The New Bitcoin Debate: Proof of Work Change vs. Defensive Patents

There’s never a dull moment in the world of Bitcoin. In less than a year, it has survived two contentious scaling proposals: Bitcoin Cash and Segwit 2x.

Even though the drama has died down for the most part, a new subject of contention is starting to brew; this time regarding Proof of Work.

2 weeks ago, Cøbra published an “Open Letter to the Bitcoin Community” urging them to consider changing the Proof of Work mining algorithm. In it, he asserted three main points:

- Bitcoin mining is becoming more centralized around Bitmain.

- A recent Bernstein report calculated Bitmain’s profits to be in excess of $3 billion in 2017 alone.

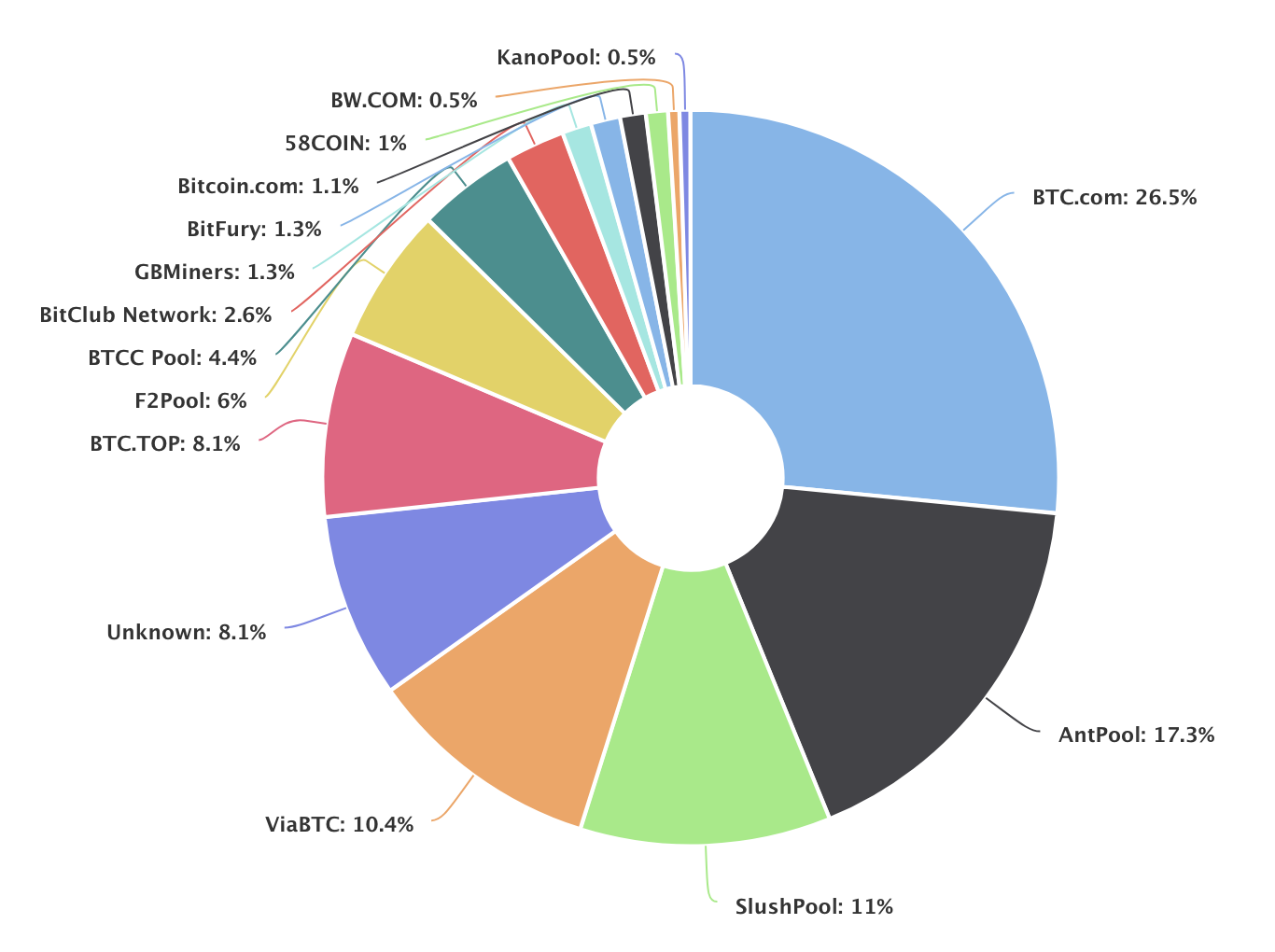

- This is concerning because Bitmain owns both BTC.com and AntPool, which equate to 43.8% of Bitcoin’s hashrate (3/14/18).

Now even though BTC.com and AntPool are mining pools, it’s unclear how much of that hashrate the Bitmain owns with their own mining rigs. With a warchest of $3 billion, it’s a very real possibility that Bitmain can increase their hashrate dominance either by creating more ASIC’s for themselves or buying out/investing in other mining companies like they did with AntPool.

However, these concerns were somewhat allayed a couple of weeks later when Bitcoin Magazine released their feature on the Bitcoin Defensive Patent License.

The Bitcoin Defensive Patent License (BDPL)

“One of the best ways to (reduce miner centralization) is to encourage mining individuals or entities to grant their respective mining patents under a mutually defensive patent license that is tailored to address the unique needs of the Bitcoin or other blockchain protocol(s) and prevent any one mining consortium from obtaining the dreaded ability to launch majority (or near majority) attacks.” -BDPL

