Bitcoin (BTC) Evening Update: Awareness of Probable Price Pathways Keeps the Panic AWAY!!

)

SUMMARY

Traders panic because of the unknown! People fear the future because of the unknowns. However, Technical Analysis allows one to become more aware of the probable price pathways as well as the possibilities and so is often not as inclined to panic as one who trades purely from instinct and raw bravado! Technical Analysis is nothing more than a process of identifying as many possibilities and then selecting the most probables from which the primary and alternate price pathways are formulated. In conducting this process, a Technical Analyst is aware of just about all outcome potentials and so would not be so inclined to panic.

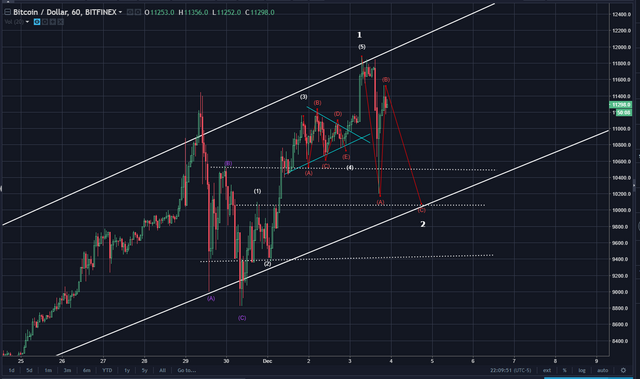

The below chart has updated the Elliott Waves so that white waves show that fives waves are complete. Elliott Waves states that after five waves, there is a requisite three wave correction and the chart below is showing exactly that.

The a,b,c correction could become deeper as my alternate count shows below. The horizontal dotted support/resistance lines provide guideposts to where and how far the red c wave could travel. The video has more details you might want to listen to, especially on how the dotted horizontal lines line up with a fib retracement bar.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

These Technical Analysis Books: Elliott Wave Priniciple & Technical Analysis of Stock Trends are highly recommended

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - haejin1970

BTC Wallet - 1HMFpq4tC7a2acpjD45hCT4WqPNHXcqpof

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LecCNCzkt4vjVq2i3bgYiebmr9GbYo6FQf

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**

I have been leaning toward the second correction you showed that touches the channel....and it's because of the fractal nature of the movement.....

Still looks like it could be a valid fractal follow through.....macd also.....

so would you assume the probability that the correction is in the C wave working towards the terminal end? How many waves can be in the C wave, it should be 5 right?

If this is the price pathway and once we count 5 waves, it should be nearing the terminal end of C. I'm thinking out loud so any feedback would be greatly appreciated

The wave can have multiple counts. I count the chart as it stands a little differently than haejin's primary count. My count is much more similar to his alternate count presented here.

Personally, I do think the "circle" part of the fractal will be the terminal end....but the time crunch is really hard to say....in the first circle you had a span of two days where price hung in that area. However, from what I study in chart fractals and how they tend to invert or alternate, in this case, it alternates in speed and density. The density is smaller in this fractal, which could lend to a more speedy bounce back up...which wouldn't leave time to make a buying decision. But when fractals are repeated in a different speed and shape...that is as good as a guess...it could flip upward as soon as it hits. If it plays out exactly as a repeat, it could still waiver for a day or so up and down before trending back up.

Fractal changes are hard enough to point out on a blog post when they vary in shape (warped) like here....much less explain all the possible moves from this point to the next. The dots on the right are my short and long position setups for this fractal....as you can see, I'm confident in the repeat with a long buy set at 10934....which I think is playing it safe to make sure it hits.....I think prices will go closer to 10800, but risking that price depth is not worth it when shorting at such a high price with such a small difference price (relatively).

Well thanks for taking the time to answer. It makes me realise I still have a whole helluva lot to learn!

Hey, me too. I never rely on just seeing fractals to make a guess where it's headed. If the count doesn't look right, it probably isn't...and thus the change is unpredictable. Really, you can find fractals all over charts....they just don't always trend the same way. Things went well this time, but everything lined up just right, including my EW count.

That path looks possible. I think we still have another swing upward before the larger correction though. Good video, thanks for supporting Haejin's blog!

You are great guy for such amazing analysis.

Nice one...First one...

I assume this applies to Silver too...

bitcoin is like stairs, going up and down but alway in the up derection ☺

좋은 정보 감사합니다. thank you!

@haejin please to TA for Nexus, many thanks!!

did you use Bank of America to fund your coinbase/gdax?

was it a wire transfer?

I read their FAQs and a lot of threads about gdax wire transfers and SOO MANY deposits never go through and yet their banks charge them... they lose the money and some say for 5 months - a year and still nothing. most o the complaints are coming from people that used BOA

also, if its a wire transfer it'll show up on the next business day unless sent on a weekday before 1pm P.T. ( 4 pm where we live on the east coast ) @haejin

Hopefully you get the money soon!