Do we need 709 Digital Currencies?

To make sense of the multitude of coins, I break them down into two types; “Digital Cash” and “Digital Assets”.

In a previous post, Blockchain - Beyond Bitcoin (Part 2), I went into more detail on what I mean by Digital Cash.

Digital Cash

Of the top 20 currencies by market cap, I would only classify 8 of them as Digital Cash;

- Bitcoin

- Litecoin

- Monero

- Dash

- Ethereum

- Ethereum Classic

- Ripple

Why do we need so many cash coins?

8 Coins even seems like a lot of cash for the internet.

....

We shall see each coin is a little different, there is certainly room for more than one!

Whats the difference?

- speed

- liquidity

- stability of platform

- stability of price

- privacy

- inflation

- and most importantly along the way each coin will drive a unique economy.

What gives value to a coin?

At the moment the coins value is mainly driven by speculators who are pumping and dumping to make a profit but in the long run this will change.

In the same way as Euro increases in value compared to the Dollar if the Euro economy does better, each digital coin will increase in value as it finds its unique use cases, and its economy grows.

Key measurable features of Digital Cash...

Speed

In general this is how long you have to wait until your transaction is irreversible. i.e. the longer it takes to build a transaction into the blockchain.

Dash for example uses a protocol which means the transaction is almost instant. Other coins speed can be measured by average block time.

Liquidity

This is important because the more liquid a currency is the easier it is to exchange and the lower the cost to exchange.

More liquid currencies will also generally have a less volatile price as the true market price will be reflected in the price at any given time and will be less open to manipulation by whales.

Stability of Platform

The risks of a security flaws in newer coins or wallets are real. The longer a coin has been in operation the more robust it will be.

Stability of Price

Inflation is OK as long as its predictable. Instability means its difficult to plan and use it for business, even if the price is increasing.

Its the business use cases that will drive the long term viability of the currencies so stability of price will be important for widespread adoption.

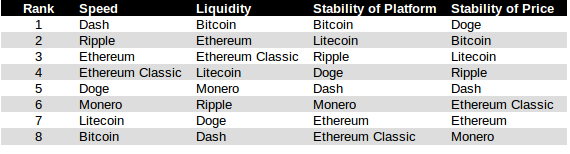

How do the 8 top coins rank for these features?

Speed has been measured based on average block time

Liquidity has been measured by market cap

Stability of platform has been measured by launch date

Stability of price has been measured by standard deviation of weekly returns in 2016.

Other Key Features...

Scalability

This refers to how many transactions can be handled per second. There are many different approaches to deal with limits. Blocksize is often mentioned as a limiting factor but there are alternatives.

Privacy

People generally will want a bit of privacy and will not want the public to be able to see how much they are paying for items, or how much they have in their account.

Monero is king at the moment and Dash also provides some privacy advantages but none of the other coins provide much privacy. With Bitcoin for example its possible for transactions to be linked back to you.

Inflationary

Some coins have caps on the number of coins that will be created. Over time these currencies will become more and more rare which should lead to inflation of the price, and increased transaction fees for miners.

On the other hand some coins have no limits and as such would not make a good investment over the long term but still may be useful as a medium of exchange but not as a store of value.

The most important feature of a coin...

What can you use it for?

Its Economy

The driver of the prices for the various currencies is now mainly speculation. Their unique use cases have not been established. The underlying value and utility of a currency will eventually be linked to the economy in which it operates in much the same way we now value Euros and Dollars by the output of their respective economies.

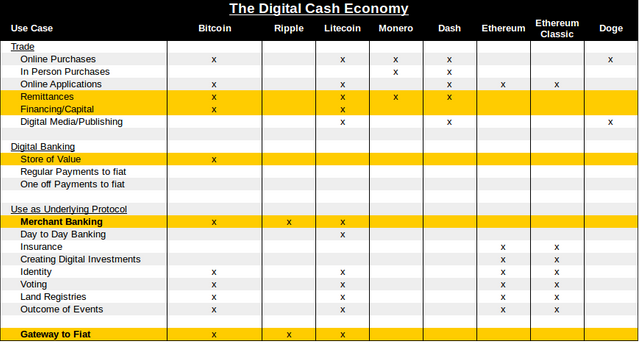

The Digital Cash Economy…

In a conventional economy currency has 2 main uses; can be used in the trade of goods and services and as a store of value.

Digital Currencies have many more potential uses in particular they can provide a underlying protocol for other services.

What Economies are likely to develop around the top 8 Coins?

When we think of this an interesting picture develops. Highlighted in orange are the big ticket use cases.

Bitcoin excels in many areas.

There are so many exchanges and ways to get it, it now its a key bridge between fiat and digital currencies.

The price of Bitcoin has been relatively stable over recent months its even possible to visualise a future where people put savings into Bitcoin instead of traditional bank accounts.

The only part that lets it down is its speed and increasingly the cost of transactions.

