocurrency ecosystem.

It is an off chain - onchain hybrid solution that any project can plug into their project to assist them with all problems they could potentially face and helps them in the long run to become a decentralized autonomous system. We called it Social Mining, proof of engagement. A certain percentage of the token supply is dedicated for social mining. Any ICO or Post ICO project can plugin our solution to boost their community and to help them become more decentralized.

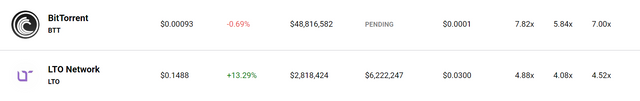

We have been testing the system now for about 6 weeks and the results are already overwhelming for our first client LTO Network. After the first 6 months, LTO network now has 8 different language channels, community marketing team, over 50 mainnet nodes, community development team, and community produced merchandise shop. The platform is in every sense the opposite of an Initial Exchange offering.

2nd best performing ICO was raised via our IDK and proof of engagement

You can find a very good in-depth comparison of the two projects here:

https://cryptodiffer.com/news/buid-the-meme-that-thrives-in-todays-bearmarket-by-steven-price/

For more information on Social Mining you can check out our content at:

www.icodog.io -

https://icodog.io/crypto-stories/the-story-of-icodog-november-progress-report/

Or on the LTO Medium Page: https://medium.com/ltonetwork/community-engagement-and-whitelist-the-lto-way-4698b98fdddd

Want to know more?

Join us on our Discord and Telegram channels and get into the discussion, or join our 8,000 member community on our ICO DOG Investment Platform:

Smart post!

thanks the product is even smarter :D Thanks for taking the time to read our content.

Short Exchanges Long decentralization.

▀

Upvoted this quality content

ooh man nice post , love it ,

Thank you a lot :D These comments mean a lot to us.

You forgot to mention the acceptance of the coin by businesses. A large part of Bitcoin's success it that you can actually purchase things with it. I think this is the key for the success.

Posted using Partiko Android

Sadly the Ponzi scheme projects have tainted peoples eyes when it comes to ICOs so projects that actually need ICOs are not able to raise money for their project. This is probably the sad part about ICOs.

Nice article by the way.

Sda, but true #Metalica

You must be able to get some traction before ICO. If you can show vision, execution and hence traction you have many ways of promoting your product before ICO. So, I don't really think any real damage was done. ICO should be here to allow anyone to invest. Not a mean for anyone to raise money.

I think we are getting back to the roots now, which was good until the fucking IEOs started popping up. The worst ones are actually korean IEOs because the literally "airdrop" chicken to peoples home address trying to market shitty ICOs.

Gran post, amigo. Gran información.

Lot of scammers have been using ICO to scam people. And this situations has created a negative atmosphere into the crypto space contributing in some how to this bear market we actually are.

I think I' ve seen a comic somewhere that demonstrates your sentiment. More or less it says that crypto is the lowest hell one can be. Having this in mind, it is rather easy to jump from a shitcoin to another without even thinking about it.

I have become very suspicious of the big exchange Binance, and particularly the BTT ICO. It looked like a pump and dump. They also charge huge listing fees. They are centralised. They apparently steal other company's tech, for their own DEX.

I found all this out from Youtuber Chico Crypto if you want to know more.

Yeah, I also saw that video, it's getting pretty bad with front running and other dubious stuff. We will probably write a whole article on that stuff as well. If you liked this content maybe you will like our other stuff as well https://steemit.com/@icodog

Thanks for the reference @icodog, let me check it out.

Wow ,vary clever