How to borrow from your HODL without price risk.

I am not a financial advisor and this is post shall not be construed as legal or financial advice. Links below contain an affiliate code. US based IP addresses are denied registration at Bitmex, so configure your exit proxy accordingly.

The Tempting Fiat Trap

For many, the rapid ascent of Bitcoin and other cryptocurrencies has done great things for their net worth. This creates a bit of a quandry when deciding to use that new net worth to improve your quality of life, or to let it ride and achieve even longer term goals.

SALT, Othera and Unchained Capital are just a few of the projects in the market looking to solve this issue. They will collateralize your crypto in exchange for what you need for money now, ensuring you can buy your crypto back at the price you sold it at. Since they are holding your crypto, it's not being sold so long as you repay the loan, and can continue to appreciate. You've now used your gains while continuing to make gains, sounds perfect right?

Not quite. These solutions largely work like traditional debt, in that you are paying interest and your collateral is subject to confiscation. KYC/AML regulations apply to these solutions as well, making them antiquated bordertarian solutions before they've even launched.

The most important factor in the launch of the Wall Street futures is that it allows traditional, fiat-beholden businesses, to hold Bitcoin without price risk. You have this ability as well, with tools like Bitmex.

On futures exchanges like Bitmex, you can use a fraction of your Bitcoin to represent a larger amount of Bitcoin to compensate for price fluctuations, like so:

Let's say you have $1,000 worth of Bitcoin and need to borrow $500 of it. Let's also assume Bitcoin is roughly at $10,000/coin.

- Sell your $500 (50mBTC) to do what you need to with it.

- Deposit $500 (50mBTC) into Bitmex

- Buy 1000 XBTUSD (US Dollars worth of Bitcoin) on the furthest out future available. (Usually 3 months out)

What you will have achieved here is that, if the price of Bitcoin increases, you will receive Bitcoin in the amount equal to that increase. If Bitcoin price doubles, your $1000 purchase of XBTUSD will now be worth $2000, meaning you now have 100mBTC. The loan has now re-paid itself!

If the price goes down during this same period, your 50mBTC will conversely become smaller. This is offset however by your repayment, you will now be able to re-pay the 50mBTC you borrowed for less than you cashed out at. This puts you at a break-even.

How to use Bitmex

If you're not acquainted with trading or financial products, and consider much of what I wrote above to be gibberish. Don't worry. It'll click once you start playing around in the interface.

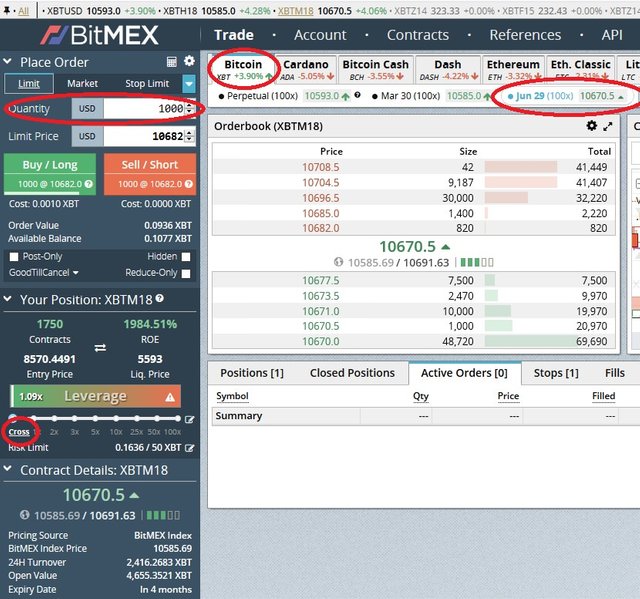

In this screenshot I've highlighted the key components you will need to set up your order.

- XBTUSD amount in Dollars

- Specify Cross-Margin

- Bitcoin tab (or shitcoin of choice)

- Choose the right-most contract for longest time-horizon.

I want to emphasize that if you are still completely lost on how these instruments work, educate yourself before putting any money into play. There are great tutorials out there to go over the basics.

Force Majeure

Any complex financial decision comes with risk. These risks are not unique to this method.

- The numbers above assume Bitcoin will not drop by 50% or more through the life of the loan. If this occurs, either with this method or the antique solutions, your collateral can become worth less than what you have borrowed and result in liquidation.

If you feel Bitcoin could dip more than 50%, with this method, you should adjust your borrow-to-balance ratio accordingly. - Even though Bitmex is an extremely large, profitable, competent, and generally trusted resource in the community... it is centralized. This does present a small, but not insignificant, counter-party risk that also exists with traditional solutions.

Cost Considerations

Borrowing money from someone else incurs interest costs, borrowing from yourself does not. However, be mindful that a round-trip trade on Bitmex is going to cost roughly 1% in commissions, plus your mining fees for transfers. You will also likely incur fees when selling your BTC for fiat and back again at your Exchange/ATM of choice.

If you are borrowing for an extended period of time, let's say longer than the 3 month futures contract, you will likely need to rollover into the next contract, thus incurring another ~1% in Bitmex commissions.

This sounds complex and expensive, but it really isn't. All totaled, these fees should be less than 5% on a 1-year play. That is MUCH cheaper than any credit card or SALT loan.

Congratulations @diecommiescum! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @diecommiescum! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!