Bitcoin (BTC) Morning Update: Patterns Within Patterns

SUMMARY

Bitcoin (BTC) overnight broke through the upward wedge and has now bounced back within the pattern as shown in below chart. I've drawn trendlines (purple) across the tops and bottoms o fthe price correction. The point where the upper white line of the wedge intersects the purple is where the price is currently. IF it can decisively breach that point as shown by the blue arrow, it would be bullish. However, I still feel the correction as the red ABC is a bit short in time and price retracement.

Now, the longer term chart is very interesting. The Cup & Handle (blue) is showing that the handle formation has matured quite well and nearly complete. The top and bottom blue lines of the handle correllate with the purple trend lines shown in the first chart. Bear in mind that the Cup & Handle is the combination of the rounded formation and a bull flag. The blue arrow outlines the price pathway that could lead to additional patterns. The LS, H and RS of an Inverted Head & Shows are outlined. This smaller one is then embeeded within a larger Inverte H&S pattern. The purple line is used to measure the minimum run potential and that marks it at $17,300 or so. And yes, as the video analysis shows, volume also confirms.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

I hope we do not get a triple top down ,,,

But I think There are more chances of triple bottom though bitcoin has made a breakout today but it is sudden so i personally think that there will triple top down till 72** or 75**. But by the way your suggestions will be appreciated.

All the cryptos are really getting donkey-punched!

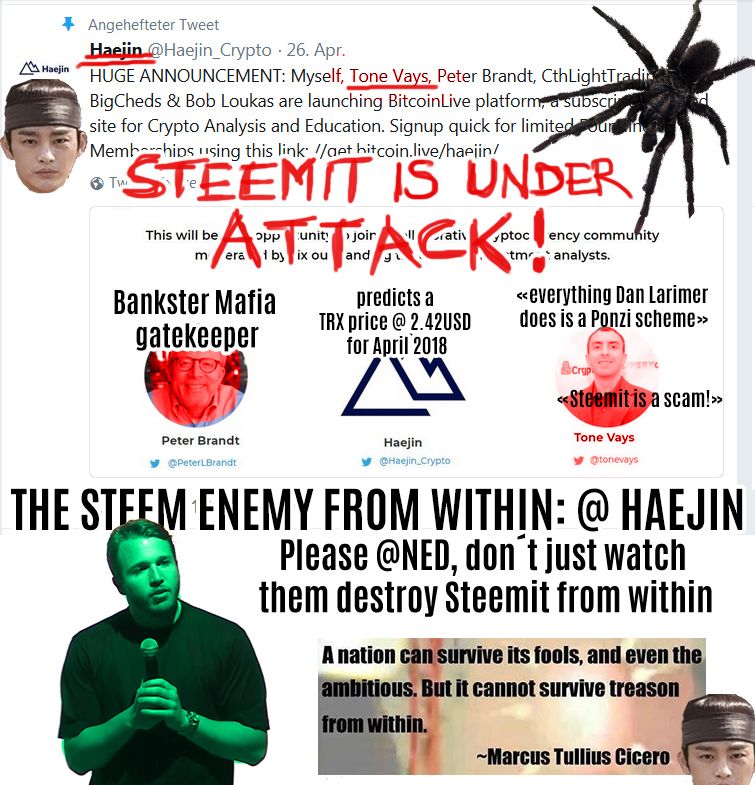

@ned please, it is up to you now!!!

Since BTC is working on wave 2 of upward pattern. it hasn't even retraced .5 yet. I would say at least .618 around $7723 would be minimal retracement. I won't be surprised if it's .786 to bring it $7200. then wave 3 would be strong enough to breach $12k resistance line. but I am expecting Wave 5 to be violent and get to ATH $21,300 or so. So far our support line has held solid, so a parallel resistance line can give nice idea of where wave 5 would end.

Through your post, we learned the condition of the current Bitcoin, thank you very much for your posting and you have told us what the condition of Bitcoin is and how we will not do it especially now whether it is our thing or desire, we should do something Think of yourself before thinking about yourself

everything is uncertain in this world of cryptocurrencies

TA update Bitshares?

Shitpost shitpost shitpost shitpost shitpost

spam-content spam-content spam-content

downvote downvote downvote downvote

Spammer spamming the spam 🙊🙊🙊🙊🙊🙊🙊🙊

spam spam

@haejin I am looking at the same chart at the same time period and broker with you. But I don't see the exact same images? Why? what did you change?

Thanks for update us by your important post . Thanks a lot . But i am worried about that steem price getting low day by day.