What is Bitcoin for Dummies: A Guide For Beginners

What is bitcoin? It’s digital money. It’s the new gold. It’s hot and everyone wants a part of it.

This article is for those who are yet to understand the cryptocurrency world.

By the end of it, you’re going to either love crypto or hate it.

Let’s start with “currency”

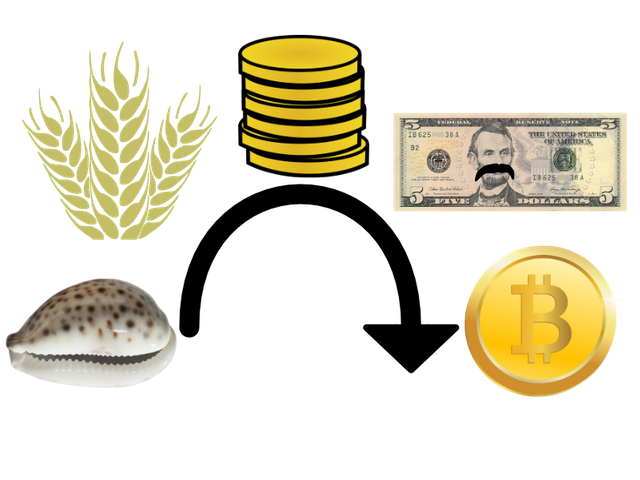

Currency means “money currently in use”. US dollars, European euros, Russian rubles, and the Chinese yen are all government created money known as “fiat currency”. “Fiat” just means an official order or authorization.

For approximately 4,000 years and across the globe, people used shells known as “cowries” as currency. They were beautiful, unique, and could not be manufactured.

Later (almost 2,000 years ago), in and around Egypt, wheat was used as a currency. Wheat, being a common and important part of our diet, was valuable, portable and exchangeable.

Today, governments authorize their bills as legit, and because we have faith in our governments and banks, we use their money. Ultimately, the worthless bills are just an idea backed by confidence.

What about Crypto?

Then you have cryptocurrencies. Crypto- is short for “cryptography”, a computer technology used for securing and hiding information, among other things.

Cryptocurrency is defined as electronic money made with technology to:

- Control how it was made

- Protect transactions

- Hide the identities of its users.

The technology around cryptocurrencies effectively give them the same traits as regular, cold hard cash.

Cryptocurrencies are not made out of thin air. Instead, people have their computers work many hours and expend massive amounts of electricity to “mine” the digital money. They solve mathematical equations. More on that later…

Enter…Bitcoin

Bitcoin was the first widely adopted cryptocurrency, and was created in 2009 by Satoshi Nakamoto. No one knows who Satoshi is, the developer could be a guy, gal, or a group of people. And here’s the kicker: Satoshi disappeared before bitcoin took off. No one has heard a peep out of “him” for years.

Bitcoin Versus The Dollar

Did you know that the American Bureau of Engraving and Printing (BEP) prints billions of US dollars each year? During 2016, the BEP delivered 7.6 billion notes to the Federal Reserve, that could be 1s, 5s, 10s, 20s, or even 100s totaling lots and lots of money.

While it’s true that 70%+ of the notes that the BEP delivers each year are used to replace worn out ones, that still means approximately 30%, or 2 billion notes, were introduced that year!

Because the government creates all of our money, that means they also control it. If any country were in a severe emergency, the government could prevent you from accessing your money. For example, in June 2015, the Greek government froze all banks. They limited everyone to withdrawing only $67/day from their own accounts!

For Americans, this example hits closer to home: if you owe the IRS money and have not paid, they have the right to freeze your bank account and 15–21 days later take your money to cover your debt.

Enough with the fear tactics, let’s dig into bitcoin.

The purpose behind bitcoin is to allow one person to directly send money to another. This type of transaction is known as “peer-to-peer”.

In other words, bitcoin allows Alice to pay Bob directly, whether they’re a block away or across the globe. Bob and Alice don’t need to use a trusted third party like a bank or Paypal to process their transaction. As you can see, peer-to-peer transactions are highly efficient.

And unlike US dollars, there are only 21 million bitcoin that will ever exist. Only about 16.7 million of which are available right now. The rest are slowly being created by the users of bitcoin.

Right…Now I want to bake me some bitcoin

How are bitcoin created? By a little process known as “mining” (and no it doesn’t involve underground caves, flashlights and pickaxes).

I’m going to explain bitcoin mining in 3 steps (keep in mind, this is very oversimplified):

Every bitcoin transaction is recorded and verified on a public, digital record. There are over 7,000 people using their computers to simultaneously keep identical records of these transactions. The purpose of so many records is to reduce the risk of any single person or group manipulating and falsifying the data. In other words, public records provide transparency, security and ensures bitcoin transactions are permanent.

Mining is the computer process of recording and verifying information on the digital record known as the blockchain. There are many different ways to mine but bitcoin mining also requires computers to solve a tough math problem.

Because mining requires computer power, people do this work in return for money.Miners are paid in transaction fees, that’s a small amount of bitcoin paid by people like you and I when we send bitcoin. Another incentive to mine is that the first computer to solve the math problem will earn 12.5 new, virgin coins. At the time of this writing, that’s equal to nearly $86,000.

All of this wild bitcoin technology was created by this unknown person called Satoshi. The unique advantage of that is that no bank or government creates or maintains bitcoin. In other words, banks and governments cannot control bitcoin and so cannot control its users.

Okay… But what do I use bitcoin for?

What do you use bitcoin for, what are the benefits of it and why should you be interested?

