Can 2018 Be The End of Bitcoin Cryptomania?

The End of the Beginning

As we all know, yesterday was the introduction of the CME Futures for Bitcoin, which came about smoothly without any major glitches. Today marks the first trading day of the CME Futures, along with the CBOE Futures on the TD Ameritrade: Think-or-Swim platform. So, what does this all mean? The end of the beginning is upon us. The beginning, meaning that Bitcoin and Cryptocurrencies are still obscure terms, which most people are not familiar with. After Thanksgiving Weekend and Bitcoin’s reach to the psychological milestone of $10,000, people all over the US finally paid attention to the price explosion of this digital currency. Now everybody wants to get in on the action. Over 100,000 new users are signing up to Coinbase on a daily basis. For the past few weeks, you could not go by one day without having someone mention about Bitcoin, Litecoin, or some other cryptocurrency. You probably heard about Uber drivers talking about Bitcoin, the hairdresser down the street probably told you Litecoin is better than Bitcoin. But, does all this excitement signify the end of the Bitcoin Cryptomania? Perhaps, there are few things we need to observe before making such conclusions.

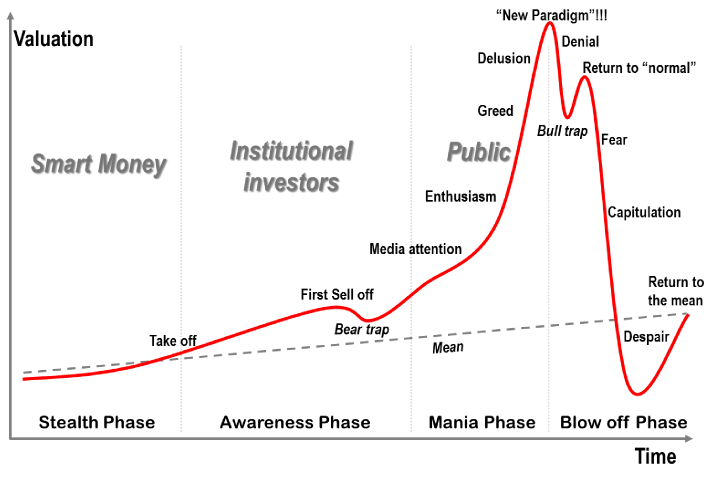

The Asset Bubble Cycle (Picture Above)

If we take a look at the featured picture above, we notice that there are many parts of an asset bubble. There’s the Take off stage, which was when Satoshi Nakamoto wrote Bitcoin’s Whitepaper and handed the project over to the Bitcoin development team. The development team worked on the project, introduced and promoted this new technology to the world and made Bitcoin what it is today. Of course, there are still many flaws in the tech, itself. Regardless, the Take off stage is long gone. This stage was followed by a First Sell-Off, which happened with the whole Mt. Gox fiasco. This was when Bitcoin had a run up to $1,300, but plummeted down back to the lower triple digits due to a hack in what was, at the time, the world’s largest Bitcoin exchange. But sure enough, Bitcoin was able to fight its way back to Media Attention phase, which we just passed. The media attention phase was (and is) when all the news channels started blasting headlines about Bitcoin. Not just the financial news, but the local news as well. Just the other night, I saw a news report from a local news channel WPIX, regarding Bitcoin Futures trading with an $18,000 price point. When things like this hit the local news, then you know even the Average Joe probably know about Bitcoin.

Seems to me, we are currently in the midst of the Enthusiasm stage. Now, I have multiple friends and associates interested in opening up Coinbase accounts. Many are still waiting to get their accounts verified. Some are waiting for their bank accounts to link to the app. Coinbase became the #1 app on Apple’s Appstore, not too long ago. People are definitely enthusiastic and jumping on the bandwagon. So, does this mean you are too late? According to many people in the community, there are “Waves” of new users. Each Wave consist of a batch of newly verified accounts on Coinbase. We have seen what the most recent “1st Wave” did to Crypto. Bitcoin jumped to $19K, Ethereum jumped into the $700’s, and Litecoin jumped into the $300’s levels. Please remember this is just the 1st Wave, with many Waves to come. So, you only missed the 1st Wave, don’t miss the 2nd one. And of course, you don’t want to be in the last Wave, when everything is about to implode.

