Future of Litecoin (LTC): 2019 and Beyond

The cryptocurrency market is currently on a strong bullish vibe that has seen most of the top digital assets make massive gains since the start of 2019.

Litecoin (LTC), a fork of Bitcoin, is one of the coins that is performing really well as the price of the asset hit $94.48 USD on April 6th 2019. This represents a 214% increase in price since January when the price stood at $30 USD per coin. With the market slowly finding its way to the highs witnessed in 2017, when LTC traded above $400 USD, is there a possibility to reach the all-time high again?

Before we dissect into the future prospects of LTC, we look at the history and interesting facts about Litecoin below.

Outline

- What to know about Litecoin

- Historical price of Litecoin

- Technical Analysis of Litecoin’s price

- LTC Vs the Dollar

- LTC Vs Bitcoin (LTC/BTC)

- Factors affecting Litecoin’s future price

- Conclusion

What to know about Litecoin

Litecoin (LTC) is an idea that cropped up from Charlie Lee, a former Google employee, back in October 2011. Lee saw major improvements that Litecoin would bring to the cryptocurrency universe as Bitcoin started showing some weaknesses. These improvements by Lee include:

- Faster generation of new blocks

- Greater liquidity through a larger coin supply (84 MM)

- Fairer distribution of coins to miners

- The ability to test and implement new technology faster

However, the coin did not gain much attention from the world till it hit a $400 USD, and close to $20 billion market cap in December 2017. The platform is built to make transactions four times faster than Bitcoin with block confirmation speeds set at two and a half minutes.

Follow this link to learn more on the various differences between Bitcoin and Litecoin.

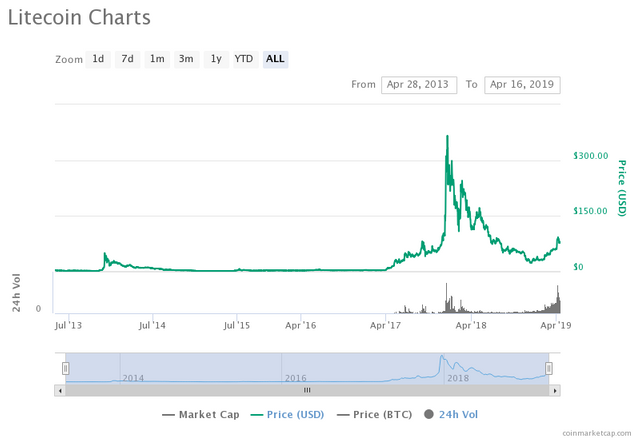

Historical price of Litecoin

Litecoin is one of the few early coins that did not raise an ICO which saw a late introduction of the coin to exchanges in early 2014. The first price listed on an exchange was around $4.30 USD. If you invested your money then in LTC, you could have made close to 10,000% in profit if you sold in December 2017 at its ATH. An investment of $100 USD back in 2014 in the digital asset is currently worth $2000 USD today representing close to 20X your initial investment.

Litecoin (LTC) price since 2014 in US dollars (Coinmarketcap)

Today, LTC trades at $78.22 USD across major exchanges, representing a slight 4% decrease in price in the past 24 hours. With the price steady above the $70 USD mark, we focus on how the price of LTC might look in the near future.

Technical Analysis of Litecoin’s price

Litecoin has always had an affinity to the cryptocurrency investors as the volume traded daily shows. The coin is currently ranked fourth on the daily volumes traded with a total of $2,525,119,857 USD traded. Only Bitcoin, Tether, and Ethereum ranks above the coin. This shows the potential Litecoin has in the future once the market stabilizes given the reception from investors.

1. LTC Vs the Dollar

The LTC/USD pair technical analysis shows the price is facing a crucial few weeks in the coming future as the price struggles to cross the bullish pennant. The price set a new support level at $99.58 USD, which if crossed may signal an upcoming boost in LTC’s price.

The current bullish momentum is the first steady bullish trend the LTC/USD pair is experiencing since the start of the bearish run in February 2017. A break above the bullish pennant may push the price towards testing a new resistance level at $170 USD.

2. LTC Vs Bitcoin (LTC/BTC)

The volatility in LTC/BTC is not as great as that on LTC/USD. Litecoin tends to follow Bitcoin’s price but in different variations, as shown in the chart below. LTC currently trades at 0.0156 BTC (1560000 sats) representing a percentage drop against the top cryptocurrency. The Ichimoku cloud signals a bullish run on LTC/BTC pair as Lead 1 crosses above Lead 2 and a green cloud starts to form.

The weekly price also is struggling to break the resistance level at 0.01877 BTC as the price remains above the cloud. The accumulation of satoshis (sats) is important for long term traders which shows the coin is performing better than BTC, the benchmark cryptocurrency. For Litecoin, the challenge doubles as the asset is competing with Bitcoin to become a global super cryptocurrency.

Factors affecting Litecoin’s future price

Litecoin’s future looks bright despite the coin losing over 80% of its value since the all-time high price. The adoption of LTC is taking off at a superficial rate as exchanges, merchants, retail stores and other enthusiasts are taking up the use of LTC. The coin has seen a couple of additions on exchanges across the world which allows more markets to purchase and trade the coin.

In August this year, the halving of Litecoin block rewards happens which will reduce the miners’ rewards from 25 LTC per block to 12.5 LTC. Previous halvings of Bitcoin’s block rewards have seen the coin boost its price to insane levels which may be the case with the current rise in LTC’s price.

Miners will have lower rewards which means the transaction fees, which are part of the miners’ income, need to be increased. However, this may cause a reduction in the adoption rate of the coin, a move that is not ideal for the Litecoin community. Litecoin is added to the Lightning network to curb the issue of increased fees and offer the Litecoin Core platform users instant transfer of coins.

The partnerships and developments in the Litecoin community will play a huge role in the future price of the coin too. The Litecoin Foundation, the lead developers of the Litecoin Core project are also looking at increasing the privacy levels of the coin through the MimbleWimble protocol.

Conclusion

While the future remains uncertain on the world of cryptocurrencies, the rest of 2019 looks bright for the LTC enthusiasts. The technical indicators and fundamental analysis of the digital asset shows a possible $170 USD valuation by the end of the year.

(Technical Analysis images from KenyanMiner on Trading View)