You Need to Know About Bitcoin

Indeed, even the most educated among us experience serious difficulties wrapping their heads around Bitcoin. It's an interesting issue and a regular purpose of exchange among financial specialists, business visionaries and stock dealers, so you should need to thoroughly understand it.

First off, here's an excessively disentangled clarification of Bitcoin: It's a computerized cash (there are more than 800 now) that isn't controlled by a focal expert, for example, an administration or bank. It's made by "diggers," who utilize PCs and specific equipment to process exchanges, secure the money's system and gather bitcoins in return. Supporters say it takes into account more secure exchanges over the web. That is to some extent due to block chain, an innovation that records cryptographic money exchanges sequentially in an open advanced record.

Bitcoin is just eight and a half years old, however it's the most seasoned and most exceedingly esteemed cryptographic money out there. In such a brief time frame, it's had a rough and questionable history, but on the other hand it's pulled in a decent amount of prominent supporters. Navigate to peruse 11 bits about Bitcoin that will influence you at any rate seem like you to hear what you're saying next time it unavoidably comes up.

The introduction of Bitcoin

The birthplaces of bitcoin follow back to 2008, when its maker, who passed by the alias Nakamoto, distributed a proof of idea for Bitcoin. The evidence was then distributed to a cryptographic money mailing list in 2009. Nakamoto left the venture in 2010 and vanished, however different designers got the work. Bitcoin's birthday is Jan. 3, when Nakamoto mined the initial 50 units of the money.A slippery maker

The genuine personality of Bitcoin's maker has never been affirmed. Newsweek asserted to have discovered Bitcoin's maker in 2014, recognizing Temple City, Calif., inhabitant Dorian Satoshi Nakamoto. He has energetically denied it. In 2015, an Australian business visionary named Craig Wright said he was Bitcoin's maker, yet he couldn't create the proof to help his claim. Whoever Nakamoto is, that individual is exceptionally rich, as the maker is evaluated to have mined a million bitcoins in the cash's initial days.Exceptionally costly pizza

The primary exchange including bitcoin was accounted for on May 22, 2010, when a software engineer recognized as Laszlo Hanyecz said he "effectively exchanged 10,000 bitcoins for pizza." As of Nov. 28, 2017, 10,000 bitcoins are worth about $99 million.You can spend bitcoins

While it may not appear like it, individuals keep on using bitcoins to purchase stuff. The biggest organizations to acknowledge the cryptographic money incorporate Overstock.com, Expedia, Newegg and Dish.

While it may not appear like it, individuals keep on using bitcoins to purchase stuff. The biggest organizations to acknowledge the cryptographic money incorporate Overstock.com, Expedia, Newegg and Dish.Government Bureau of Bitcoin

At a certain point, the U.S. government was one of the biggest holders of bitcoin. In 2013, after the FBI close down Silk Road, a dark net site where individuals could purchase drugs and other unlawful products and ventures, it assumed control bitcoin wallets controlled by the site, one of which held 144,000 bitcoins. Speculators have been raking in huge profits by offering on government-seized bitcoins.A mountain-sized mishap

In mid 2014, Bitcoin endured a staggering misfortune after the affirmed hacking of Mt. Gox, a Japanese trade. About $460 million of the money (in 2014 esteem) was stolen. It was the biggest loss of bitcoins ever and raised worries about how secure the money was.The very rich people's takes

Warren Buffett, maybe the most popular speculator on the planet, was not all that excited about Bitcoin one of the main circumstances he tended to the money. "Avoid it. It's an illusion, essentially," he told CNBC. "The possibility that it has some enormous natural esteem is a joke in my view."

Kindred very rich person financial specialist Jamie Dimon, CEO of JPMorgan Chase, had significantly more grounded words about Bitcoin: "You can't have a business where individuals will create a cash out of nowhere. It won't end well … somebody will get murdered and afterward the administration will descend on it."

