Bitcoin Correction - Manage the Crisis and Prepare for the Next Bull Run

The past week has been very emotional (unpleasant) for investors in Bitcoin and cryptocurrency. Particularly for new entrants to Bitcoin's recent ATH (all Time High) who may legitimately wonder about the relevance of their investment in “digital gold 2.0”. The same goes for the altcoins that followed the boss in his fall, often even suffering even more severe losses.

The time is therefore perfectly suited to recall some fundamentals on the functioning of Bitcoin and the crypto market, and in particular its tendency to follow fairly identifiable cycles. The opportunity also to underline that if it is impossible to predict the future, the study of the past is rich in teaching for the informed investor.

What is technical analysis (TA)?

Technical analysis (or graphical analysis) of a financial asset is the analysis of its past price curve in order to forecast market developments.

Technical analysis does not claim to be an exact science. It is also often associated with a human science since its object of study is directly centered on the understanding of the psychology of the market and therefore of human psychology.

The study of a graph makes it possible to identify phases of increases and phases of decreases, as well as phases of price stagnation.

To explain that this phenomenon is not only due to chance, technical analysis is based on the psychological analysis of crowds which it claims to be an application in the markets. A market, like a crowd, can therefore be caught either in a dynamic of optimism ( Bull market : period of increases), or even euphoria ( Bullrun : period of strong increases ), or in a dynamic of pessimism ( Bear market : period of declines), even desperation (the lowest points of the Bear market ), or in complete hesitation (period of price stagnation or small bullish and bearish cycles in a range).

Bitcoin chart analysis

The Bitcoin price curve is unique when compared to other asset classes since it is very easy to detect cycles that repeat themselves endlessly and at a regular time interval.

These cycles have a duration of 4 years , and are the consequence essentially of the algorithmic policy of the monetary creation of Bitcoin. Indeed, unlike fiat currencies, the monetary creation of Bitcoin is programmed and known in advance . Every 4 years and this since the first halving in 2012, the issuance of bitcoin is divided by 2, and this until 2140 . This reduction in Bitcoin's money creation creates additional scarcity. Over 18.5 million units out of 21 million BTC have already been issued.

What happens during these cycles?

With each halving of Bitcoin, there followed a moderate increase in its short-term price ( bull market period ) caused by the reduction in money creation, this increase then begins to increase more and more. more resulting in a bullrun period .

We can see that the trigger for the bullrun is the breakout of the ATH ( All time high , highest price) of the previous bullrun . Indeed, each time Bitcoin has passed its old ATH, the media coverage around Bitcoin begins to be more and more present (traditional media, social networks, word of mouth). This over-media coverage leads to an influx of new buyers, which therefore pushes up prices. We can therefore clearly distinguish this self-sustaining loop: prices go up -> people are talking about it more and more -> new people are buying it -> prices are going up even more -> etc.

Coupled with speculation and extreme euphoria, as well as FOMO ( Fear of missing out, the fear of missing an opportunity, the fear of "missing the train"), we simply get spectacular increases, prices way too highs, and extremely dangerous volatility for beginners.

Many investors who returned long ago are increasingly starting to take profits and exit the volatile crypto market into stablecoins . And at a precise moment, it is the whales who decide to sell , these famous whales which literally make the market. They weigh so much that when they decide to sell, the market turns around and it is almost impossible for retail investors to push up prices and keep the bullrun going .

This is when the bubble bursts, many investors start to sell, even at a loss for those who entered way too high. Panic begins to take over , and signals the beginning of the bear market . The more the bear market advances, the more the prices fall ; investors are losing more and more money and hope, some are resigned to selling, and for others it becomes almost unbearable to hold on ( hod ). Bitcoin and the crypto market are completely out of the media and trends. Total disinterest sets in and prices continue to fall.

We arrive at the lowest of the bear market (-85% for Bitcoin, -90% -99% for altcoins), the best time to enter, re-enter, or strengthen your positions. Long-term investors will favor these purchasing areas at each bear market , especially in DCA strategy ( dollars cost average , the fact of investing the same amount regularly). More and more investors are starting to see good entry opportunities, and the market is slowly turning around.

The bear market ends and the market enters the consolidation phase . This phase can be characterized either by price stagnation or by cycles (in a range) of small bull markets and small bear markets . Interest in crypto is on the rise, and Bitcoin is approaching the fateful date of its new halving , which signals the start of the new cycle.

It is important to specify that these cycles are not intended to last indefinitely . And this for three reasons:

The effect of halving becomes less and less significant , since the difference between the number of bitcoin issued before and the number of bitcoin issued after the halving becomes less and less significant (reduction of 3.125 BTC issued per hour at the halving of 2020, reduction of 1.5625 BTC issued per hour at the 2024 halving , etc)

The more we advance in time, the more investors there are who have already entered this market (or who already know Bitcoin). It therefore has fewer and fewer potential new entrants.

The capitalization ( market cap ) of Bitcoin becomes increasingly significant. The bigger a market, the less volatile it is.

