The Bitcoin Ranger? A Response to Mike Adams Uninformed Statements on Bitcoin

A couple of weeks ago as Bitcoin and the rest of the alt coins were taking a break from a long-lasting bull run, I wrote, “Bitcoin and AltCoins Take A Well Deserved Breather and A Response to Natural News.”

In the latter half of the article, I addressed bitcoin haters and critics, but also made a point to directly address Mike “The Health Ranger” Adams of Natural News. I respect Mike’s insights on the subjects of health and nutrition, but when I saw him speaking about bitcoin in a bad light, I knew I had to respond to his apparent lack of knowledge of the bitcoin market.

Since then, he has gone further into absurdity, releasing a video entitled, “BitRAPED - How Bitcoin is not a magical source of wealth creation.”

Yes, Mike came back with another uninformed bitcoin hit-piece. Did no one forward our response to his last one that made him look quite silly? In it, we easily dissected his critiques and suggested that he stick to talking about vitamins instead of finance.

And, if the comments section of his video is any indication, so are many others.

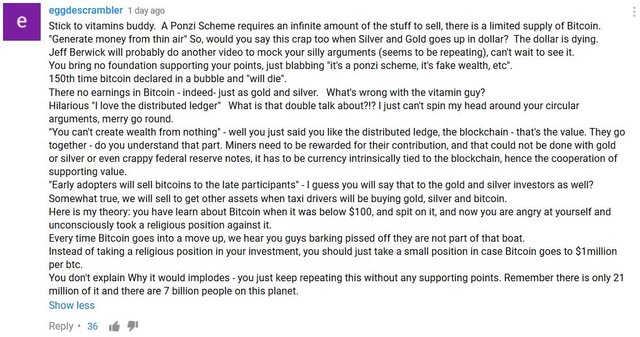

And Eggdescrambler correctly predicted the future when he said, “Jeff Berwick will probably do another video to mock your silly arguments.”

I really don’t want to get into a conflict with Mike. But his arguments are so weak and uninformed that they need to be publicly outed.

Mike starts his latest bitcoin video saying; “I’m going to talk about why bitcoin is a fraud as it’s currently being promoted.” He continues by likening bitcoin to a Ponzi scheme and further insists that it is a bubble much like the tech, subprime mortgage, stock and bond market bubbles. He then calls people investing in bitcoin suckers who think they can just “effortlessly make money out of thin air.”

This is an absurd apples to oranges comparison because bitcoin is an entirely new asset class. It’s an emerging currency - not an equity stake in a company or mortgage bond.

That Mike believes the value of bitcoin is derived from nothing but thin air, shows his lack of understanding about the way currency and money evolve. Unlike the fairy tales they tell you in school, governments don’t decree money and currencies. They co opt them, monopolize them, or outlaw them. It is true that bitcoin is a “digital’ currency. For the most part the fiat money you use every day has already become a digital entry - the central bank can create dollars without printing them, just by making entries in a computer. This is how money is created out of thin air, willy-nilly, by decree. But you have to outlaw real money if you want to do this or it won’t last.

Mike and other critics would do well to learn exactly what a Ponzi scheme is and who really creates money out of thin air. For that is one of the things that make bitcoin attractive. They aren’t actually just created out of thin air. Like gold, they have to be mined, except in the crypto currency space this means the mining of “power.”

Bitcoins are created through extensive effort and risk through such “mining”, which has real and large capital costs and expenditures. The capital committed to these projects have a real opportunity cost. The technological application that underlies them have real benefits. But, like when the internet first became available to the public in the nineties, some people didn’t get it even when you explained it to them as an information highway.

So when Mike presses on that the wealth being generating by bitcoin holders is the equivalent of “money being farted out of flying unicorns as rainbow money as they dash across the sky with their farting rainbow powered butts” he should probably be pointing his health guns at the Fed. In the Schumpeterian sense of creative destruction, the blockchain, like the internet was, is disruptive and destructive. As Ethereum’s CEO said, it is “marching confidently across the industries. … [with] the potential to be deployed by banks, financial institutions, businesses, regulators, etc.” It will rearrange capital, labor and the way we do things in ways that Mike and others cannot yet see for that will be the purview of human trials, of those that do.

