Prominent Bitcoin Trader: Price is Heading Towards $100,000 in 2018 - By Joseph Young

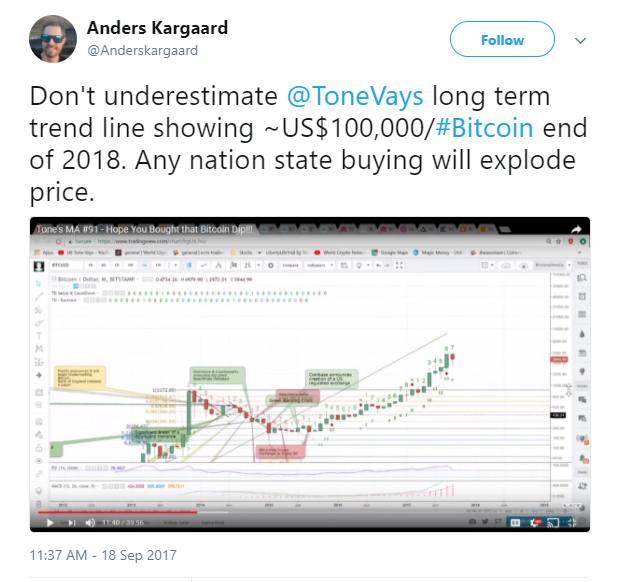

Earlier this week, prominent bitcoin trader and investor Tone Vays provided technical analysis on bitcoin’s short-term trend, major price correction following the nationwide ban on Chinese bitcoin exchanges, bitcoin’s swift recovery, and the long-term future of bitcoin.

The analysis of Vays demonstrated the potential of bitcoin price to surpass the $100,000 mark by the end of 2018, which would provide bitcoin a multi-trillion dollar market cap. For many years, financial analysts and researchers in both the cryptocurrency and banking sectors such as RT’s Keiser Report host Max Keiser emphasized the possibility of bitcoin to surpass $1 trillion in market cap if and when it succeeds in evolving into an alternative financial network against existing banking systems and financial institutions.

Advertisement

897

SHARES

Twitter

Linkedin

Facebook

Reddit

Weibo

Get Trading Recommendations and Read Analysis on Hacked.com for just $39 per month.

Earlier this week, prominent bitcoin trader and investor Tone Vays provided technical analysis on bitcoin’s short-term trend, major price correction following the nationwide ban on Chinese bitcoin exchanges, bitcoin’s swift recovery, and the long-term future of bitcoin.

The analysis of Vays demonstrated the potential of bitcoin price to surpass the $100,000 mark by the end of 2018, which would provide bitcoin a multi-trillion dollar market cap. For many years, financial analysts and researchers in both the cryptocurrency and banking sectors such as RT’s Keiser Report host Max Keiser emphasized the possibility of bitcoin to surpass $1 trillion in market cap if and when it succeeds in evolving into an alternative financial network against existing banking systems and financial institutions.

Based on the exponential growth rate of bitcoin regarding userbase, adoption, developer activity, trading volumes and market cap, a long-term price target of $100,000 is possible to achieve, especially if leading institutional and retail investors continue to endorse, embrace and adopt bitcoin. In 2017 alone, $90 billion investment bank Goldman Sachs and Fidelity Investments with $2.13 trillion worth of assets under management expressed their optimism toward bitcoin.

In August, Fidelity CEO Abigail Johnson stated:

“But I am still a believer – and it’s no accident that I’m one of the few standing before you today from a large financial services firm that hasn’t given up on digital currencies.”

Upon securing a $100 million funding round at a valuation of $1.6 billion, Coinbase CEO Brian Armstrong also promised its users and investors to provide a platform for institutoinal investors in the US and overseas markets.

With an increasing number of instituitonal and retail investors showing interest in bitcoin and global mainstream adoption of bitcoin increasing generally, $100,000 is an achievable long-term target for bitcoin.