Indian Income Tax Department Raids Bitcoin Exchanges in India—What Does It Mean For Bitcoin Users From India?

First of all, there's no need to be scared!

Today, under the guise of conducting a 'survey' the Income Tax sleuths conducted surprise visits to the office of major Indian Bitcoin-altcoin trading exchanges today.

According to PTI, Income tax officials across the country under the leadership of Bangalore's investigation wing raided 9 exchanges across New Delhi, Bangalore, Hyderabad, Kochi and Gurgaon.

The survey, under section 133A of the Income Tax Act, is being conducted for "gathering evidence for establishing the identity of investors and traders, transaction undertaken by them, identity of counterparties, related bank accounts used, among others," as per the IT-department.

I'm personally not in the least bit surprised by this move and rather expected this to happen. After all the government isn't happy about the rising interest in crypto-currency. In the past some politicians have called Bitcoin a ponzi scheme-out of sheer ignorance!

For the currency to be regulated there needs to be major changes to multiple existing policies in India. Running an exchange isn't easy and getting the government to work with you to change their attitude is extremely difficult.

According to the statement made by the finance minister Arun Jaitley, "Recommendations are being worked at. The government's position is clear, we don't recognise this (cryptocurrency) as legal currency as of now."

There are legitimate concerns such as the rising wave of e-ponzi schemes. Many such ponzi schemes are riding the wave of this crypto's popularity. Consistent spikes in Bitcoin price has kept it in the news and interest levels have spiked massively in the last few months.

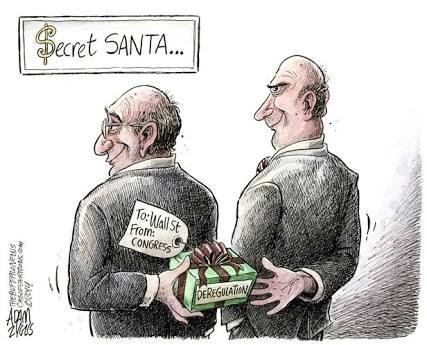

To make it difficult for people to transact, some of the major banks even removed their payment gateways from these crypto exchanges. This unfortunately backfired as it made it cheaper for people to transact directly through regular transfer methods.

RBI as we know keeps issuing new warnings about investing in cryptocurrencies but refuses to come up with a policy that can help build an ecosystem in the country.

Does this affect Indian users in any way?

It depends on how you look at it. If you are a tax paying citizen of the country then you are fine. Because, the Income Tax department now has all the information on transactions taking place at these exchanges.

All of the 10-15 exchanges in the country operate with KYC which means the government has information on all your transactions to/from an Indian Bitcoin exchange.

Declaring your income earned through investments made in crypto-currencies will go a long way in ensuring a peace of mind if the taxman comes knocking at your door! You can follow my guide on filing taxes from on your Bitcoin profits.

As much as I dislike the government taxing every single thing in the country, this is the first step towards legitimizing cryptocurrencies in India.

The Black Money Perspective

The government has failed to curb black money and money laundering despite demonetisation. Which was a terrible move for the economy. Indian government has failed to curb and reduce corruption and Bitcoin is their latest target. It's a good target to shift blame for the failure of their incompetent policies.

Way forward

If Indian exchanges have followed the current laws things will largely continue un-disturbed.

If you've paid your taxes then you are absolutely fine.

Income Tax evasion is a major problem in India so the IT-department is well within it's right to investigate.

This move could very well result in quicker regulatory policies coming into effect in the near future.

India is currently adding 200,000 Bitcoin users per month on all it's exchanges combined and the price for 1 Bitcoin is over $21,000. There's a lot of room for cryptocurrency to grow in India if efforts are channeled in a positive way.

For the time being we can only sit tight and watch what the government does. If you haven't filed your returns in the past few years, I would ask you to re-consider and do it right away. The government cannot take away your Bitcoin but if you are holding Bitcoin (your hard earned investments) on exchanges, it's always a good idea to store it in a secure wallet.

If you like my work kindly resteem it to your friends. You may also continue reading my recent posts which might interest you:

- India Has The Highest Number of Facebook Users In The World—What Does It Mean For Steemit?

- 4 Tips For Steemit Account Recovery & Wallet Security!

- Let's Talk—How Did you Discover Steemit.com?

This shows the influence of Cryptocurrency in India. Seems Politicians are annoyed at seeing some people making good money without paying them Haftaa. Pay your taxes before due date. Issued in Indian Public Interest by BlockChain Community.

True that!

Well said @mirhimayun

Also, @firepower - so basically our money is safe in Zebpay right - as a proper KYC is done by them.

Whether they watch it or not the cryprocurrency will be a future currency

That's right!

Great Information !!

Thanks. :)

BTCPOWER through India !

Indian Government want a cut in whatever we do.

Where does this money go finally.

To Thier pockets.

#truthofbeinganindian #earlychristmas

haha I agree!

This is actually good news, it means they know it's here to stay and they have to deal with it. It's better then the law in the U.S. where they treat crypto as a property and impose higher and more complicated taxes.

That means Bankers are afraid! And people from India should unite and show them all of this works.

Largest Exchange CME Group (NASDAQ: CME) will begin initial lists of bitcoin futures on December 18.

Bitcoin enthusiasts hope that the launch of bitcoin derivatives will allow institutional investors to invest in the digital currency trend, helping to make bitcoin a legitimate asset class and pave the way for an exchange-traded fund .

Elsewhere in the cryptocurrency business, Bitcoin Cash was at $ 1557, while Bitcoin Gold was at $ 274.11.

Ethereum, the second-largest market-cap currency cryptocurrency after bitcoin, was $ 664.93.

It's not hard to conduct your cryptocurrency dealings anonymously

Blockchain technology marks the end of government control over our money, and eventually it will replace the government itself

It actually took them a lot more time than I anticipated tbh. Expected them to do this before the demonetization coz clearly this a huge escape route for black money even the big whales could slip away slyly.

Demonetisation was BS. They havn't been able to curb black money and never will as long the govt remains corrupt they will never harm their own interests!