Bitcoin is the market’s response to a Ponzi scheme perpetrated by the central banks who took gold away from it, and outlawed it. If it is successful, it will create an entirely new paradigm in money and banking that has the potential to end all wars, government, and central banks. Or, from Mr. Vitamins economic analysis… unicorn farts?

The next point of contention Mike makes is that bitcoin is a dangerous investment because there is no “bitcoin corporation,” to hold accountable. As already pointed out, historically money emerges spontaneously, it arises like language, bottom up, through exchanges.

It is a bit of a tech itself in that it is the market’s innovation on direct exchange.

The fact that there is no centralized bitcoin corporation is EXACTLY WHY it makes a sound monetary or currency asset. When Ludwig von Mises defined sound money, he said specifically it just meant that the government buds out of it, that no one institution has the ability to control its supply. That’s why the market picked gold. In the same way, no evil government agency can raid the headquarters and shut it down or kidnap bitcoin’s CEO.

As we have mentioned numerous times, short of turning off the internet everywhere on Earth with an EMP, bitcoin cannot be stopped.

While in one breath claiming that bitcoin is a “fiat cryptocurrency” in the next Mike says that it is a mathematical certainty bitcoin mining will end at some point. How can it be both? The word “fiat” means by government decree almost literally.

Mike doesn’t understand the economic implications of his own argument because, like most slaves taught by their government masters, he has no idea where money comes from, nor any clue about the difference between good and bad or sound and unsound money.

Wait… big surprise! He’s the health guy. Why in the world is he making a fool of himself talking about things he knows nothing about? Because that’s part of the internet reality.

He is free to say what he wants. Along with all the good the internet brings it also brings the bad, and that is the thing about the market. Bring it all on and let people learn to separate the wheat from the chaff rather than tell them to rely on the authorities to make sure no bad gets on it. It’s beautiful. Fools will be fools and history and the market will put them in their proper perspective. Our readers are no fools. We are not Luddites, afraid of embracing technological solutions to the corruption created by government or the innovations that bring wealth.

Whatever the case may be and whatever happens to bitcoin, Mike’s analysis hopefully is sounder when it comes to giving health advice. Hopefully, for his customers, he does a lot more research on the stuff he apparently has some credibility about. But his analysis of bitcoin is a bad sign. So beware.

As Mike said himself, someday in the distant future, bitcoin mining will cease after all 21 million have been mined. It is therefore, by definition, finite, unlike any kind of “fiat” in history.

Indeed, it gets even worse. Embarrassingly worse, as he can’t get this most simple point, a point that in fact falls on many deaf ears.

Consider where in one article written by Mike 3 days ago he states:

Bitcoin mining will collapse in the next few years, and the blockchain will follow

“Bitcoin will approach its “end game” in the next decade when all Bitcoin mining permanently ceases due to the mathematical limit of 21 million Bitcoins in circulation. (The mining algorithm allows no more than 21 million coins to exist.) In the last 24 hours, 1,850 Bitcoins were successfully mined. This is equivalent to approximately 675,000 Bitcoins in a year, accounting for parallel increases in computational difficulty and enhancements in ASIC mining rigs that carry out hashing calculations more efficiently.”

This is simply false. Bitcoin is nowhere near its “end game”. Mike’s numbers are incorrect.

The math can easily be done if one is aware of the fact that miners will receive half of the bitcoin reward they get for solving each block every four years.

Based on the block reward halving frequency of four years, the last bitcoin probably won’t be mined until the year 2140. According to math and knowledge that there are 32 halving events, in 2136, the block reward will yield 0.00000168 BTC per day, which is 0.00000042 BTC per block. That's 42 satoshis.

Finally, even when the last bitcoin is created in about 100 years, bitcoin can still continue on.

The business model would change. The miners would solely rely on transaction fees, which Mike actually pointed out, have been rising tremendously… although he said that that rise in fees was a reason bitcoin would die… but then says bitcoin will die because miners won’t be rewarded for mining anymore.

His arguments make no sense… it’s like he just found out about bitcoin a few weeks ago, did a Google search on it, and then decided he needed to come up with a number of reasons to try to scare people about it.

Yes, it’s true, bitcoin currently has problems mostly due to a massive upswing in usage. It is currently working its way through those just like it has since its creation in 2009.

Yes, it’s true, bitcoin has risen by about 200% in the last 6 months and it could certainly have a sizable pullback after such big gains.

And, yes, it’s true, that bitcoin could have problems in the future related to mining rewards, quantum computing or unforeseen hacks.

