Wall Street Has Solved A Big Problem For Bitcoin

Wall Street has solved a big problem for Bitcoin: market volatility, paving the way for the people’s currency to gain broad acceptance among merchants as a medium of exchange.

That’s a bullish development for the “people’s currency.”

Starbucks and Dunkin Donuts have been talking about Bitcoin lately, for an obvious reason: accepting Bitcoin as a form of payment for their products will create a great deal of buzz for the two franchises among young customers enchanted with the digital currency.

But they have yet to accept it as a form of payment for coffee and lattes.

Why? It’s hard to say. Perhaps, they are concerned about the volatility of the digital currency, which could result in a great deal of loss should it fall precipitously against the dollar.

That’s an old problem, however, which Wall Street has solved recently with the introduction of Bitcoin Futures. Starbucks, Dunkin Donuts, and any other merchants concerned about this prospect can short Bitcoin Futures.

This means that any losses in the spot market will be made up in the Futures market.

[Ed. note: Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment. Disclosure: I don't own any Bitcoin.]

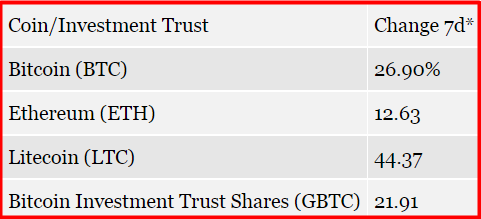

*As of February 17, 2017, at 11.30 a.m.

Meanwhile, Wall Street has been introducing new products, like the Bitcoin Investment Trust, that allow for broader investor participation in the Bitcoin market -- and could help the digital currency move from the “innovator” and “early adopter” stage in the Rogers Curve, to the “early majority.” That's when demand for a product turns into a cascade, and the product becomes an "epidemic."

And that’s good news for Bitcoin bulls, as an “epidemic” means higher Bitcoin prices, especially since Bitcoin is in limited supply, provided that big governments, big banks, and hackers do not spoil the party.

Thanks for the information😉

You are welcome :)