This exciting new patent is an extension of the former Bitcoin Defensive Patent proposed by Blockstream. Crafted with the help of an incredibly qualified intellectual property attorney of 14 years who is also a “director of emerging technologies for a non-governmental organization working with the United Nations World Intellectual Property Organization,” the patent seeks to re-facilitate the spirit of sharing blockchain innovation (which has been stunted due to the rising number of blockchain patents). By signing up, companies will be able to gain access to all the other patents in the BDPL, but they must also share theirs as well.

Now this may not sound like the most attractive arrangement for businesses, especially because proprietary products are how many companies thrive in today’s capitalistic economy. Luckily there’s a huge incentive to join the BDPL, especially if you’re a mining company.

Asic-Boost as the Lure

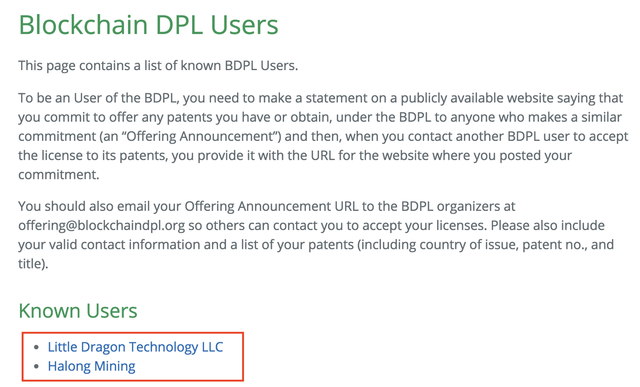

Little Dragon Technology LLC announced on March 1 that it would sign up for the BDPL. As the current holders of the patent on Asic-Boost, they are essentially offering it as an incentive for other mining companies to join the BDPL.

In fact, one company has already started to reap the benefits of being part of the defensive patent. Halong Mining has announced that they have successfully integrated Asic-Boost into their specialized computers, becoming the first Bitcoin mining hardware company to do so. This bodes well for the Bitcoin community as Slush Pool has also added overt Asic-Boost support in preparation for some of these miners to come online.

Now if I’m Bitmain, I have two choices:

- Join the BDPL to use Asic-Boost but give up my other patents I have and/or could be developing.

