What the Fork just happened?

It's sure is good that Bitcoin is in such a powerful bull market this year. Because using the leading crypto currency is not exactly what any rational person could describe as being "user friendly."

I mean, just imagine if fiat currency holders had to spend most waking hours constantly on guard, monitoring multiple web sites for details of the next "hard fork" in the road (something like a stock split) and were forced to speculate about how to claim the new coin to be issued and what the price impact of the fork will be?

Especially given that if you aren't with the right crypto currency processor (the equivalent of the bank) or aren't willing to perform this new scary sounding procedure of transferring all of it to some "private keys" (the equivalent of liquidating all your financial assets and withdrawing all your cash from the safety of banks) then you would lose out on the new Bitcoin Gold or whatever was to be issued that week. And then, just to create even more uncertainty, they pull off the fork move a days prior to when it was supposed to happen.

I don't think fiat currency holders or stock or bond holders would tolerate this sort of thing for very long.

Or how about, in this new age genre of payment processors and crypto currencies, that Russian hackers can take it all in an instant, practically at will. And there wouldn't be a damn thing you could do about it. Equifax can't stop hackers. How is the average person expected to?

Compare this to chartered banks, which haven't lost me a dime of my deposits in a lifetime, and continues to guaranty replacing cash if it were somehow lost to a hacker (up to deposit insurance limits, of course).

Secondly - I'd love to hear what's going to happen to this amazing bull market, once all the geeks are in. After all, only geeks (or really, really, desperate network marketers) could possibly handle the complete lack of security let alone how inconvenient and tedious crypto currencies are. 99% of the population won't be willing or able to handle crypto currencies. So what will happen to this bull market once and last few geeks get in and there's no more new fresh money to boost demand and prices ever higher?

I suppose there are a few answers for this. For instance, once all the old fuddy duddies (such as myself) are long gone, replaced by the more capable online millennials, the user unfriendliness issue could decline. Or given the number of Bitcoin will be limited to only 21 Million vs. fiat currencies which print infinite amounts, this will compensate for issues. Or, large entities may continue accumulating vast quantities of BTC (they'll just hire geeks to it for them).

But I do believe the average person has no desire to touch this stuff. Not unless the terror of owning these thing is drastically reduced.

Don't get me wrong. I'm still a fan of this crazy Bitcoin bull market. Still a holder. Still accumulating more. And I suspect I will remain one for a while. But these are some of the questions we might want to be asking the crypto gurus. The answers could help us estimate the ultimate end of the bull market.

Because all bull markets do end. I realize that's hard to even imagine, given recent price gains. But they do. I guarantee it.

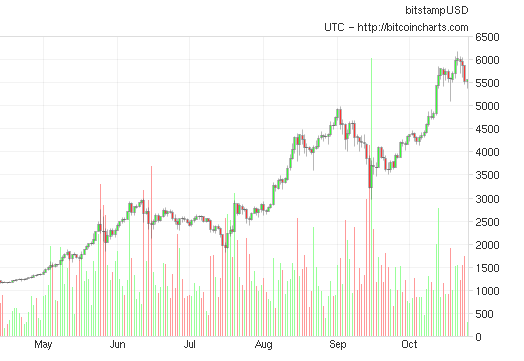

NEXT: Technical Elliot Wave analysis of the BTC price chart - Time for a pause?

Louis Paquette

Vancouver, Canada

My Facebook

Good post. I Agree 100%. The forks make me nervous af. Still early days, but each one has potential to throw a wrench in the cryptocurrency market.

Thanks grake!

You make some good points. Bitcoin is still relatively UN-User friendly. But then so was the INTERNET in the late 80's and now even my 90 year old Gran is online.

Very true! I can still recall how just getting online some days was a challenge...