Now that you know the long-term trends through these cycles, let's get closer to some trends within bullrun periods , corrections (or retracements).

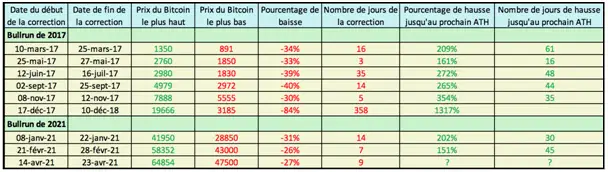

For this, let's analyze the bullrun of 2017, comparing it to the one we are currently experiencing.

Regarding that of 2017, Bitcoin exceeded on March 2, 2017 the $ 1,200 reached 3 years earlier at the peak of the bullrun of 2013.

The following 8 months will cause bitcoin to rise by more than 1600% to almost reach $ 20,000 at the peak of the bubble.

Despite this 1600% increase over 8 months, bitcoin has experienced 6 corrections (including the final correction) greater than 25% decrease, so many possibilities for novices to suffer losses.

We now know the 3 rd correction of more than 25% on Bullrun 2021.

Although the market is strongly bullish during bullrun times , if it does not correct and therefore soars without ever stopping, then the bullrun will not last long . This is why confirmed investors tend to consider the phases of declines to be healthy .

You have to be aware that when you invest in bitcoin (yesterday, today or tomorrow), you can end up with a 30% drop in the hours that follow.

The cryptocurrency market is very strongly correlated with Bitcoin. That is, when the price of Bitcoin goes up, altcoins (all cryptos except Bitcoin) tend to follow its rise. This increase will be more substantial than that of Bitcoin when we are in the alt-season (period when the entire cryptocurrency market outperforms Bitcoin).

Likewise when the price of Bitcoin falls, altcoins tend to follow its fall.

And in the majority of cases, the fall is much greater. When Bitcoin drops 10%, there is a good chance that altcoins will drop 15-25%.

Strong periods of fear will take place during these corrections, but it is important not to panic and sell. Selling in panic is to make sure you realize losses.

Before investing, we must therefore determine an investment plan, and stick to it.

Which investor plan to choose?

- You do not hold stablecoins and you do not wish during this bullrun to redeem crypto with your euros.

If you are a beginner then the best thing to do is not to sell . Wait for the correction to end, and for prices to rise again. If you want to sell so you can buy lower, you risk being trapped by the market. You don't have the technical and graphic skills to be able to be a winner in the long run. You have in front of you whales (very large portfolios), experienced traders and robot traders ( high frequency trading ) very successful in times of high volatility (the crypto market is extremely volatile in times of bullrun ).

If you are a seasoned trader , you can try to outperform the market by trying to sell at the right times and buy back at lower prices. Only those who have extensive experience and who are profitable can allocate a large percentage of their crypto portfolio to these kinds of trades .

If you are a newbie trader , you can allocate a small percentage of your portfolio to these kinds of trades . Do not sell the rest of your crypto, the risk is too high. - You hold stablecoins and / or want to invest new ones in crypto with your euros.

If your investment plan was to strengthen your positions (buy more crypto), then you have the option of partially entering the market at favorable prices in the short term . In many cases, this solution is preferred. This technique will become more and more risky as we approach the end of the bullrun .

We are currently at the third retracement of more than 25% on Bitcoin since the start of this bullrun . So if you buy during this second retracement, the risk will be lower than during the 5 th or 6 th retracement.

If your investment plan was to always keep X% in stablecoins , then keep your original plan. Don't buy volatile crypto for your stablecoins if you can't keep your X% stablecoins .

The percentage chosen in stablecoins in your wallet will depend on several things:

Your risk profile. Do you accept to take a lot of risks in order to hope to gain more, or do you prefer to take less risk and hope for a smaller gain which is more likely to be realized?

Your short-term / medium-term projects requiring liquidity. You should never invest money in risky assets (stocks, real estate, crypto, etc.) that you will need in a short time. If the market breaks down just before your project is completed, then you will be forced to sell at a loss. It is best to secure this money in low-risk assets such as savings books or fund euro life insurance (although at rates lower than inflation), or stacking of StableCoins in DeFi or in centralized platforms (see remunerated euro accounts with CeFi) .

From the market trend. In the current case of the cryptocurrency market, the percentage of your portfolio invested in stablecoin will depend on the progress of the bullrun . The longer the bullrun lasts (but especially the more Bitcoin reaches price levels never before reached), the more you should have a significant share in tablecoins , and therefore a smaller share in volatile crypto.

The best strategy is therefore to set exit levels (sale of volatile crypto against stablecoins) each time Bitcoin crosses a threshold bringing it closer to its future ATH. Thanks to various long-term indicators, it is possible to issue probabilities on the future ATH of Bitcoin and which will allow you to establish your exit levels.

In the end, and whatever your strategy, the goal is that by the time the bubble bursts, you have already converted the majority of your volatile crypto into stablecoins. An objective as simple to state as it is complex to achieve and which in any case deserves your full attention.