The SEC Rejected Bitcoin ETF for the Petition is a Misfit,says Bill Barhydt

The rejection and reconfirmation of the Bitcoin ETF files arouse worrying concerns about the future of the whole market, with the token value all shows radical fluctuation caused by large-scale selling off. It seems that the market and holders are deflated by the rejection of a series of ETF rejection, though most of the powerful punters predict an approval in the next year.

In explaining the reason why the SEC declined Bitcoin ETF, Bill Barhydt, a founder of a Bitcoin payment company, stated that the SEC veto the petition for it is operated in the form that different from all the instrument the organization has ever meet.

“I think the issue with the SEC, quite frankly, is that the people who are doing the applications don’t fit mold of who the SEC is used to approving,” said Barhydt.

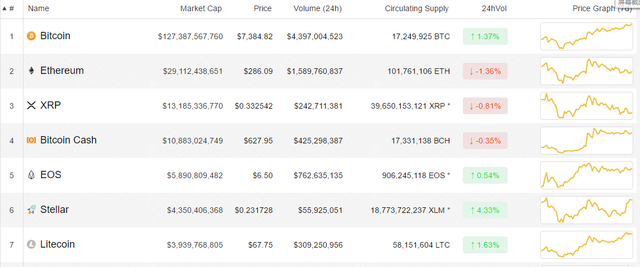

Whether the upending review ignites a new round of panic or euphoria is not known. Nearly a month after the rejection of the last petition, the market becomes much sober but remain so weak. However, the market is far from being stable for political and financial elements around the world, which can be implied through its fast-changing real-time pricing data.

source from www.citicoins.com

As for Bitcoin price, it maintains an upward trend and stands still on the $7200, according to the price change showed in the bitcoin price history. And now in the market, some experts are looking to the price move of Bitcoin, forecasting a further increase in the following days, which also boost up other altcoins, such as the price of BCH.

The experts said that the Bitcoin price could linger around $7153 to $7379, and a drop below the $7153 level, then a further slump is on the way, while if the price goes up to $7379, the market recovers slowly in the future.

SEC reason is simply and stated as follows: bitcoin price is not yet stable, and the market could be manipulated by huge sale and huge buy which affects the price. But my own view is that SEC should consider the ETF may be could help stabilize the price.

It's way to attract a larger amount of capital, but beyond this, it's a way to gain recognition from traditional financial system and put the activity under supervision. In this way, I may say the ETF could help stabilize the price.