Bitcoin - Institutional Investors Are 350$ From Jumping In ?

Institutional Investors - the wet dream of every crypto holder and most likely every retail investor in general. Before we jump in the discussion it might be helpful for some of my audience to clarify the difference between Institutional Investors and Retail Investors*.

Retail Investors

According to www.investopedia.com

Retail investors invest much smaller amounts than large institutional investors, such as mutual funds, pensions and university endowments, and trade less frequently.

In other words people like you and me are in the "retail investors" bracket. Small accounts that don't have big impact on the markets.

Institutional Investors

On the other hand we have these guys, usually operating with vast amounts of money (most of the cases yours and my money)

According to www.investopedia.com

An institutional investor is an organization that invests on behalf of its members. Institutional investors face fewer protective regulations because it is assumed they are more knowledgeable and better able to protect themselves. There are generally six types of institutional investors: endowment funds, commercial banks, mutual funds, hedge funds, pension funds and insurance companies.

So obviously if you hold Bitcoin for example, you would definitely want the big guys on your side ! The reason is pretty obvious - large amount of money means that the buying power of these institutions are HUGE. We are talking $1B+ in many cases, $1B equals to 125,000 Bitcoins. If few of these funds decided to buy Bitcoin the price would explode (like it did on many instances).

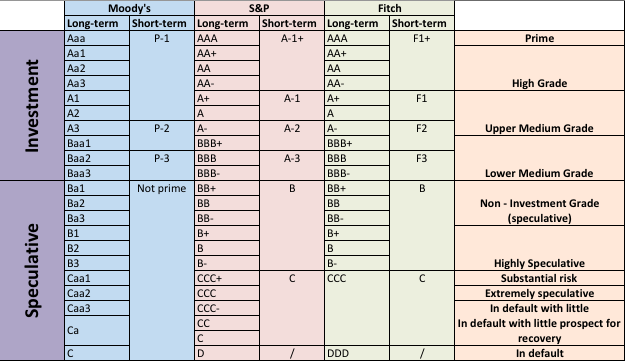

An important note is that a lot of the mutual funds/pension funds etc. are restricted from trading high-risk assets for obvious reasons. For example a pension fund is obligated to trade only investment grade instruments.

Why 350$ Away ?

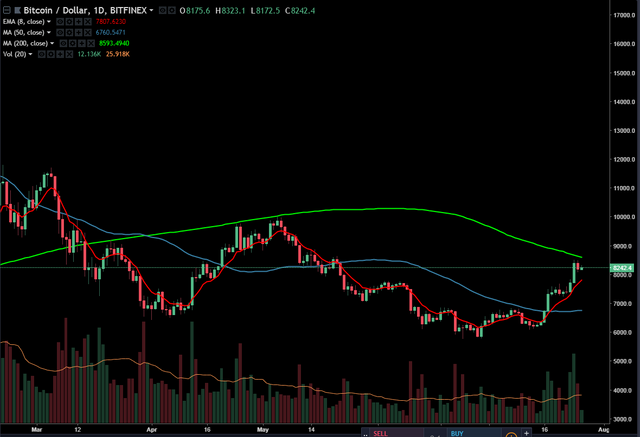

The answer to this question is - The 200-day Simple Moving Average ! Many of the institutional investors/traders observe this long-term indicator very closely. Once it is above this level (the green line on the chart below) they kind of conclude that the participation group is mostly from buyers and the trend is upwards. I also use this indicator very often and I think it is one of the most reliable tools in acknowledging long-term movements. Of course no one can guarantee you that once we break the 200-day institutions will rush in to buy BTC or ETH but it definitely won't hurt.

Another very interesting moment is that the 50-day weekly line has acted like a resistance for some weeks now, we are just under it for the moment but this is one more obstacle before the green line.

Bitcoin, Weekly chart

In my modest opinion a rejection from these key levels are more likely than breaking (as of yet) I would definitely suggest that long positions be extra cautious until BTC makes the price discovery. Hopefully institutions will

Nice analysis @ervinneb..and welcome to TIMM!

Excellent informative post mate. I am going to have a closer eye on the 200-day simple MA from now on

Very valuable post again! Thanks , keep on it!