Be that as it may, not every one of the very rich people are against Bitcoin. Stamp Cuban has said its esteem is swelled, however he as of late put resources into an investment finance that backs digital money. Richard Branson, be that as it may, has talked all the more hopefully about it.Super affluent twins and a keen adolescent

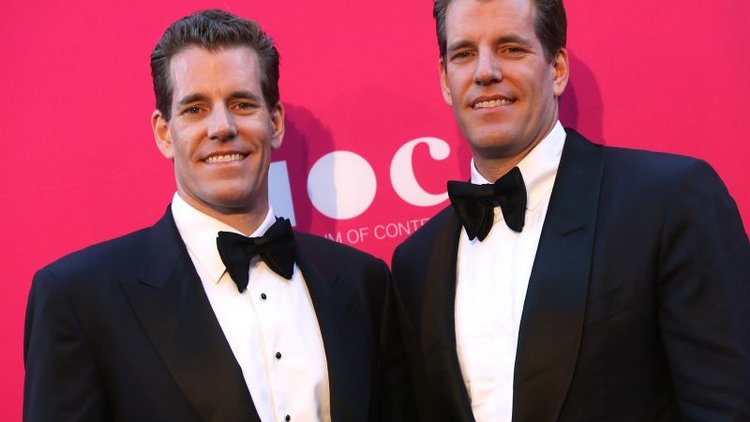

Other striking financial specialists in Bitcoin incorporate Cameron and Tyler Winklevoss (the Harvard-taught twins who sued Mark Zuckerberg asserting that Facebook depended on a thought they'd had). They purchased $11 million worth of Bitcoin in 2013, a sum said to be in regards to 1 percent of all bitcoins available for use around then. At the point when Bitcoin's esteem achieved more than $11,000 toward the beginning of December, the twins were announced the primary Bitcoin extremely rich people. The Winklevoss twins have been appealing to the SEC to make a bitcoin trade exchanged store. The organization dismissed the thought recently.

Another is speculator and business person Erik Finman, who put $1,000 into Bitcoin when he was 14 years of age and is currently a tycoon.VIPs need access

VIPs have additionally communicated excitement for the digital currency. Performing artist and Goop originator Gwyneth Paltrow prompts Abra, a Bitcoin wallet, and Ashton Kutcher, Nas and Floyd Mayweather have all put resources into Bitcoin new companies.Support from a major monetary organization

In August 2017, Fidelity Investments turned into an uncommon champion among budgetary foundations in grasping Bitcoin and different cryptographic forms of money. The organization enables its customers to utilize the Fidelity site to see their bitcoin property held through computerized wallet supplier Coin base. "This is an analysis in the soul of realizing what these crypto resources resemble and how our clients might need to interface with them," Hadley Stern, senior VP and overseeing executive at Fidelity Labs, told Reuters.A hard fork

On Aug. 1, 2017, Bitcoin encountered what's being known as a "hard fork" because of a couple of issues, including the set number of exchanges that can be prepared every second. Basically, the digital currency split into two, with Bitcoin Cash appearing. Here's the means by which Rob Marvin of PCMag clarifies the circumstance: "The Bitcoin fork addresses an essential ideological break over what's more critical: protecting the decentralized nature and autonomous control of the Bitcoin organize, or quickening exchange rates to make the digital money more feasible for standard web based business and installments." Bitcoin Cash permits bigger pieces of cash and more exchanges every second.Stunning

Toward the finish of November 2017, Bitcoin's esteem come to toward $10,000 per unit. There are nearly 16.7 million Bitcoin units available for use, and the cryptographic money's market capitalization ($167,156,585,840 as of Nov. 28, 2017) is really higher than that of Disney, McDonald's or IBM, and it is somewhat over that of GE.Traded on an open market

Starting at early December, there is another approach to put resources into Bitcoin without having a portion of the computerized money. On Dec. 10, 2017, Bitcoin prospects - "money related contracts committing the purchaser to buy a benefit or the vender to offer an advantage," as indicated by Investopedia - ended up plainly accessible on Cboe, a Chicago trade. What this implies for the fate of Bitcoin is questionable, however some contend it will help settle the digital currency's wild value changes.The shrouded cost of Bitcoin.

The procedure to make bitcoin, called mining, is a vitality escalated process, with a large number of the diggers utilizing specific gear for the procedure. This registering power has added a weight to vitality frameworks around the world, and in a few nations, for example, China, those frameworks still are controlled by coal.

Power Compare, a U.K.- based vitality examination tax benefit, assesses that Bitcoin mining expends more power than 159 nations, including Ireland and most nations in Africa.

Power utilization for all digital forms of money is on track to utilize more power in 2018 than the entire of Argentina, as per Bloomberg.

That's informative, but it doesn't really tell you what Bitcoin is.....

ya you say right but its just to know about bitcoin little bit. when we start writing on bitcoins its will be too much .........

That's true. Explaining things that complicated is difficult for anyone to understand anyway. I appreciate the research you put into this post. It was helpful!

Supply and Demand of Bitcoins

Well post about bitcoins.