Will Ethereum Benefit from Bitcoin Hard Fork?

Bitcoin is running into some major issues that can’t be avoided.

To put it simply, there was a bug in the original Bitcoin code. This bug placed an artificial limit on the size of blocks, which led to slower transfer times, backlogs, and an inability to scale up the currency.

It is effectively a cancer on the entire Bitcoin dream.

One way to (potentially) fix the bug is a “hard fork.” This would require a fundamental change in Bitcoin’s original source code, a move that many in the community consider sacrilegious.

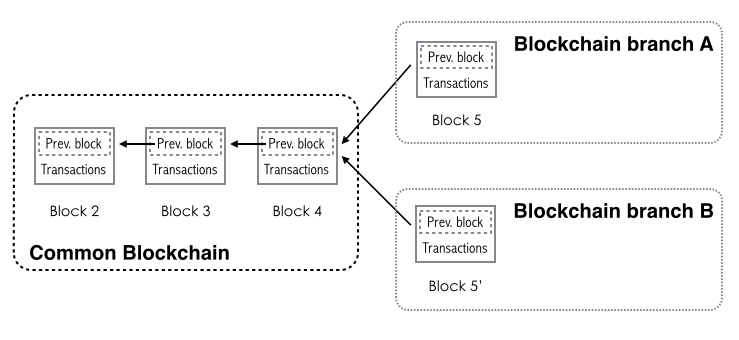

It would split the Bitcoin community in two, and more importantly, split the currency in two.

One would continue trading under the ticker symbol “BTI.” The other would come into existence as “Bitcoin Ultimate” or “BTU.”

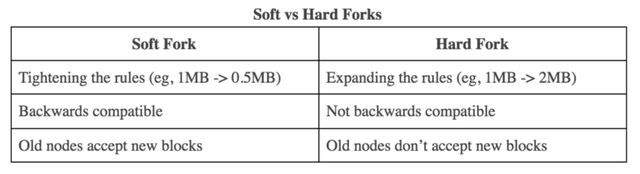

Hard Fork Vs Soft Fork:

These problems have diverted investors toward its heir apparent: Ethereum.

But don’t think that Bitcoin developers are sitting idly by, waiting to hand over the top spot. Not a chance. They are trying to work out the kinks as you read this.

Some of the most important players just convened a special meeting. They decided on a “soft fork” that would speed up transactions without altering the source code much.

It’s a half-measure.

I seriously doubt that a soft fork will hold forever, which means that Bitcoin is probably going to hard fork its currency. It wouldn’t be the first.

Litecoin just did the same thing, and Ethereum itself forked many times in the last year. Both of those cryptocurrencies survived the split, so I expect Bitcoin will survive as well.

That being said, I expect a bumpy ride. The Bitcoin community is deeply divided over the hard fork, so there’s bound to be some turbulence. In those moments of uncertainty, investors could once again turn to Ethereum as a safe-haven asset.

To sum up: I don’t think the hard fork will destroy Bitcoin, but it could give Ethereum another tailwind.