To complete the Asset Bubble Cycle observation, after the Enthusiasm stage, we have the Greed stage…this is probably when Wall Street starts cashing in on Crypto Exchange Traded Funds (or ETFs). This is when the BIG Money comes in. If you think that Crypto is in a bubble now, then you haven’t seen anything yet. Afterwards, we have the Delusion and New Paradigm Stages. This is when you start hearing from the big newscasters hailing Crypto to be the “Next Big Thing”, spewing how “Things Are Different This Time”…just like how they were saying that the Dotcoms were “The New Economy”. You’ll see this not only in news broadcasts, but you’ll see this on all the major magazine covers, as well. Of course, we are currently not in that stage yet. But, we will be there…one day. Just don’t be fooled by greed when the day comes.

Basic Economics: Supply vs Demand

The Legendary Investor, Kenneth Fisher, predicted the Dotcom Bubble Burst by looking at the Supply vs Demand of stocks during the 1990’s. Of course, he looked at more than just Supply vs Demand, but this was one of his simplest analysis on how the market was going to perform in the late 90’s. He examined how at the beginning of the Dotcom Bubble, there was a gargantuan demand for technology stocks. This was when all of the bigger, more established, higher quality tech companies were coming into existence. At some point, the demand reached its peak and started to dwindle. During the dying down stage, many of the Dotcoms and tech stocks were bought up already, with new Dotcoms IPO’ing every day. At this point, the new Dotcom IPO’s were just not as high quality or exciting as their predecessors. There was an overflow of stocks in the financial markets, when there was very little demand for such securities. The low demand with high supply of stocks was one of the catalysts to the Dotcom Bubble Burst.

If we were to take the above analysis one step further, we can surmise there’s only a limited amount of money in the economy. As more IPO’s enter the market, we can only sell one stock to get into another stock, meaning we need to deflate one company’s stock price to inflate another one’s. So, there’s only so much supply the market would allow before all stock prices start deflating.

Which brings me to the next point with cryptocurrencies. As we all know, Coinbase is signing up more than 100,000 new users every day, and there are thousands upon thousands still waiting to get their accounts verified. These people are eager to get into the cryptomarkets ASAP. So, we can see the demand for cryptos overwhelmingly engulfs the supply. And the last time I checked, Coinbase is still one of the top apps on the Apple’s Appstore. So, the demand is still HUGE.

SEC Regulation on Initial Coin Offerings (ICO’s)

Most techno geeks and Libertarians will say that regulation on crypto is bad, for obvious reasons. It can stifle the growth of crypto, along with taking away some of the freedoms associated with cryptocurrencies, which is after all one of the main purposes of crypto: Freedom. However, regulation is not all that bad in my point of view. You know why? Regulation makes crypto “safer” and would allow for mass adoption by the general public. Most importantly, regulation limits the supply of ICO’s available in the market. Before the SEC stepped in, there were dozens of new ICO’s coming out on a daily basis. Most people cannot tell if the ICO’s were legitimate or scams. Joe Schmoe from next door could create a website and a Whitepaper and start collecting funds for his new “project”. We can all see the problem behind this. What’s more damaging is the continuation of unregulated ICO’s would lead to an oversupply of cryptocurrencies in the market, thereby dampening the demand for this new asset class. In other words, even if there’s a giant demand for cryptocurrencies, the humongous influx of ICO’s (especially the scams) would diminish the demand quickly. Regulation would weed out the scams and allow legitimate ones. Not only would this make the cryptomarket a better and safer investment ground, but this will ultimately limit the amount of ICO’s in the market. And remember in economics, when there’s great demand with limited supply, equilibrium price moves higher.

When Will This All End?

Mark my works: The Bitcoin Cryptomania will end next year, 2018. Just kidding! Well, not really. If you have been trading crypto in the past year, or so, you will realize that whatever happens in the stock market takes only a small fraction of time to complete in the cryptomarkets. In other words, while it takes a couple of years for the Stock Market to go from a bottom, to a recovery, and then a bull market, followed by a correction, and bear market, and then back to the bottom, the cryptomarkets complete this cycle within weeks. So, we are talking about an extremely fast and short time frame here. Of course, the futures markets are created with the intention to slow this all down, however Bitcoin is still moving very fast compared to traditional markets. So, if we go back to the Asset Bubble Chart (featured picture above), while it may take about three to four years for an asset bubble to blow up, cryptomarkets can take months. Now, I am not spreading Fear, Uncertainty, and Doubt (FUD). I am just keeping everybody’s eyes open to look at the warning signs of what may ensue in the very near future.

Just remember that when you start hearing Jim Cramer speaking about how “Cryptocurrencies is the new thing now and is the way of the future”, and that “This Time It’s Different,” and when you start noticing magazine covers featuring Bitcoin all over the place, and if you notice a sudden drop in the sign ups on Coinbase among other cryptocurrency exchanges, then you know it’s time to take your profits and enjoy your new found wealth.