Bitcoin [BTC] fails to see increase after Consensus, Thomas Lee clarifies why

Fundstrat’s Thomas Lee clarified that this bullish prediction for Bitcoin’s price after Consensus did not come true, saying that it was “very disappointing”.

Consensus took place from May 14-16th earlier this week. It boasted an attendance three times more than its previous iteration and is a testament to the growing mainstream interest in cryptocurrencies and blockchain. Therefore, Thomas Lee predicted a bump in price over the last week. This did not come to be.

Lee took to Twitter to mention what he thought were the reasons that Bitcoin and other cryptocurrencies did not gain price over the past week. He said that it was a “week of generally positive news for crypto”, including various institutional adopters and infrastructure developments that came to be during the conference.

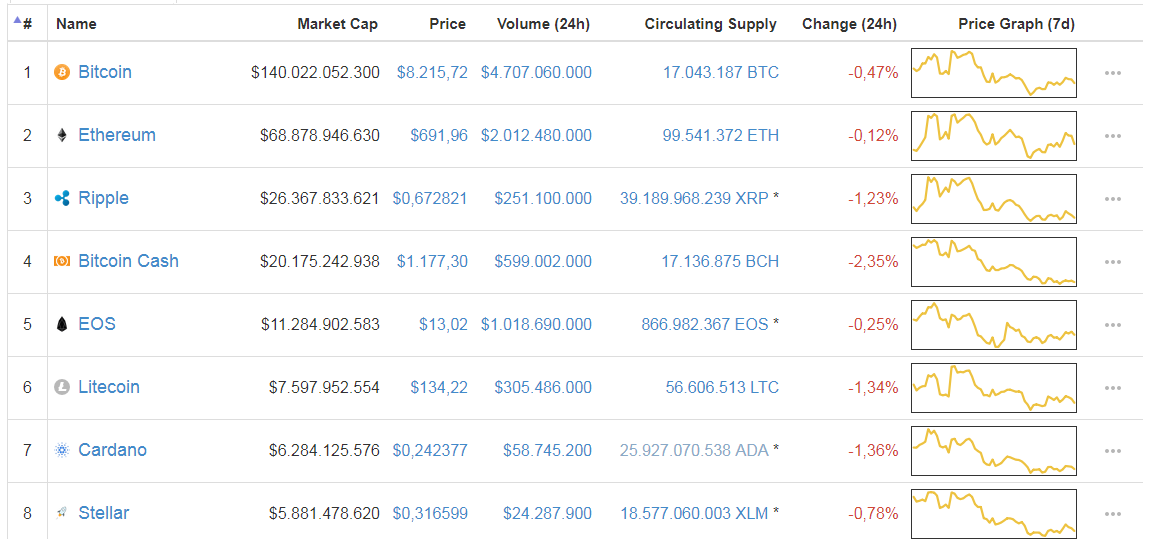

The uptick seen in the aftermath of the 2017 conference was not seen, as Bitcoin had a 1.35x growth between 20th May and 25th May 2017. It grew from around $2000 to a high of $2700 before correcting to around $2500. This year, Bitcoin was facing a bearish market before Consensus and did not recover but stayed at around the $8200 mark over the week.

Lee said that cryptocurrencies were, and have been suffering from an “overhang of regulatory risk” and a hostile reception from financial institutions. The opportunity was offered at the conference to strengthen the community’s conviction. He said:

“Conferences are chances for the community to gather in a centralized place and meet constituents new to the community, it seems natural that the combination of “sanity check” plus “new interest” should strengthen the crypto-community’s conviction.”

He gave the reasons for the rally not happening as the “Consensus sell-off”. Even major announcements were made on the front of institutional investors, with Nomura working with Ledger and Global advisors to provide a crypto-custodian bank service.

Lee predicts that a conclusion must be reached on a regulatory framework, from institutional regulatory parties like the SEC, and that a cultural buy-in must occur by the institutions themselves. The “Blockchain: good, crypto: bad” mentality must be broken to allow for a rally in price.

He mentioned that multiple institutional service providers and institutional custody solutions were released, which indicated progress. However, he said:

“It is obvious that crypto still faces significant internal resistance and hurdles within traditional financial institutions. In our many conversations with institutional investors/banks, we find that specific teams may be enthusiastically committed, but widespread internal acceptance of crypto/blockchain faces hurdles”

He also mentioned that it was encouraging that a large share of the incremental addition to attendance were financial institutions.

Zcash [ZEC] was the major rallying crypto this week as stated by Lee, due to its addition on the Gemini trading platform operated by the Winklevoss twins. Consensus was a great growth for the community.

Lee said that even though Bitcoin has been stated as being boring, and that many offices are looking for the “next bitcoin”, it will be one of the two primary onramps for major institutional trading along with Ethereum. Even as a currency, through payments, it is seeing growth through companies like BitPay and Square.

Lee gave a bottom line on the conference, saying:

“While there was not a Consensus bump, our conviction on cryptocurrencies strengthened during the conference.”

Source from Anirudh VK