Bitcoin TA - summary of analysts - 29. July 18

Regular daily update on BTC ta analysts opinions.

My summary - short-term (next 24h) sentiment: bullish (last: bullish)

We are ranging between 8'300 and 8'100 waiting for next bigger move.

RSI still very close to overbought on daily

Major support at 7'800 and 7'680 area

critical area auf 8'500 needs to be taken now to continue bullish momentum.

It seems in the war of the bears and bulls we are entering another battle: Can the bulls create enough FOMO to create distance to the lows and overcome major resistance levels? If so we are not going to see the current levels for a long time.

Or do the bears lead the bulls into a trap and than smashing hard to the downside. That would create a lot of frustration and might lead to the capitulation which you would expect to be necessary to call the bear market over.

Bull scenario*:

- After completing 5 waves up we reconfirm 7'000+ level in a ABC pull back gathering strength for another move up.

- That confirms a higher low and bullish 5 wave count.

- Volume needs to increase.

- We overcome the death cross area of the 30/50 week MA and break above it.

Bearish scenario*:

- We move up for one or two weeks into the death cross (30 and 50 MA weekly) at around 8'500 and than drop significantly.

- Alternate - bears are turning after the RSI gets oversold and make a lower low

- After breaking 5'800 a significant drop towards new lows in the range of 4'975 and 4'300.

*scenarios based on daily-candles - so around 4-14 days timeframe. See also definition section

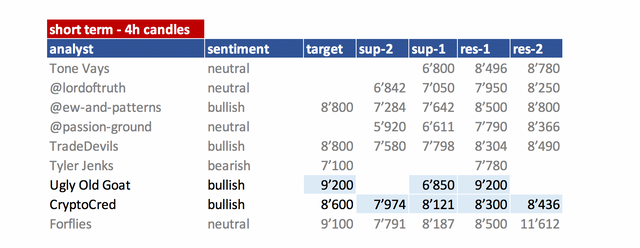

Summary of targets/support/resistance of TAs

Short-term overview

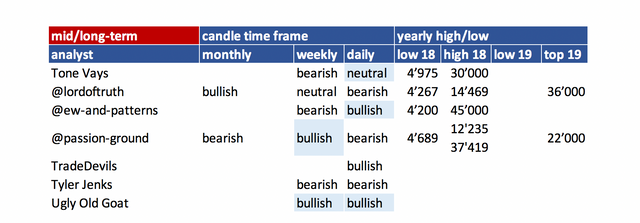

mid- and long-term overview

- please refer to definition section for time-horizon.

- be aware that mid- and long-term is mostly my interpretation of what analysts sentiment is as they not always clearly differentiate those time-frames. To interpret that consistently is very hard so please be kind with my interpretation.

- you can easily spot which analyst did an update

(block writing - grey ones don't have an update today).

Their changes are in light blue.

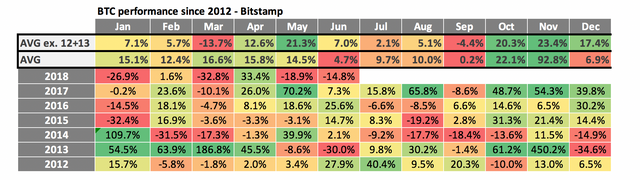

Helpful statistics:

monthly performances

- Added 2012 + 2013 on request.

- As 2012 and 2013 the % move are gigantic I added two averages. One without 2012 + 2013.

- June performance was very weak. With -14.8% clearly below the average of the last years. With 2013 this is the only negative month at all.

- July is a mixed bag - 2 year positive performance and 2 year of negative performance. 2012 and 2013 were positive though.

- The average is positive with 2.1% but that is mainly due to the bull rund 2017. The average incl. 2012and 2013 is even more positive. That is mainly due to the 40%+ spike in 2012 so I wouldn't rely on that.

So just looking at this table we probably facing another negative month.

News about the blog

- I added two analysts

- CryptoCred: Posting target on twitter and has very good educational videos. See Educational links section for them.

- Forflies: I added him not knowing him too well - that is why his logo is in grey box - meaning under evaluation.