Litecoin has very similar features to Bitcoin but I am not so sure there is much of a unique use case for this coin. It does have a large Market Cap and a dedicated user base in China however its not dissimilar to Bitcoin but I see no long term advantage for its use.

Moneros privacy may give it an edge for use in trade and remittances.

Its more complicated to implement however as evidenced by the lack of any major wallet provider providing integration.

Dash is quick and seems to be aiming at retail purchases. This may become the day to day currency that people buy items with online or in person.

Dogecoin is mainly used for tipping on website and fourms. I am not aware of any significant ecosystem outside of that.

The Ripple network is focusing on the interbank market which will be possibly the largest use case for Digital Currencies. It aims to make cross border and interbank transfers quicker and cheaper. Banks seem to like being in control so this will probably continue as a “Blockchain” enterprise however the same could be accomplished by just using bitcoin so it will be interesting to see if this project continues or if cheaper competitors appear based on Bitcoin.

Ethereum and Ethereum Classic are slightly different currencies. They provide fuel to their respective ecosystems. The purpose of the Ethereum project is to create decentralised apps that live on the Ethereum Blockchain.

The two versions of Ethereum resulted from a split in the code base in August 2016.

Ethereums value will stem from the ecosystem of apps that it can create and support.

Do we need 8 versions of digital cash?

The wild west of the 21st century where prospectors search for digital gold is on the internet. So many coins will come and go. I discovered last week there was a potato coin but unfortunately when I went to get some it seems to be no more. :(

The highlights of 2016

Ethereum stood out early on, then levelled off.

The later half of the year was Moneros chance to shine but it has been declining since.

What does the future look like?

Bitcoin will be used for trade, digital banking, a gateway to digital currencies and as an underlying protocol.

Dash will be used for trade and online purchases

Monero will be used for trade and may become more popular than Bitcoin specifically for online purchases.

Ethereum will be used for online apps

I am not convinced there is a unique use case for Ripple, Litecoin, Dogecoin or Ethereum Classic. I will talk about "Digital Assets" in the next post.

Image Credits Some images have been sourced from https://pixabay.com

Disclaimer – The views expressed in this post are my own and are not intended to be investment advice, do your own risk assessment!

We need 709 Digital Currencies for greed reasons. I have an old post that illustrated this point here

The only thing I'd point out, is the "top" currencies aren't necessarily the best ones. Many of them had great marketing, but you can't decide on a coin just because it had a large marketing campaign.

When I say that, I'm thinking of Peercoin for example. It's a coin that won't be respected today, but I forsee down the road, it will be needed and used for its own purpose. (It was released in 2012 and still going strong).

Interesting post @intelliguy.

I plan on extending out my analysis to anything with market cap above 1m and peercoin will make it into that category.

My next post will be on Digital Assets which largely make up the token coin space but what I think makes them a little different is that they are more like shares in the companies rather than cash. The Digital Cash coins in my view are more like fiat currencies and like them operate with a particular economy. They dont really have that much value but are useful for exchange.

Digital Cash coins value will derive from how much they are used in contrast to Digital Assets whose value will derive from how the respective company grows.

I think by splitting the coins into these two groups should give insight into their long term value.

Thanks. I will thorougly enjoy your analysis to include Peercoin too. It's well forgotten because it doesn't have the marketing push behind it. Some people even think the creator of Bitcoin who admitted he was moving "on to persue other projects" might have created Peercoin and Primecoin, two vastly different answers to traditional proof-of-work might have been involved (or the sole creator) of both.

Good luck on your quest. You're doing great work and I appreciate seeing your results.

Many thanks. I appreciate the feedback and encouragement and heads up about peercoin and primecoin. They really werent on my radar.

Hello @eroche,

It gives us pleasure to inform you that this post have been upvoted by Project Better.

The Mission of Project Better is to reward posts have many votes from Minnows but earn pennies.

Your payout is $0.039 before we vote on your post.

Learn more about the Project Better here! ,

Want to donate your voting power to support Project Better and earn curation rewards? Click Here!

We hope to see you continuing to post some great stuff on Steemit!

Good luck!

~BETTER~

"I am not convinced there is a unique use case for Ripple, Litecoin, Dogecoin or Ethereum Classic."

Agree bro! There's no reason to have this coins, my answer is quite simple. Why i need something nobody see as money?

If the "coin" isn't bringing something unique to the cryptosphere then it largely has no point IMO. There are a few great projects out there, but not all of the coins are needed... maybe 5%?

I see Dogecoin and Zcash as digital cash too,but I might be wrong on this .

Dogecoin is in the list and Zcash will make into a more detailed analysis of coins with market cap greater than 1m.

I am not convinced about Dogecoin for the reason that it doesnt have that many established use cases yet. I cant see how it will grow. In contrast from the table above there are some unique and large use cases for Monero, Dash, Bitcoin, Ripple and Litecoin and Both Ethereums.

Dogecoin has been the most stable over 2016 however which would be an attractive feature for a cash coin.

The Jury is still out on ZCash. Is it too anonymous? ...