Bitcoin TA - summary of analysts - 05. July 18

update with @ew-and-patterns post.

Regular daily update on BTC ta analysts opinions.

**My summary - short-term (next 24h) sentiment: neutral ** (last: neutral)

Bearish scenario*:

- Rebound is a dead cat bounce turning below 7'000

- Price falls below 6'000 again and quickly gravitates towards 5'500.

- Short term recovery from 5'500 staying under 6'000.

- After breaking 5'500 again a significant drop towards new lows in the range of 4'975 and 4'300.

Bull scenario*:

- We get huge follow up.

- We go up to 7'500 and higher.

*scenarios based on daily-candles - so around 4-14 days timeframe. See also definition section

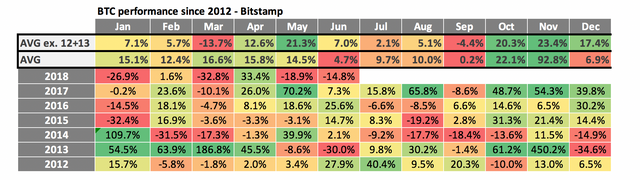

Monthly performance overview:

- Added 2012 + 2013 on request.

- As 2012 and 2013 the % move are gigantic I added two averages. One without 2012 + 2013.

- June performance was very weak. With -14.8% clearly below the average of the last years. With 2013 this is the only negative month at all.

- July is a mixed bag - 2 year positive performance and 2 year of negative performance. 2012 and 2013 were positive though.

- The average is positive with 2.1% but that is mainly due to the bull rund 2017. The average incl. 2012and 2013 is even more positive. That is mainly due to the 40%+ spike in 2012 so I wouldn't rely on that.

So just looking at this table we probably facing another negative month.

News about the blog

- updated definition section for time frame of candle forecast.

- added/update monthly performance section

- updated "Educational links" section

- added a bullish and bearish scenario to my overview section

I hope you find those changes helpful.

Analysts key statements:

Tone:

Mid-term outlook: -> unchanged

He expects us to put in a swing low at around 5'000 in first two weeks of June. From there we probably bounce strong towards 7'500 and more. For now he keeps this target. If we see a good move up he might postpone his 5'000 target but the price target will most likely remain.

Still he is expecting that we put in a final low only at around October.

Short-term outlook: -> unchanged

- Weekly: Not came higher than the break down area of his triangle. He expects this move to struggle to go over 7'050.

He is waiting for weekly close. The 30 MA will probably drop another 400 USD next week - so taking big steps to the downside.

The most he can see is to move up to the death cross of 30 and 50 MA. Probably at the time of 1 August - at a level of 8'500 we have the death cross - if not earlier.

@lordoftruth:

Technical indicators ( RSI & Stochastic ) suggest that the uptrend is more likely to resume.

This week we still need to keep an eye on Downside Tendency as if the price do not move above 6'842, our bearish scenario ( Medium Term ) will remain valid.

Todays trend is neutral. Trading between 6'210 and 6'842.

@ew-and-patterns:

Main count - still valid from older post:

Get ready for the next drop. The expanded flat pattern will likely be done in the next 24 hours (meaning the move up ends with the high of wave C).

7'000 at max before the drop. I don't think it will be a big drop, but it will lead to a new low.

BTC is channeling and moving very orderly for now. IF true, there are a few waves down to come. Target still 4'200.

-New bullish count - not primary:

We need are some more signs of a wave 2 correction. If BTC turns exactly @ 6280 or @ 6160 (fib targets for white wave 2) this count will be a lot more likely than it is now.

@passion-ground:

Only time will tell if a meaningful and lasting bottom is in. The monthly chart still holds out for further weakness into 2019, however, that does not diminish the nice move up we’ve had off the most recent bear market low. (See video for details)…

For bull run we need to see a much more powerful wave up to 8'366 level.

Daily doesn't look good. Positive sign we have some bullish divergence on the RSI.

The most bullish count is that the intermediate (4) is in and we are moving up.

@philakonesteemit:

A bounce at the 7'000 level was much expected due to hitting a major trend line support established since Nov 11, 2017.

Bullish View, if we break the 7'650 range, there's a chance to hit 7'850 to 8'000 range (0.5 to 0.618 fib retracement)

Bearish View, if we break 7'161 range, we'll most likely test 7'040, which I see as failing to hold and then testing 6'500.

@haejin:

@haejin is moving his analysis to bitcoin live. Those of you who want to follow him directly should look into subscription. I will try to get in contact to see if I can use an abstract to post here also in the future.

Bitcoin (BTC) Short Term Update: The blue circle shows a potential price pathway of BTC. The purple waves have been updated and it shows a scenario where purple 1,2,3 could be complete and 4 is getting its final touches. Purple 5 is still targeting the 6'300 zone or so.

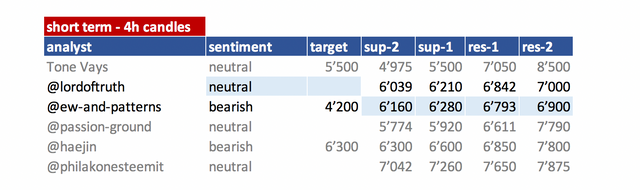

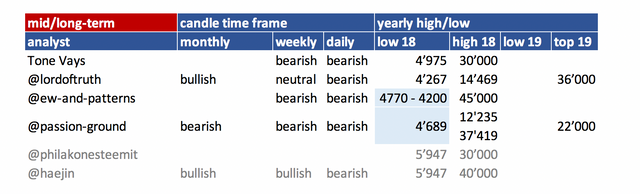

Summary of targets/support/resistance

- please refer to definition section for time-horizon.

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 03. July | here |

| @lordoftruth | 05. July | here |

| @ew-and-patterns | 05. July | here |

| @passion-ground | 03. July | here |

| @haejin | 13. June | here |

| @philakonesteemit | 31. May | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely). The sentiment is based on 4hr, daily, weekly, monthly candle charts.

- The forecast time horizon of candles can be compared with approx. 4hr = 1-2 days; daily = 4-14 days; weekly = 4 - 14 weeks; monthly = 4 - 14 month.

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

Educational links:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here. In addition he has an online course which you can find here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

Short term sentiment looks bullish at the moment.

$20,000 in a week on small capital with proof.

Amazing

I already signup

How he made that?

Check link

http://traderecorder.com/index.php/2018/07/05/total-profit-over-20000-in-previous-week/

Thanks for the update and the enhancements. I suggest taking Haejin out or you include his BTC updates he now and then publishes on Steemit. The current one is very outdated. Keep going with this; very usefull!

Thanks - I am not yet ready to discard @haejin and @philakone but might do that in the future adding others therefore.

Are you still onto the digitial ID topic? What exactly are you doing there?

Thanks for your response. There is a new analyst I’ve started following also and think it’s of good quality @forex-intraday. Maybe a good addition for your blog?

I have been incredibly busy and indeed haven’t posted anything since the first one. Going on holiday soon and need to think about what i want to do with the blog. I now realise even more how much effort it must be for yourself to post every day!

Congratulations for the publications you do, I think I have had more mastery in monitoring the financial health of cryptocurrencies thanks to that. I really do not know how to thank you for your votes in some of my publications during the World Cup promoting the brand steem-bounty, I'm from Venezuela and every vote for me is an opportunity to stay in this country since it is my most stable source of income for support my family Thank you very much !!

And have also received a 2.00 percent upvote.

Follow: @ab-com

Play and win SBD: @banglawolf

Daily Steem Statistics: @tanvirkawser

Learn how to program Steem-Python applications: @vappy

Developed and sponsored by: @steemitfollow

Ru

Приветствую. Представляю студию блокчейн-копирайтинга. Предлагаю наши услуги по написанию WhitePaper, созданию видеороликов , написанию уникальных статей и обзоров (в том числе для steemit), переводов. Огромный опыт и большой штат сотрудников. Списко наших услуг и портфолио в нашем телеграм канале или на сайте.

En

Hello everyone! I present to you our blockchain copywriting studio. We propose to you next services: writing WhitePaper, creating videos, , translations, writing unique articles and reviews (Including for steemit). Extensive experience and highly qualified team. List of services and portforlio in our telegram channel or on our website.