This play beats bitcoin with 100%-plus returns — and it’s less risky

Summertime and the living isn’t so easy, if you’re a stock investor looking over your shoulder at oil.

The hesitation we saw yesterday, as we adjust to the oil-in-a-bear-market world, looks set to continue today. So you just might just like to escape to another investing world where there is no Fed, OPEC or FANG stocks throwing curveballs.

Fatigue for traditional investors may be one reason why the excitement is booming in the wild west of the cybercurrencies right now. Over on Reddit, one forum dweller said they were ready to drop $20,000 into bitcoin — after doing some research and concluding the only way was up for the crypto cash. It beats “$20k sitting in a safe-deposit box,” the poster said.

“Only invest what you are willing to lose,” was one response.

And that leads us to our call of the day, which says there’s some big money being made on cybercurrencies — but the risk is on the same scale. And where there’s an opportunity, there are hedge funds.

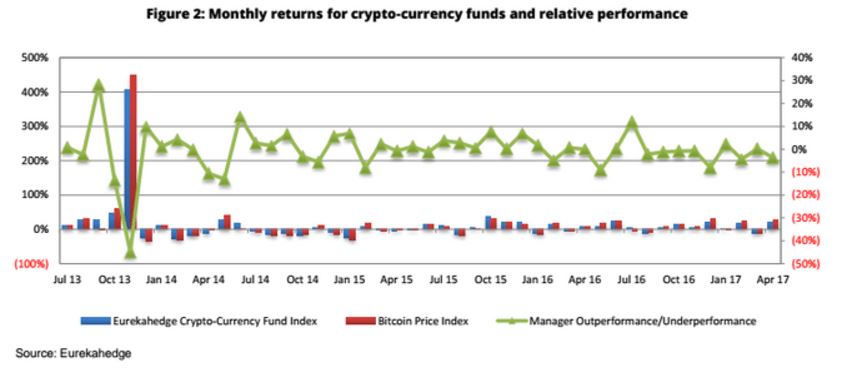

Blogging for ValueWalk, Rupert Hargreaves took a deep dive into the Crypto-Currency Fund Index from Eurekahedge. The data firm uses the index to track the performance of five actively managed hedge funds with holdings in bitcoin, ethereum and other digital cash.

The findings? The Eurekahedge index not only beat traditional hedge funds, it even blew bitcoin itself out of the water.

Between June 2013 and April this year, the index shows eye-popping cumulative returns of 2,152.32%, versus 1,408.11% for the Bitcoin Price Index. Looked at annually, that’s a return of 125.35%, compared with 102.96%.

The funds on the index seem to offer a “less volatile way” to bet on cryptocurrencies over just buying bitcoin or ethereum, even though the level of volatility for the index itself “is off the chart,” Hargreaves notes in his blog post.

In its report on performance, Eurekahedge said that “over a period of 14 months between December 2013 and January 2015, the Eurekahedge Crypto-Currency Fund Index lost almost 73% of its value from its 2013 high. In contrast, the Bitcoin Price Index lost almost 81% of its value,” according to Hargreaves

Whether we’re on the edge of a South Sea Bubble or greatness for the cybercurrency faithful, bitcoin and its pals have been bringing the drama meanwhile.

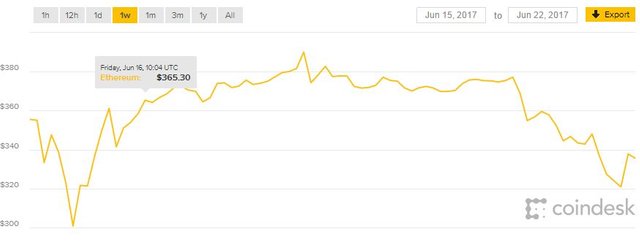

Popular rival ethereum suffered a flash crash yesterday, which CoinDesk blamed on an influx of new users, pumped on media hype. ZeroHedge said it was caused by one seller trying to dump $30 million of ETH in one go.

Just a day in the life of a brave new world.

Check out: How big is bitcoin, really? This chart puts it all in perspective

Key market gauges

The Dow DJIA, +0.20% S&P SPX, +0.19% and Nasdaq COMP, +0.11% are trading into the black a bit. Europe SXXP, -0.03% is looking at its third-straight loss on weak energy names.

Crude CLU7, +1.47% is bouncing back. Some metals are on the rise, and that has lifted parts of Asia ADOW, +0.53% MSCI’s inclusion of China stocks continued to boost the Shanghai Composite SHCOMP, -0.28% .

Risk off? Gold GCU7, +0.00% is up.

Read the latest in Market Snapshot

The chart

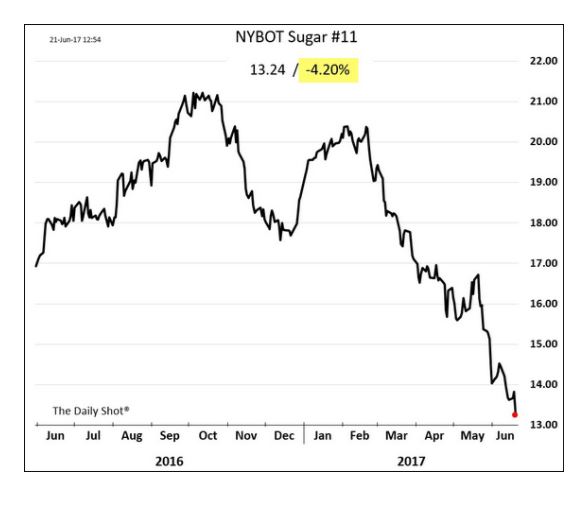

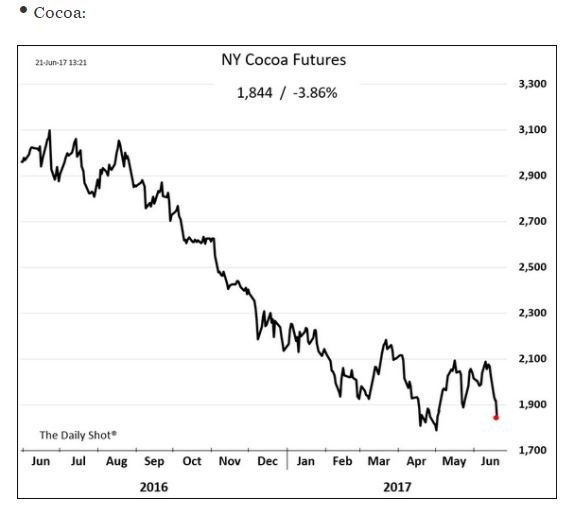

It’s not just oil that’s hurting these days. Check out what’s happening with some soft commodities, via these charts from The Wall Street Journal’s Daily Shot.

Here’s sugar futures: