Prices are down, but is BTC mining still profitable? Depends.

The vast portion of mining power is sourced from China.

The recent slump in coin prices has led to concerns over the feasibility of mining operations. However, mining operations are still profitable in some parts of the world; the lower Bitcoin price is making way for diversification in the mining industry by enabling the growth of farms in countries with electricity prices that are lower than the energy costs in China.

Opportunity for Newer, Better Services

Only a few months ago, BTC prices allowed a handful of mining facilities to control a vast portion of the network’s hash rate. Even if competing mining pools offered lower fees and better returns, the established mining pools out-marketed new entrants; moreover, the established pools had the cash flow to constantly grow their hash rate, thereby intimidating new entrants.

Now, hash rate isn’t rising; it’s depreciating.

Given that the market leaders are no longer growing the size of their mining farms, new market participants are confidently entering the market, knowing that their share of the hash rate won’t fall any time soon. Now, new mining farms that are launching operations in countries with low electricity costs are able to easily take on the goliaths of the mining industry.

Newer mining farms are pursuing disruptive business models as they intend to charge low fees, provide better service, and pass all transaction revenue to users.

Cryptonoras, a relatively new mining operation, aims to lead the shift to a more globalized presence in mining farms. The mine is located in Norway, enabling its users to benefit from a unique set of benefits.

The Status Quo of the Mining Industry

Established mining pools have enjoyed the benefit of limited competition. This has allowed them to charge high fees, consume a hefty percent of the mine’s block rewards, and even hold transaction fees from block rewards.

AntPool

AntPool has long asserted its dominance over the market by rallying rig after rig to keep competition at bay. This gave them the ability to not only keep 2.5% of block rewards, but also keep transaction fees.BTC.com

This mining pool tussles with AntPool by not charging a 2.5% on block rewards. However, its other fees, adding up to 4%, are even more than what AntPool takes.F2Pool

Unlike what the name may hint, being a part of this pool is far from free as it claims 3% of block rewards and still keeps transaction fees.Additionally, AntPool and F2Pool have neglected users’ returns in more ways than one. One event that serves as a testament to this is that these farms’ operations on Bitcoin Core 0.9.5 caused them to miss out of tens of thousands of dollars during the fork that took place on July 4, 2015. Those funds were the due gains of not the farm, but their users; negligence on behalf of the pools led to a loss to pools’ users.

Time for Change

New market participants, like Cryptonoras, are keen to boost their service quality to acquire increased market share. Thus, they keep their mining operations up-to-date with the most recent Bitcoin Core updates.

More importantly, they’re ensuring the hash rate is not concentrated in just one country. This allows them to focus on opportunities available across the globe.

For example, Cryptonoras, takes advantage of the incredibly low energy costs in Norway. While energy costs are at $0.08 kWh in most regions in China, Norway’s low energy costs, $0.04 kWh, gives miners the opportunity to gain incredibly low operating costs. In Cryptonoras's case, operations remain profitable even if the current low Bitcoin price, forces some large, established miners to barely break-even.

Additionally, the Chinese government has an increasingly negative stand against cryptocurrencies and Crypto-related operations. Scandinavian and North European governments are leading the way in the positive approach. This allows mining facilities there, like Cryptonoras, to gain access to insurance services. Thus, the assets mined by Cryptonoras will be insured, giving users increased peace of mind.

On a valuable note, the decentralization and increased spread of mining rate has accompanied another benefit. Mining services like Cryptonoras only charge an initial contract fee; after that, there are no cuts in users’ block rewards or transaction fee earnings.

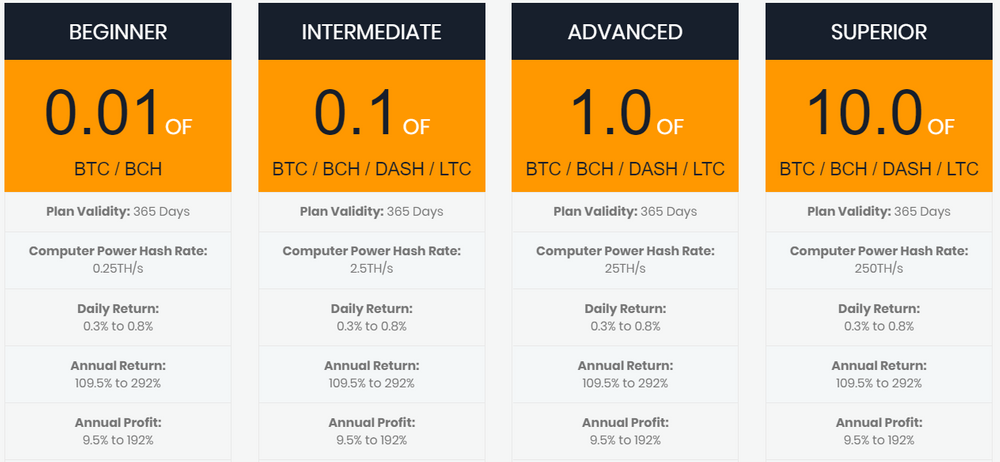

The Plans

Cryptonoras aims to make access to a stake in mining operations accessible to the masses. This allows the farm’s output—block reward earning—to be distributed among the masses. Thus, its plans start from prices as low as 0.01 BTC.

