Proof-of-Stake vs. Proof-of-Work: A Brief Introduction

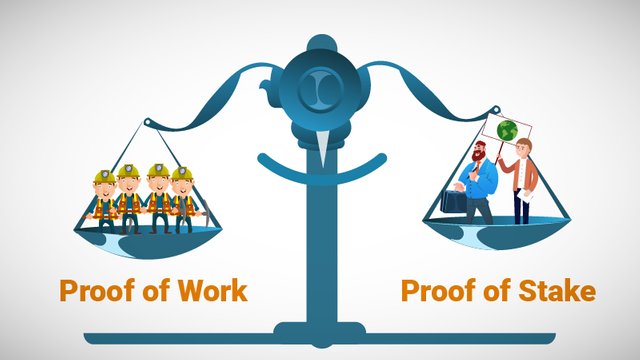

Both Proof of Work and Proof of Stake computer algorithms have been vital in the success of virtual currencies like Bitcoin, Ethereum and many others. Thanks to the two mechanisms, cryptocurrencies can achieve “distributed consensus.”

Distributed consensus can be defined as the ability of a large pool of people who are geographically separated to be able to agree on something. When it comes to crypto coins like Bitcoin and the rest, something means deciding on which transaction or block is valid and which is not, therefore, its rejected.

In this piece, we are going to look at two of the most popular consensus mechanisms that are used by blockchain based projects to verify transactions and also guarantee the security of the networks. Without further ado let’s get started.

Outline

- What Is Proof-of-Work (PoW)?

- Here is how Proof-of-work works

- What Is Proof-Of-Stake (PoS)?

- PoW Adoption Vs PoS Adoption

What Is Proof-of-Work (PoW)?

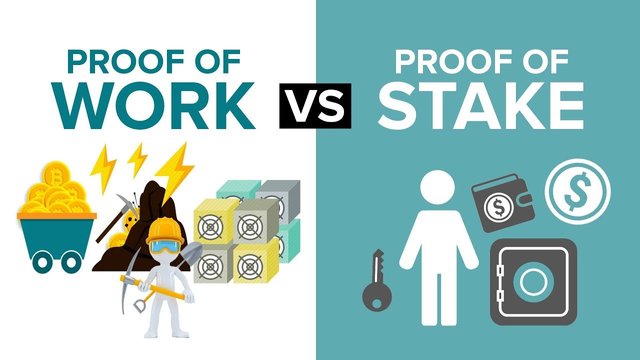

SHA-256 is the PoW function that is used by Bitcoin miners to help them solve computationally difficult math puzzles and in the process add new blocks on the blockchain. The hash function also known as hashcash produces a specific type of data which is used to verify the “amount of work” that has been done.

Think of proof of work as an activity that eventually leads to the production of a single piece of data that can fit into the bitcoin blockchain. However, the “activity” is both computationally expensive and time-consuming.

Here is how Proof-of-work works

For a miner to successfully mine a block, they need to hash the block’s header in such a manner that it is less than or equal to the “target.” Currently, the target is SHA-256 hash of a given block’s header. It must be a 256-bit alphanumeric string that always has to start with 18 zeros. It’s important to note that the target changes after the mining difficulty changes which is after every 2016 blocks.

The miner will get to this particular hash “target” by varying a small portion of the block’s header that is known as “nonce.”

A nonce typically starts with Zero and increases every time it obtains the required hash/target. Interestingly, since the varying of the nonce is a game of hit and miss, it requires many attempts before a miner successful finds the block header.

The process involves a lot of work and requires an enormous amount of computational power and hardware resources to prove that a large amount of work has been put in before successfully mining an individual block. Hence the name Proof-of-Work.

The miner that manages to be the first to obtain the correct Bitcoin or any other coin hash is rewarded with a certain number of coins.

However, a few studies on PoW have suggested that running and maintaining networks like Bitcoin that are supported by the algorithm, is as costly as powering millions of houses in the United States.

What Is Proof-Of-Stake (PoS)?

PoS is an alternative way to reach a decentralized agreement. It came about as a solution to the labor and resource intensive PoW algorithm. Its beginnings can be traced back to 2012 when a Bitcointalk forum user suggested the new consensus mechanism since PoW was consuming way too much energy and mining a single block felt like a waste of resources.

Alternatively, Proof of Stake is more user and environmentally friendly than Proof of Work. In PoS, the number of coins a staker has stored in the system matter. The more significant the stake, the higher the chances that one will not be incentivized to breach the system as there is a risk of losing it all.

Unlike PoW, here coins are not mined, but they are forged or minted. The algorithm works by randomly selecting individuals based on how much they have staked in the system, and they get to add blocks on the blockchain.

The pseudo-random selection happens after many different factors have been analyzed. This ensures that it’s not only people that have huge stakes that are selected, but everyone is considered. Some of the factors include coin age-based selection, randomized block selection, master nodes and many more.

The consensus mechanism is usually applied to those crypto coins that are pre-mined, and this allows users to have coins for staking. Therefore, the supply of PoS cryptocurrencies is fixed from the start. Also, there is no block mining like in PoW.

PoW Adoption Vs PoS Adoption

Bitcoin was the first blockchain to use the PoW mechanism. Every time a transaction is sent over the Bitcoin network, it takes around 10 minutes to be confirmed. Also, the blockchain can only handle 7 transactions per second.

Over time, transaction fees have increased significantly. For example, in the beginning, the BTC fees were only a fraction of a cent, and this made the network useful when it came to transferring small amounts of funds.

However, as the network got busier, the fees increased peaking at $40 per transaction in December 2017. Even though the fees have since reduced, they are still too high making Bitcoin unsuitable as a global payments system. As you may have guessed it, most of the issues plaguing Bitcoin have been caused by limitations of the PoW mechanism.

The second largest cryptocurrency by market cap Ethereum also currently uses the PoW, however, it’s planning a hard fork that will see it switch to PoS. Part of the network’s desire to shift is to address scalability issues that arise due to PoW.

Even though the developers of the Ethereum blockchain managed to tamper with the original code and this allowed the network to process transactions at 16 seconds as opposed to Bitcoin’s 10 minutes the network can only support 15 transactions per second which are quite low then what the network needs.

The hardfork will see Ethereum scale considerably enabling the network to support thousands of transactions per second.

Regards, dear friend, @icodog.

Whenever this dilemma arises between PoW and PoS, I can not stop thinking about the "Tangle" structure.

There also predominates PoW and PoS?

Can this technology overcome or replace Blockchain?

Excuse me if I bother you with my curious question.

Thanks for posting such valuable content.

All best, Piotr.