Bitcoin (BTC) Morning Update: Will Retracement be 0.38 or 0.618 Fib Level?

SUMMARY

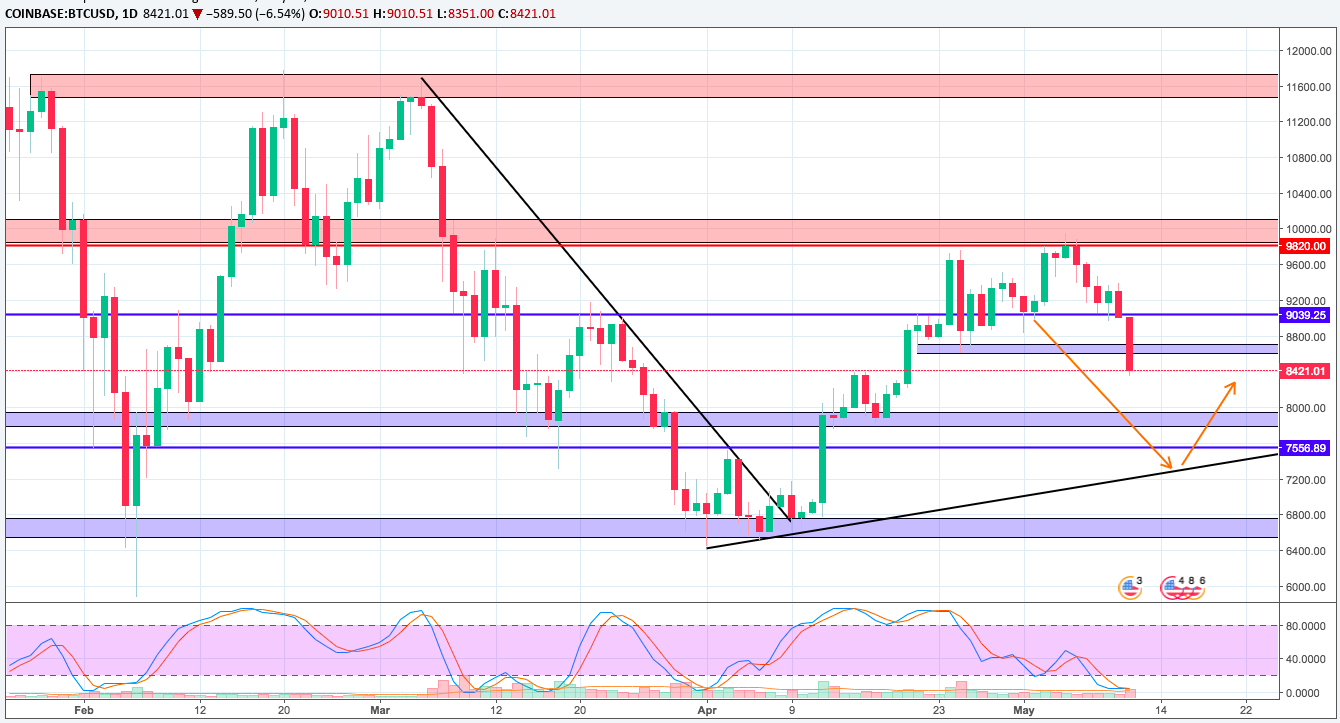

Bitcoin (BTC) has likely put in the full five waves, given the correction sequence. IF this is correct, then the correction would likely decline towards the 0.618 Fib level. Soon, the B wave bounce should occur. Since the declin thus far looks like an ABC; the correction could be the Flat type (3,3,5). It it becomes a ZigZag, it doesn't matter.

The bigger picture is showing a rounded price pattern (white line) and the correction could well fit into the handle formation. Even if the correction completes now at the 0.38 level, the handle formation fits as would a decline towards the 0.618. Since wave 5 is NOT extended, it's unlikely for the retracement depth to be 0.78 or 0.88.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

Asshole you dont know what you are talking about.

The situation of closing the candle like this, do not need to say more.

However, now it is not time to sell anything else because selling here is selling bottom.

In the night we reach $ 8300 and are forming another bear flag model, the ability to sideways and have a leg lift here before going up, the lowest candlestick price may reach below $ 8000.

The explanation for this sell-off, I would like to explain is that investors are concerned about their funds on UpBit, just that people sell to withdraw money from this floor and certainly will. Using this money continue to reinvest on another floor (Korea is an extremely crazy state because the crypto) so expect a huge rebound when the sell off this end. will update tomorrow morning at @ sonpham1997

I wrote an overview of bitcoin graphs here.

Thanks for the good information

Props for calling this major correction.

@haejin, what does this statement mean, "Even if the correction completes now at the 0.38 level, the handle formation fits as would a decline towards the 0.618" --- does that mean we could bounce here at .38, or go to .618 - and its gonna be hard to predict either way? or possible to have a B wave up, then dip to .618?

It means that the Cup and Handle is still valid even if the correction ends at the 0.38 level.

Don't understand what are you saying.. It is not correction that is happening (nothing to do with Fibonacci tool)..

Coins are down due to the Korean exchange (UPbit) raid by prosecutors..

This is definitely one of the times that market sentiment makes much more sense to follow than technicals. Bitcoin is down temporarily because of the ignorant comments from influential dinosaur asshats Buffett and Munger, followed by the Upbit raid. Nothing more. FUD

BTC to $7,700 any thoughts?

Since 19th december to 11th may bitcoin is doing a majgor correction.

Will this correction finnaly pass after the Consensus 14-16 May in New York?

I do believe in the Fibonacci tool, usually it is very accurate.

Scarily so.

I have hard time believing this time correction will be so deep. There is already news coming out that the whole Upbit thing was missunderstanding.

https://twitter.com/cryptomanran/status/995001338328207360