The lowdown on bitcoin futures

Nov. 20, 2017 (The Ferowich Report) — Investors will soon have the ability to short bitcoin and capitalize on downside volatility on the world’s largest derivatives and futures exchange in Chicago.

“Sometime in the second week of December” bitcoin futures will be listed on the Chicago Mercantile Exchange, Terry Duffy, CEO of CME Group, told CNBC Nov. 13. The new listing promises to reshape the architecture of the $137 billion bitcoin market.

The bitcoin market is saturated with bulls who think the price will go to the moon. On a structural level, this has been the case out of sheer neccesity: there hasn’t been a way for U.S. investors to short bitcoin, or profit a decrease in bitcoin prices.

“Today you cannot short bitcoin,” Duffy said. Without a mechanism to short bitcoin, ”the market is structurally, and very heavily, tilted in favor of the longs,” Mohamed A. El-Erian pointed out.

The past two years have born witness to consistent upward pressure on bitcoin prices. “Bitcoin has often been dismissed … But in 2016, it has also been one of the best-performing assets in the world,” the Wall Street Journal’s Telis Demos and Paul Vigna reported last Dec. 30.

Fast forward: Bitcoin has posted a 740 percent ROI since the start of 2017.

From zero to 100, real quick: “I was sitting around with my team one day. Obviously, bitcoin has been in the news pretty much for the last nine years. Came out at $0.08. We didn’t [launch bitcoin futures] because of a valuation play or anything of that nature. It’s just one of those things that appears to be an evolution in the way commerce is being transacted. Whether it’s bitcoin or something else, I thought it was important for us to be a part of it,” Duffy said Nov. 14.

“I don’t know if it’s going to work,” he added.

“But I do know one thing, if you take our way of doing business, with our systems, our safeguards, our margining, our mark-to-market, all the things we bring to the marketplace, limits on positions, intraday limits on trading. These are all things that hopefully – this asset class will trade, if it is an asset class. If not, no harm no foul,” the CEO said.

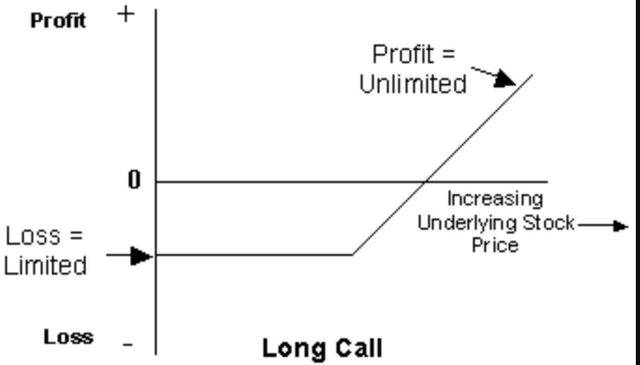

CME is playing bitcoin futures as a long call option. The grassroots infrastructure is in place to keep costs of listing relatively low, and more importantly fixed, but the upside is unknown.

Financial futures innovator and Chairman Emeritus at CME Group, Leo Melamad, argued Nov. 7 that bitcoin is well on it’s way toward becoming a new asset class. “The world in the 1970s didn’t look at currency as a valid instrument of finance. I, too, went from not believing [in bitcoin] to wanting to know more,” Melamad said.

“I’m not trying to rein in the volatility of bitcoin. But what I want to do is give it a place for other people to lay out that risk. Today you cannot short bitcoin [in the U.S]. So there’s only one way it can go. You either buy it or sell it to somebody else. So you create a two-sided market, I think it’s always much more efficient,” Duffy said.

CME futures on oil, gold and crude oil use daily volume limits to cut off trading when price swings get too severe. CME’s term sheet on bitcoin futures shows that trading will be tempered at three circuit-breaker points: 7 percent, 13 percent and 20 percent.

When futures prices swing up or down to the 7 and 13 percent “soft” limits” trading could be paused for two minutes, while trading would cease for the day at the 20 percent “hard” cap.

“A similar nighttime limit kept S&P 500 futures from falling more than 5% on Nov. 8, 2016, when news of Donald Trump’s upset win in the U.S. presidential election triggered wild volatility in stock-market futures,” the Wall Street Journal’s Alexander Osipovich reports.

CME’s bitcoin futures will settle in cash in line with CME’s Bitcoin Reference Rate, which aggregates data from GDAX and Kraken in San Francisco, itBit in New York, and Bitstamp in Luxembourg.

Good read