Major cryptocurrency fell sharply,dragged down by Bitcoin - Here's why

The bitcoin cost went into freefall toward the beginning of today, in spite of uplifting news for bitcoin selection from the developing Lightning Network, as speculators advance beyond the U.S. Security and Exchange Commission's (SEC) choice expected not long from now on whether to concede endorsement for a bitcoin trade exchanged reserve (ETF) — something the SEC has beforehand dismissed because of fears around bitcoin's wild value swings and value control.

Bitcoin fell by some $500, or 5%, in simply a question of minutes, as indicated by CoinDesk information, and taking the bitcoin cost under the mental $7,000 check.

The sharp fall in bitcoin value comes after unverified reports from Business Insider that U.S. venture bank Goldman Sachs is dumping intends to open a work area for exchanging digital forms of money because of the dinky administrative scene.

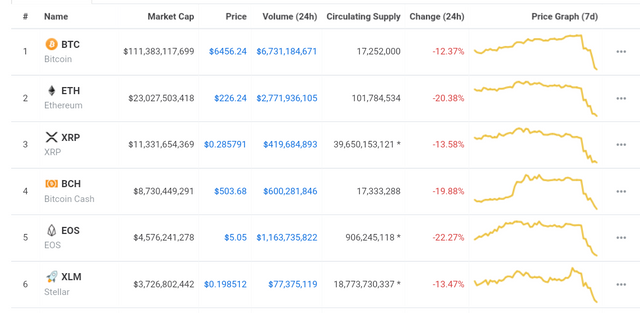

All cryptocurrency go down with bitcoin freefall in just two days.

BI announced:

Goldman has moved plans to open a work area for exchanging digital currencies additionally down a rundown of needs for how it can take an interest in cryptographic money markets, as per individuals comfortable with the issue.

Accordingly, the bank discharged an announcement: "We have not achieved an end on the extent of our advanced resource offering," it said.

Controllers around the globe have been pondering how to appropriately manage bitcoin, digital forms of money, beginning coin contributions (ICOs) and cryptographic money trades. A year ago the SEC cautioned that a portion of the coins issued in ICOs could be viewed as securities, which means exchanging them would need to agree to government securities laws.

Goldman Sachs' turn comes after the bitcoin and more extensive digital money token cost has been very much upheld by news this year that institutional cash was going to get into crypto — and many will currently be addressing whether that cash is truly on its way.

Prior this year the new CEO of Goldman Sachs David Solomon flagged the bank is investigating including further bitcoin and digital currency administrations to its portfolio. In a meeting with Bloomberg Solomon said the bank must "advance its business and adjust to the earth."

Bitcoin bulls are additionally attempting to hold tight until early November, when the New York Stock Exchange's parent organization, Intercontinental Exchange (ICE), plans to reveal a bitcoin ETF as a component of its digital money stage Bakkt and in association with espresso chain Starbucks, programming mammoth Microsoft, and Boston Consulting Group.

Recently, CEO of crypto installment startup Abra revealed to CNBC the reason the SEC has insofar denied crypto ETF is on account of the crypto business does not fit the candidate prime example.

Bill Barhydt recommended that the SEC has rejected crypto ETF applications since "individuals who are doing the applications don't fit the form of who the SEC is accustomed to affirming."

It's been recommended that the presentation of an enlistment procedure for famous moment bitcoin trade ShapeShift may have spooked a few clients and "included fuel" to the auction.

Bitcoin moved to an eye-watering close $20,000 before the end of last year yet has been intensely sold off all through 2018, dropping to year-to-date lows of around $5,800 and starting a more extensive auction of the more extensive digital money advertise.

Somewhere else, other real digital forms of money including Ethereum's ether, swell, bitcoin money, and EOS were additionally hard hit toward the beginning of today — all falling no less than 10%.

The fortunes of most digital currencies have been firmly fixing to bitcoin this year. Ethereum's auction has been to a great extent credited to the tremendous number of ICOs that went live on Ethereum's blockchain a year ago, with huge numbers of those speculators salvaging all through 2018.