It’s not risk-free. At all.

Currencies and money are things that emerge over generations, and bitcoin is still emerging.

But, Mike, the vitamin guy, didn’t gave any new critiques of bitcoin that haven’t already been talked about for years and he gave even less evidence for his claims.

Really, Mike, stick to vitamins. I guarantee you, The Dollar Vigilante will not be doing exposes on vitamins at any time in the foreseeable future. We love to hear what you have to say about them… because you know about vitamins!

You clearly don’t understand money, finance or economics though… and definitely not cryptocurrencies. So, why not leave that up to us? We’ve been talking about it here since it was $3 in 2011.

We kinda know what we are talking about.

On that note, if you want to learn more about bitcoin check out our free 4-video tutorial where you get the chance to receive $50 in bitcoin directly from me.

Check it out Mike, I’ll even send you $50 in bitcoin so you can actually use it to find out how bitcoin works.

Mike needs to stick to what he does best - Health Industry! Everything Bitcoin we go to the Man @dollarvigilante

Again the bitcoin bashing. Well another tool just like james woods and these other suckers. Don't they get bored of this? I mean if he would have spent that energy into getting into bitcoin, he would chill out in anarchapulco with you ^^

Oh and btw. Great response jeff! :p

yea, mike is still at this? it just gets more silly the harder he tries. makes me wonder if he is really this ignorant or if he has a disinfo agenda... not sensible posturing, can't be helping his own health cause with this misinfo. what's his deal?

I too follow the Health Ranger's info on all things health related.

I understand his concern about bitcoin, but don't think they'll be any more of an issue than with dollars.

Money is an idea backed by confidence. It has value so long as it holds confidence. Value is subjective. Money could literally be anything we agree upon. So long as we're confident we can use it to exchange for goods and services.

Dollars are just as digital as bitcoin, except the Fed can continue to inflate them to oblivion, as the history of hyperinflation shows.

There's still only a small percentage of the world's population getting into bitcoin, which means the price discovery is still ongoing. Which means it will continue to rise, swing past it's eventual "real value" and then back down, and then back up, etc, etc, etc, until it settles around its "real value" range.

The simple truth is that no one knows what's bitcoin going to look like in the future, especially not Mike

We on the other hand have very good vibes about it :)

Bitcoin is cool, but STEEM is 100 times better... even the transactions speed of 3 secunds always and free transactions... I keep everything in Steem, 3-5 years ago I had everything in Bitcoin.

But of-course I agree with Jeff Berwick.

Yeah...Uninformed indeed. Sucks for him.

I heard and did not get down with all the BTC bashing... He still on for my best truther rap video though.

Vaccine Zombie

Like Jeff was basically saying, he can stay in his lane here.

:-P

Mike Adams is knowledgeable in many things, however I also thought he was out of his element with the bitcoin declaration.

Nice take.. a bit personal. I just wrote something at the same time as you. A bit more technical:

https://steemit.com/bitcoin/@kyle.anderson/bitcoin-end-game-a-mathematical-certainty-correcting-bad-bitcoin-journalism

Yeah sure there will still be some satoshis until 2100 but Adams point with mining still stands.

Doesn't mean his reason is sound.

These are two excerpts from my bit by bit run through Adams' piece. I do not like poor Bitcoin journalism.

I too would be willing to send over a mBTC so he can get to know the system better.

https://steemit.com/bitcoin/@kyle.anderson/bitcoin-end-game-a-mathematical-certainty-correcting-bad-bitcoin-journalism

Jeff, thanks for showing us this pit of ignorance. Mike does great work in his area of knowledge. i just can't understand why someone would do this to their reputation. Anyway, I just wanted to thank you because you have saved my life. Your courage in being open to the depression you have been in and your rise back to health has been my beacon in the night. I am feeling better than I have since I was a teenager. I am 43 and was ready to give up. I just wanted life to be over and I was never that way when i was younger. i loved life and remembered how I felt then.The last 15 years have been hell. So a heart felt thank you goes out to you. If not for your courage and openness I am not sure i would be here today.

I'm not Jeff but it seems like this person has done wonders for your psyche. Hope you the best.

Those are my words not jeffs.

Adams is usually so level headed.

It's like saying, in 1994 that, 'this internet thing is all a scam, it'll never amount to anything'.