6 keys to understanding PETRO, the cryptocurrency created by Venezuela

The one that according to the Venezuelan government is the first digital currency launched by a state, launched this Tuesday. Its success in the deep crisis that the country is experiencing will depend on Nicolás Maduro's Executive can offer confidence, key in the cryptocurrency market.

The petroleum was born this Tuesday still wrapped in many doubts.

The cryptocurrency issued in Venezuela is, according to the government of Nicolás Maduro, the first one launched by a state, although countries such as Estonia and Dubai have already stated that they also have similar plans.

In the heat of the criptocurrencies, led by bitcoin, and in the midst of a severe economic crisis, President Nicolás Maduro's socialist government made a new and risky decision that officially began to function this Tuesday with the presale phase.

The government relies on it as a source of financing at a time when its revenues have fallen due to low production and falling oil prices, the country's main and almost sole source of foreign exchange inflows.

Added to this are the financial sanctions imposed by the United States that prevent it from issuing new debt or refinancing itself through the institutions of that country.

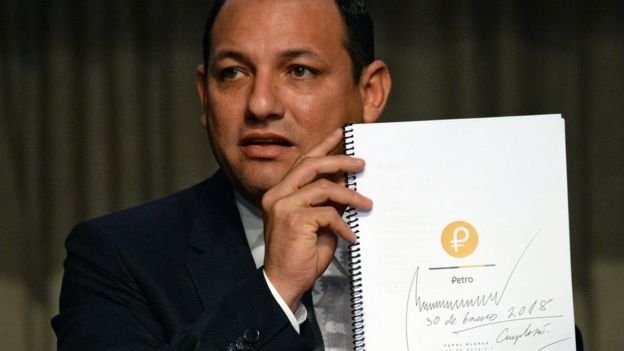

Supported by Venezuelan crude oil, petro represents a "change of era in the financial world,"according to Hugbel Roa, Minister of Science and Technology, said Tuesday.

Although the analysis of its technical data still leaves many unknowns, these are 6 keys that serve to explain what is known at the moment about petro.

1. Who can buy it, how much is it worth and how much can I change it for?

Anyone who wants it can from this Tuesday express their intention to buy petros. In this pre-sales phase the idea is to check the appetite of the market.

Venezuela's cryptocurrency superintendent Carlos Vargas said last week that the government hopes to attract investors from Qatar, Turkey, as well as Middle Eastern countries, Europe and the United States in the presale of its digital currency.

Each petro has as its reference value the price of one barrel of oil, of which Venezuela is considered the country with the largest proven reserves in the world.

This does not mean that each petro is equivalent to one barrel, but that the value of the petroleum is linked to that of Venezuelan crude oil.

With this in mind it should now be around $60, but the selling price of petro will still depend on an agreement between pre-sale stakeholders and the government.

As announced, 100 million petros will be issued, so the total value of the issue is estimated at about $6 billion dollars. According to the White Paper on the functioning of the currency, 38.4 million cryptoactives were sold this Tuesday.

This White Paper initially states that the supply is fixed, but it is also said that petro will be mined if users agree.

The document also indicates that when someone wants to change their petro, the price of the barrel will be paid but in bolivars, the Venezuelan national currency, very devalued by the hyperinflation that crosses the country.

The largest banknote, the 100,000 bolivars, barely equals less than $0.50 in the parallel exchange market.

The changeover to Bolivars will take place on exchange platforms authorized by the government, of which few details are known at this time.

Its value will lie, above all, according to Laura Rojas, an expert in digital finance, in the promise that a market will be created in Venezuela and "can be used later to pay taxes and public services,"he tells BBC Mundo.

This, together with the government's promise that it will make an effort to promote its international use through, for example, the state-owned PDVSA, which will have to pay part of its transactions in petros.

2. Is it really a cryptocurrency and how is it different from bitcoin, the most popular?

Yes, petro is one of the hundreds of cryptomonths that exist and of which bitcoin is the best known.

The main difference with bitcoin lies in the fact that petro will be centralized by an intermediary, in this case the Venezuelan government, while bitcoin is completely decentralized. It belongs to no one, it is not regulated by governments, banks or investment funds.

Another difference is mining. Bitcoin can be generated by anyone with the right equipment. Petro, according to the White Paper, will depend on whether users agree to it because the initial supply is 100 million.

Petroleum is not the first digital currency issued by a centralized entity, such as a company.

"From this point onwards, we follow established and predetermined rules that make sure that neither the value nor the offer is managed in a discretionary way," Rojas points out.

