How to overcome the syndrome of lost profits

How to overcome the syndrome of lost profits

It was a significant year for cryptocurrency, the total market capitalization has risen sharply from January 1 st to 6-fold from $ 18 billion to more than 111 billion dollars as of June 13 (to date more than 150 billion dollars).

Syndrome of lost profits phenomenon is real. The new money coming into the market with astonishing speed, to such an extent that many exchanges have been problems with the registration and verification of their new customers to meet the increased demand.

These new investors are coming in droves after hearing about the sky-high revenues from a friend or a friend of a friend, or a friend each other.

Once they have passed the verification process Coinbase or Gemini in, or Kraken, new traders sent its first market order and rush kriptosumasshestviya masters them. Next, to the stars!

Then the price drops by 10%, the newly minted investors panic, they convince themselves that they were fundamentally wrong, that the price of ETH or BTC will fall to zero, and that they should immediately close their positions. In a panic, they start selling, feeding a small pullback prices down.Phew, the failure was so close. It came just in time.

Recent attacks syndrome of lost profits in the BTC and ETH trade

We have seen this phenomenon several times this year, and I, as an investor, too concerned when I see how lost profits syndrome affects the price of ETH and BTC. The price of my portfolio fell by 20-50% in just one hour.

However, to protect themselves from the syndrome of lost profits and any reflex reaction to a panic sell-off that could happen to me, I did two things:

Firstly, I brought their coins to the exchanges. It does not give me the opportunity to quickly get rid of their position at the time of any sale or panic. I advise you to do just as well, if only for safety reasons, as the store coin on the stock exchange is to expose themselves to additional risks in the event of its bankruptcy or hacking.

Secondly, I have calculated the estimated cost of the Ether and Bitcoin in 2020. It gives me more confidence in the long-term prospects cryptocurrency and my investments. I'm not focused on intraday trading, and in the long term - and it helps me get through the short-term storm. I'm not even saying that I am right, but it's my long-term changes and forces to be more patient investor.

"I think that by 2020, the market capitalization of Bitcoin and Ethereum of 4.5 trillion dollars."

Okay, slow down partner, where did you get that? So much for my simple explanation:

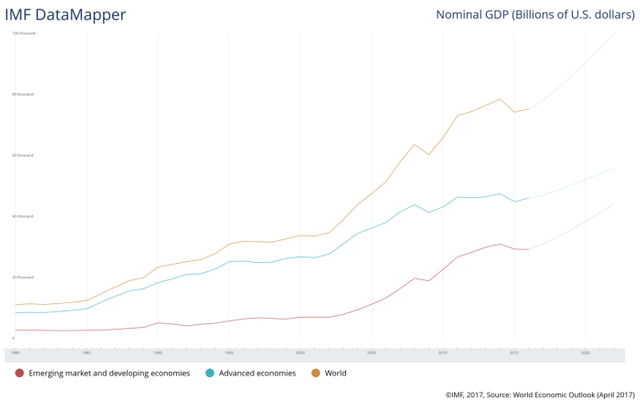

World economic growth

Nominal GDP of the global economy (in 2016) was 78 trillion dollars. By 2020, the IMF estimated nominal GDP will grow to 91 trillion dollars:

Ask yourself three years Could it be so that 5% of global GDP will be stored and exchanged using blokcheyn technology?

In my mind and will for many reasons: Enterprise Ethereum Alliance ; massive investment that international banks are investing in blokcheyn-technology; interest in digitization rates in countries such as Russia, China and others; leveling of the world's political forces, because it is cheaper, faster and safer than the current financial technologies.

Well, the premise is. Now a little math. If 5% of global GDP in 2020 will be presented mainly blokcheynami then cryptocurrency value is approximately 4.55 trillion. dollars.

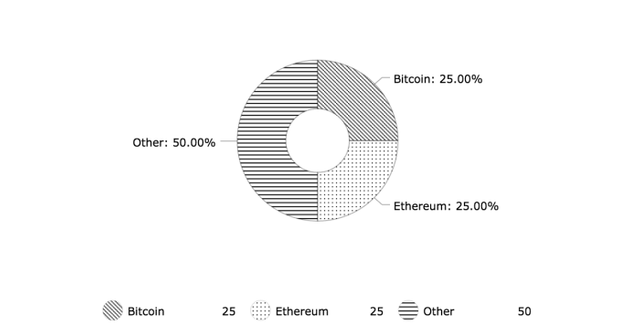

If you advance the role of the dominant blokcheynov ETH / BTC, what is their value?

For simplicity, let us assume that BTC and ETH equally dominant, each with 25% of the total market cryptocurrency and the remaining 50% distributed across hundreds of other coins.

This means that BTC and ETH stake would have accounted for 25% of the 4.55 trillion dollars, or 1.1375 trillion dollars on each network.

How much could cost one Bitcoin?

In 2020 there will be approximately 18,375,000 BTC in circulation. 1 137 500 000 000 dollars divide by 18,375,000 61 = $ 900 per coin approximately + 2,200% today.

How much could cost one air?

Everything here is a little more difficult to calculate due to not quite understand the situation with the emission of air in the future: how PoS can change the air discharge rate, and what effect the Ice Age on the issue of ETH is still unknown.

According to the original model the emissions from approximately 2014 planned 162 million Eth in circulation in 2020, but according to the / u / manly , according Vitalik rather be around 100 million coins, so we take this number to calculate.

1 137 500 000 000 dollars divided by 100 million = 11 375 dollars for a coin, about 4 000% today.

Okay, what if BTC and ETH will account for more than 50%?

If the BTC and ETH amount to 33% of the total market capacity each, the market capitalization of each amount to 1502 trillion.

BTC in this scenario would cost 81 742 dollars: about 2 900% gain today.

ETH would have been 15 020 dollars: about 5 300% gain today.

Again, this is just a comparison of like with like, without taking into calculation of speculation in the market, the dividends from the confirmation of the share or interest of the new versions of the EIP or BIP, or other external forces that could be taken into account.

Finally

Resist the syndrome of lost profits, long-term prospects blokcheyn technology is much more than the prospects for any single company or a single market segment. Tune in for the long term, and protect their investments from short-term market drawdowns.

I'm not saying that my predictions are correct, I just want to share with everyone how I foresee the value of ETH / BTC, the validity of their long-term investments and the way I deal with the syndrome of lost profits in times of market volatility.

Congratulations @dmnik! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Let's go for the Quarter-Finals

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes

Congratulations @dmnik! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!