Given that the farm’s operating costs, primarily associated to its electricity bill, are well below the operating costs of most farms across the world, Cryptonoras is able to churn out cryptocurrency at a positive cash flow.

Connect with me:

Crypto News Crypto Airdrops ICO List Blockchain Lawyers

Repito, no soy experta en estos temas, por eso los leo.

Tener alguna información de funcionamiento global y monetario de un servicio me expande a un mundo complejo de funcionalidad y administración de ese sistema.

Muy bueno, es complejo, pero interesante.

Toda información es buena para ampliar nuestros conocimientos generales.

Gracias.

Bye bye mining, hello masternodes! I think bitcoin is a bit old fashioned in this case. As far as I heared, bitcoin is not profitable at all anywhere in the world, even in parts of the world where the power costs are low. But what do I know, I dont mine myself!

With up-to-date equipment, mining currently breaks-even at roughly $0.08.

Cryptonoroas, which is in Norway, has energy costs at $0.04 kWh.

Do they sell mining contracts?

Yes.

$0.08 ???

Which coin you refer here? BTC?

Even with Free power BTC cost is MUCH MUCH MUCH higher

no it isn't...

Are you referring to the cost of Machines as well?

Then I kinda of see your point. But there no cost forsay to mine btc. As long as you have cheap/free electricity then it always profitable to mine. Key note:I not vouching for this cloud mining service just stating facts

Posted using Partiko Android

Electricity cost...

How about the tax payed over the KwH?

Posted using Partiko Android

masternodes are not a consensus protocol.

Also bitcoin mining is always profitable

And masternodes are largely a lose-lose asset.

Are you sure? Many companies terminated mining contracts of their customers, GIGA WATT went bankrupt, Genesis, I am sure there are a couple of them left that are profitable, but ALWAYS PROFITABLE, thats not true. Why do you lie about that :P ?

yes it always profitable. Gigiwatt failed due to one raising money from eth which fell in value majorly. Two it had to pay for legal due to ICO and being based in US. Third they bought during the high and new devices. Bitmain was known to ripoff people but no one listened. Fourth, they picked the wrong area. In countries such as Canada,Iran,part of Russia, Georgia and Kazakhstan electricity is so cheap it still profitable. New mining as such are getting built while old ones are going. Building mining in a bull run was a mistake alot of people warned about.

Plus mining difficulty ensures mining is near the profit limit. Also you forgot bitcoin miners can merge mine as well so more money.

Mining is always profitable you just have to be smart about it.

Like any profitable industry don't waste money.

Mining contracts are always iffy and not fair to customers. The contract assume bull run and as such during it seem like a good idea. But when less profit time than welp due to fees being set. Genesis already made it money. It paid for it devices and got money for news one thanks to the contract and noobs who bought a bad deal.

Cryptonoras has been launched during recent times. This sets its pricing optimally for users based on the current bear market conditions.

Also, its presence in Norway ensures energy costs are even lower than the countries you mentioned above.

I heard about this company. But I forgot about it, so thanks for reminding me!

Posted using Partiko Android

Glad to help.

Superb article, Chinese investors are certainly driving the market and where the innovation is coming from. Thank you @hatu resteemed and upvoted! Have you been to China? Come to our Blockchain Centre in Shanghai!

Though, more globalized mining ops are important, and companies like Cryptonoras fall into that.

On the note of visiting China, I'd love to and, one day, I will, and I'll certainly visit the Blockchain Centre. :)

In malta ...

nice post i followed you

I'm in VietNam and it's not profitable here. People are selling their mining machine to recover loss.

That's understandable. Vietnamese energy costs are between $0.07 - $0.08 kWh. Anything except for optimal operations would lead to losses; these costs are 100% higher than those in Norway.

@tienquyendahn just for now my friend once the dollar starts going down that will change!

Posted using Partiko iOS

You could say, if you own the power source it's like a money tree. But that requires some knowledge in engineering and turbines.

That must be factored in, that some people have free power and relatively low costs otherwise. If china mining gets shut down, there will be people with free power who can take over.

It needn't be free. As long as it is cheap enough, there's profits to be had through mining. Cryptonoras enjoys energy costs well below the energy bills paid by Chinese miners.

Are you using Cryptonoras? If so, do you like your experience so far?

Posted using Partiko iOS

Simple UI, insured assets, and priced well below competitors. Doesn't get better than that.

Thank You.. I will look into it.

Posted using Partiko iOS

Is too much risk to keep mining although isn't profitable now, but waiting the BTC price to go up?

Posted using Partiko Android

Cryptonoras is operating in Norway and enjoys incredibly low electricity costs. At $0.04 kWh, Bitcoin mining is profitable.

Thank you sir,I will try to follow your direction.

And always DYOR.