Bitwise Exec Predicts Trillion Dollar Crypto Market Cap this Year

Matt Hougan made a transition from his ETF career to cryptocurrencies. He jumped from the traditional fund market to a cryptocurrency index fund manager, a market he described to Bloomberg as a "significant generation opportunity with interesting challenges."

He joined San Francisco-based Bitwise Asset Management as Vice President of R & D. He caused a stir with his call that crypto-currencies are about to be a multi-billion dollar market, although he admits that Bloomberg Cryptos remain an "early stage technology" that could be a bumpy road at times.

"The way to 1 trillion dollars is finally pretty certain.How we get there is going to be volatility and uncomfortable.I think we'll get there very soon, though.I would not be surprised if we finish the year. with a combined market capitalization of over $ 1 trillion, but I would not be surprised if there was a significant drop before we got there, "Hougan told Bloomberg.

For example, Hougan suggests that cryptocurrency markets could fall by 50% before reaching a combined market cap of $ 1 trillion. And as major digital coins have proven so far in 2018, volatility is the name of the game. "I think for investors, it's important to realize that it's an extremely volatile and high-risk asset. that's why you have high potential returns, "he said.

For opponents, who could never imagine bitcoin competing with gold or working in payments / money transfer, he politely suggests that they are short-sighted and forgetting that "technology is growing at an exponential rate."

Risk and reward

The new Bitwise rental offered some perspective on an otherwise dreary day when the main cryptocurrencies were all in the red. First, he pointed out the risks that cryptocurrency investors expose themselves, which can be summarized as follows:

regulation

technology

scaling the network

bad actors

But he did not leave it there, pointing out potential rewards for being an early investor in cryptocurrencies.

"You will be rewarded with high potential returns for taking these risks now," he said, pointing out that three to ten years later, cryptocurrencies would become a "better-established asset class" with volatility then closer to what is normal in the equity and bond markets, with a higher upside potential.

Hougan is no stranger to emerging technologies, having joined the ETF space when he was still a fledgling technology before the funds essentially made their way into just about every retirement plan in America.

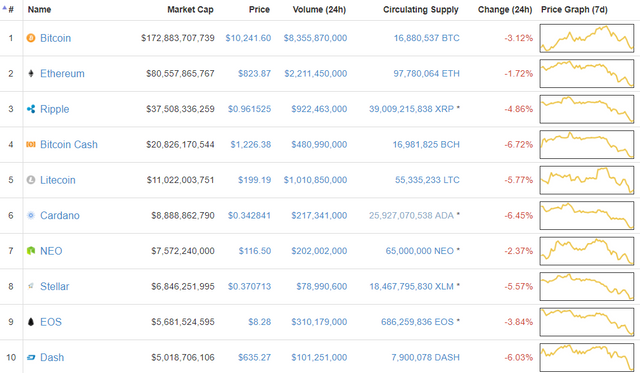

At the same time, the index fund Bitwise Hold 10 Private Index, the industry's leading cryptocurrency index fund, holds the top 10 digital coins by value. The reason, suggested Hougan, is that the ranking can change. "The first driver is not always the winner," he told Bloomberg, adding:

"Big caps have the greatest chance of success but nothing is guaranteed investors would be crazy to bet on a single cryptocurrency - you want to diversify your exposure," said Hougan.

In his new role, Hougan will focus on the classification and analysis of cryptocurrencies. Bitwise's decision to appear ETF veteran Hougan suggests that a bitcoin ETF could be on the horizon.

nice post

blockchain is going to transform the whole world.

nice

Nice

Nice

good post

nice post