3. What does the government want?

The Venezuelan government, with income problems, in the midst of a serious crisis and pressured by the financial sanctions of the United States, launched the petro and promotes it as a solution to be able to finance itself and solve the many evils that plague its economy.

Among the objectives is to create an alternative currency to the dollar and a digital and transparent economy for the benefit of emerging countries and far removed from the global financial system, controlled from the United States.

He wants Venezuela to be "a global reference for sovereignty in the face of the big global financial centers".

With petroleum, moreover, the government is looking for an income that it cannot find now. In April, it will face new debt payments that it cannot refinance because of U. S. sanctions.

Imports from an externally dependent country have fallen and this is part of the explanation for the lack of food and commodities.

All this in a context of a continuous fall in oil production, almost its only source of income in dollars, which has not even allowed it to take advantage of the increase in the price of the barrel in recent months.

"The cryptocurrency comes to strengthen our economy", said President Maduro on Monday, without giving more details. "We're going to be a total success,"he ventured.

According to the White Paper, 55% of the revenue collected will go to a sovereign wealth fund that the government may use at its discretion.

4. Is it an instrument to issue public debt?

It's the great criticism of the opposition. The Parliament, controlled by Maduro's rivals, has declared the petro illegal.

The economist and opposition deputy of the National Assembly, José Guerra, believes that petro is not a cryptomoneda and that it resembles more a bond of public debt.

According to Guerra, the creation of petro is "a debt operation that seeks to avoid parliamentary control", he said in a recent television interview. In addition, he referred to it as a "highly risky" investment.

"If the government thinks that using petro will get funding it cannot have today, it will be wrong", he added.

The new debt issuance, according to the Constitution, must be backed by the National Assembly, the legislative chamber with a majority opposition, which refuses to increase the country's huge debt.

In addition, the United States prevents the debt from being refinanced or reissued through its territory and institutions.

5. Does it serve to circumvent U. S. sanctions?

The idea of petro is to be able to obtain financing outside the circuits of influence of the United States, which both the government and the state oil company PDVSA have now closed.

However, the Treasury Department has already warned everyone interested in investing in petro.

"A currency of these characteristics seems to be an extension of credit to the Venezuelan government (...). Americans who get involved with the future Venezuelan digital currency may be exposed to U. S. sanctions", he said.

This could be a disincentive for anyone who is initially interested in acquiring petros.

Expert Rojas believes that this is the main objective of the Venezuelan government: "Lift the siege of sanctions to get money".

"In the private world these presales are an innovation compared to traditional formulas for raising capital. A company that starts or uses the sale of shares or issues debt to raise capital when it has a project that is starting", says Rojas.

Issuing cryptocurrency is an alternative. "The Venezuelan government got on that wave", she says.

6. Will it succeed?

The government already says it will have one, but there are still many doubts in the White Paper, as yet lacking specific key data.

President Maduro spoke on Tuesday about registering in the presale an intention to buy $735 million dollars in just 20 hours since its launch.

Confidence will be key to success.

The government itself is the issuer and undertakes to repurchase them. And it will do so in a context where several credit bureaus have spoken of selective default (or default) for the late payment of interest on some debt bonds.

In addition, Venezuela will continue to have the markets blocked.

This situation could be aggravated by presidential elections on 22 April, which a large part of the international community will be unaware of because it does not consider that they are taking place in fair circumstances and that the majority of the opposition is going to boycott them.

"With a cryptocurrency you don't sell stocks or bonds. The investor has no legal right to the project in which it invests. All he has is confidence that he will develop the project accordingly", Rojas told BBC Mundo.

That's what makes all cryptomoney a "high-risk"investment. "If on top of that, the issuer doesn't tell you what it's going to do, I find it hard to think there are serious investors behind the oil,"says Rojas.

Within a month the actual sale will begin and, hopefully, unknowns will begin to dissipate.

Source: www.el-nacional.com

can you teach me how to create a cryptocurrency

I wish I could help you myself with that, my friend. But here I leave you a tutorial of @exe8422 where he teaches you step by step how to create a cryptomontage using ethereum. I hope it works for you :)

Tutorial: https://steemit.com/spanish/@exe8422/tutorial-como-crear-tu-propia-criptomoneda-utilizando-a-ethereum

Build trust and communication , that's the key and the most important to gain credibility..

That's right, buddy... But trust is hard to have towards this government because it's a narco-government... Thanks for comment :)

Yes here shows that the field of cryptocurrency is successful and the means of payment in the future

That's what everyone expects, buddy... Thanks for comment :)