Christmas comes early for beloved Bitcoin maxies ($18,200USD BTC) Nothing but coal for altcoin hodlers

As a repeat of the late 2017 alt season becomes less and less likely, mainly due to an institutional and corporate fed bitcoin rally, many of us alt coin bag holders have been left on the sidelines since late July, watching our alt portfolios bleed in Satoshi value.

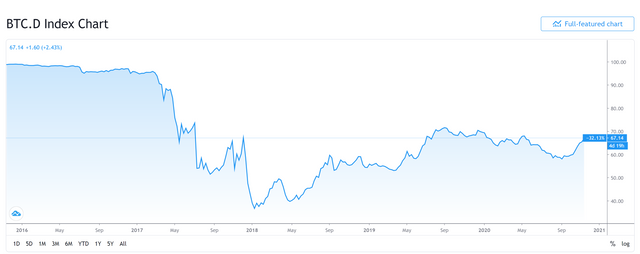

What is different this time around ? Mainly a lack of dumb money. Most institutions will not long alt coins or perceive them as a store of value like they do bitcoin. As you can see, bitcoin dominance is currently at an all time high ( in relative terms) , which is counter to the 2017 bull cycle, where bitcoin dominance fell to an all time low.

At this point, as corporations line up in droves to add bitcoin to their reserve holdings as a hedge for inflation, pandemic fueled uncertainty has scared away many of the retail investors who were usually present in pervious bull cycles. Due to the risky nature of alt coins, many of these people either understand there is an inherent underlying difference in this bull-cycle or are simply tapped-out financially due to the pandemic.

So what options do alt coin holders have at this point? It is obvious that if bitcoin begins to retrace back down in FIAT terms, based on the information stated earlier in this post, alt coins will start to bleed in dollar value, which in turn is a double whammy when you consider that most alt-coins have been either stagnant or hemorrhaged massively since late summer 2020.

So in summation, you can either walk away from the last 4 months of altcoin fueled hopium and covert those alts to btc and join the masses or cash out and buy some chocolate Santa's, that choice is up to you. But if we are simply looking at thing through the "history repeats itself" lens, things do not look good for another alt-season, at least not before Christmas like in 2017.