Analysts key statements:

Tone (neutral):

Weekly: He thinks that not the following week but the week after we will have the death cross of the 30 and 50 MA. If our price is close to that cross price level that is a short opportunity. If the RSI closes in this area - there is no similarity to 2014 anymore on the RSI level.

Daily: 200 MA seems to reject us and always was a strong resistance - turned us already one time before. He will be bullish if we go above the 200 MA and above swing high at 8'496.

@lordoftruth (slightly bullish):

on holiday until August 5th.

TBitcoin price fluctuates above 8'000 barrier, trying to resume the

main bullish trend ( The trend is slighty bullish as long as the price above 7'650 ) supported by Stochastic Positivity.

But the price appears to be faced some bearish pressure ( As we expected in our previous post ) before the Major Resistance at 8'642 and might be forced to retreat from the climb, to test 7.650K before the moving ( In absence of another set of positive developments to sustain the climb ) towards 38.2% FIB level near 7.050K, supported by RSI Negativity.

Todays trend is Slighty Bullish. Trading between 7'650 and 8'280.

@ew-and-patterns (bullish):

Blue wave 3 target is 8800-8900. If true, August may be another boring month, but September will be interesting... Stay tuned...

@passion-ground (neutral):

The above song is from a 1977 Isley Brothers album entitled, “Go for Your Guns.” Although most hodlers “went for their guns” a long time ago, the price of BTC is climbing, - it keeps pushin’ - and we’re bound to know. (If the recent low is going to hold or not – that is.) Though the ladder remains shaky, it still remains up that we gotta go! "Ain't nuthin' wrong, babe, in believin' in a dream!"

We were extremely overbought. RSI is showing divergence against those highs (4hours). That tells him we need to pull back some time. If we do so he would like to see that the uptrend channel holds.

TradeDevils (bullish):

He expects that we are still in wave 3 and have not finished it yet.

To support the bull case it is important that we take out the swing high of 8'490.

Than he expects to end wave 5 at around 9'000 area at around end of July.

UglyOldGoat (bullish):

He wrote an article about the death cross not giving it too much credit. He thinks that is overrated and has only a minor chance to really reverse us. He is looking for bullish targets at 9'000+ range (my interpretation).

Crypto Cred (bullish):

I) Blue - current pivot (resistance)

II) Range Low 8.1k (I prefer this one to my earlier level given today’s price action)

III) Current 1D candle is an inside day (ranging)

Short: clean break of 8.1 = orange targets

Long: clean break of blue = red target

Froflies (bullish):

Volume pump from 14 to 17 billion in btc upmove. That is good news.

We have a new higher low in this swing.

With that we remain in a short - mid term bullish setup. He is expecting 9'100 incoming.

We are forming a falling wedge. We might form a further low at 7'700 (0.618) and than break out to the upside.

He sees a good risk reward for a long position.

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 27. July | here |

| @lordoftruth | 26. July | here |

| @ew-and-patterns | 27. July | here |

| @passion-ground | 23. July | here |

| @tradedevil | 27. July | here |

| Tyler Jenks | 18. July | here |

| UglyOldGoat | 28. July | here |

| CryptoCred | 28. July | here |

| Forflies | 27. July | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely). The sentiment is based on 4hr, daily, weekly, monthly candle charts.

- The forecast time horizon of candles can be compared with approx. 4hr = 1-2 days; daily = 4-14 days; weekly = 4 - 14 weeks; monthly = 4 - 14 month.

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

Educational links:

- From @ToneVays: Learning trading

- From @lordoftruth: Fibonacci Retracement

- From UglyOldGoat: How to achieve the same results of a professional trader without taking the inherent risks

- From CrytptoCred: Several great educational videos - very structured and helpful

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

@famunger As per my view Bitcoins are made as a reward for a procedure known as mining. They can be traded for different monetary forms, items, and administrations.

👍👍👍👍👍

Hi @famunger I found your post very useful tl understand current crypto market trend. Can I understand that market is ready for bullish movement?

Posted using Partiko Android