- Not join the BDPL and watch my profitability and hashrate dominance dwindle slowly as others capitalize on the increased efficiency up to 30%.

Many in the blockchain community view this as a win for decentralized mining:

However, not everyone in satisfied with the result:

The two-fold sense of irony should not be lost on those who follow Bitcoin closely:

- Asic-Boost, the once criticized mining exploit, may possibly become the unifying factor to increase decentralized mining.

- Bitcoin’s network security is being protected by the very financial infrastructures it was designed to overthrow. This became a reality the moment that the Asic-Boost patent was used to threaten miners prior to the implementation of SegWit. It is reinforced even more now with the BDPL.

The truth of the matter is, Bitcoin has reached a level of adoption where its network is being directly affected by government regulation. The BDPL serves as another step towards this direction. I believe this is the fundamental underlying issue for those who aren’t thrilled about the new defensive patent. Rather than relying on protocol, extra-blockchain measures are being leveraged to protect the security of the network.

On the other hand pragmatists argue Bitcoin exists in a regulated world and has finally grown “too big for its britches.” Even though this patent license situation isn’t ideal, mining hardware manufacturers are willing to use their patents aggressively. Therefore, using patents defensively is justifiable as it simply levels the playing field.

The Bitcoin community now has two paths laid out before them:

- Do they adapt to a new era of pragmatically relying on extra-blockchain factors for network security should the occasion arise?

- Or do they remain a “purist” by refusing to let anything outside of the blockchain protocol to influence the network, especially its hashrate security?

The success of the BDPL remains to be seen as only two companies have signed up for the BDPL:

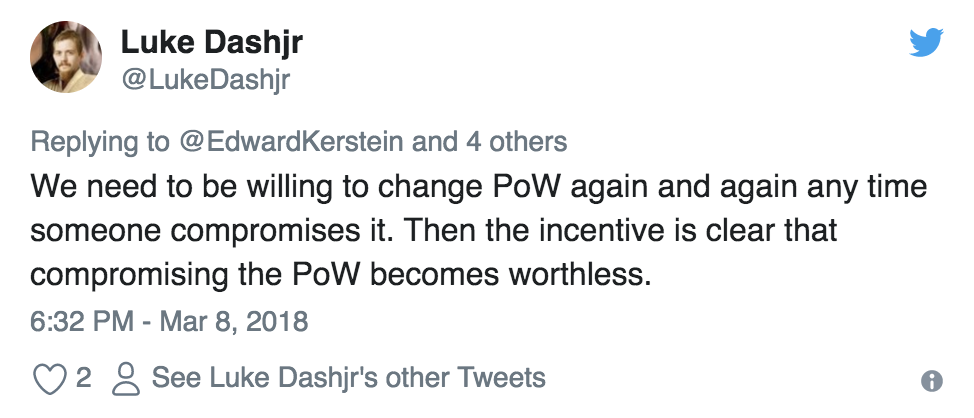

Meanwhile, a notable member of the Bitcoin community has been advocating for a change in Proof of Work:

Though this may sound like a high-risk solution, it is not new idea. In fact, it was once proposed to the Bitcoin community back in 2012 and is also on Vertcoin’s roadmap as a threat to any miner who attempts to run an Asic on their network. Furthermore, there is a cryptocurrency (Monero) that is scheduled to perform a hard fork to specifically address this problem of centralized mining:

https://www.reddit.com/r/Monero/comments/83d3vk/a_call_to_mine/

What’s left now is for us to simply wait and see how successful the BDPL will be. If it eventually fosters more decentralization in regards to Bitcoin’s hashrate, it may create an open stance towards a continued integration of Bitcoin’s protocol with government regulation.

Meanwhile, it may be worthwhile to keep track of the successfulness of the Monero hardfork and use it as a case study to see if changing the Proof of Work algorithm is a viable solution.

A common misconception about centralization is that people think it only applies to government, which is not true at all.

If BTC wishes to have a future in global adoption, then it needs to take steps to prevent mining groups from dominating the network.