First, a short disclaimer: Nothing published in this article is to be construed as financial, taxation, investment, legal or other advice. Nothing in this article constitutes investment recommendations nor should any data or content in this article be relied upon for any investment activities. Investing in bitcoin or other alternatives is highly speculative and the market is largely unregulated. Anyone considering it should be prepared to lose their entire investment. Disclosure: I own a variety of coins including bitcoin. Keeping that in mind, the following is what I’ve seen bitcoin used for.

Even though bitcoin was designed as electronic cash, its recent creation, lack of government control and unstable prices have caused western businesses to hesitate in accepting it as money.

That hasn’t stopped tech-oriented businesses like Bitpay and Coingate from popping up and allowing online businesses to accept and store bitcoin, as well as convert it into fiat currency.

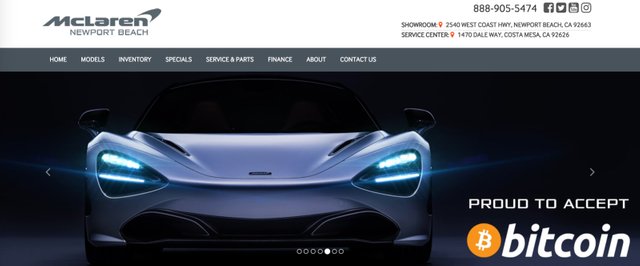

A handful of larger companies, such as Overstock and Expedia, now accept bitcoin as valid payment. And you might have heard of supercar manufacturer McLaren accepting bitcoin, though it only seems to be the dealer in Newport Beach, CA who does so.

How do you actually pay using digital currency?

The McLaren dealership is accept bitcoin through the bitcoin service provider known as Bitpay.

The payment process is simple:

You install a bitcoin wallet on your phone and make sure your bitcoin is accessible on your device.

Using Bitpay, McLaren Newport Beach will create an invoice with a barcode on it.

Using the bitcoin wallet app on your phone, you will scan the barcode.

The wallet will ask you to confirm the details of the transaction.

Once confirmed, you will generate payment and become the proud owner of a McLaren!

Lately, bitcoin has been taking the center stage in hyper-inflated countries like Venezuela. There, bitcoin has been unofficially adopted by the Venezuelans as a currency. Where a McDonald’s Big Mac might cost you one month’s wages in fiat currency, bitcoin has come in and provided a new opportunity at relatively fair exchange, since it’s not controlled by an unstable government or national bank.

While bitcoin has yet to receive widespread adoption for major transactions in North America and Europe, it has become a popular investment globally. Due to its unique technology and unregulated trade, investors have flooded in, creating volatile prices. It isn’t uncommon to see the price swing up or down by more than 10% a day.

And so, as I see it, these are the benefits of owning bitcoin:

A new way to transact outside of the government.

A way to gain 100% control over your money, outside the sphere of influence of any organization, government, or bank.

A new, very volatile investment that has probably made as many fortunes as it has broken.

OK, how do I get me some bitcoin?

Will that be cash or credit?

Occasionally you can find a bitcoin ATM, but most people buy it using a credit card or make the transaction directly from their bank account. It’s as simple as trading your dollars (or Euros, Rubles, or Yen) for bitcoin.

Despite bitcoin being rather expensive for a single coin, anyone can own bitcoin by simply buying a fraction of a coin.

The following are 3 common, simple tools you can use to buy bitcoin with a credit card:

Probably the simplest way to buy bitcoin is through Coinbase. They may not be the very cheapest, but they are one of the easiest. After plugging in your credit card numbers and verifying your identification, you can make your first purchase.

Coinmama is another popular way to buy bitcoin with a credit card. Their fees are much higher than Coinbase but have fewer identification requirements.

Bitpanda is a popular method to buy bitcoin in Europe. Their fees for credit cards aren’t very low either, but they are probably as easy as Coinbase.

Where do I keep them?

All three of those services have their own secure storage service, known as a “wallet”. But if you wanted to, you could handle storage using any one of the other dozens of bitcoin wallets available.

All you need to know is that you are responsible for creating and remembering a strong password. You are responsible for protecting your email, phone, and computer security. And it’s your responsibility to create backups of information relating to your bitcoin.

What I’m trying to say is, you’re responsible for your own bitcoin.

If your bitcoin is stolen, there is nobody to call to get it back, since there’s no authority or regulator over bitcoin.

If you’re a visual person and need more information on how to buy and secure bitcoins, I’ve created several detailed walkthroughs. Check out how I bought my first bitcoin.

What’s Next?

To summarize, the government creates and controls money, known as fiat currency.

Bitcoin was created as an independent electronic cash, an alternative to fiat currency.

Bitcoin’s advantages are efficiency, permanency, security and transparency.

Bitcoin can be used to make big and small purchases, it is used widely as an investment vehicle and it provides an opportunity to escape from the financial collapse of some countries.

All of this comes at a cost. You must be aware of the security risks in storing and using bitcoin. You and you alone are responsible for your own bitcoin.

There are well over 1,000 cryptocurrencies available, and hundreds more on the horizon. If holding bitcoin isn’t your thing, you can diversify into alternative coins.

Originally Found at MRKTRS.co

This article was originally posted at MRKTRS.co. MRKTRS is an entrepreneurial and lifestyle website that is expanding their coverage into crypto and asked me to write a “Bitcoin for Dummies” article.

About Decryptionary

My mission with Decryptionary is crypto made simple.

Decryptionary is a cryptocurrency and blockchain dictionary. It contains over 200 simple definitions, and awesome 4th-grade, stick-figure images to make this complex subject easy as pie.

Decryptionary is more than just a dictionary. It also has simple walkthroughs and word lists to make sure you really understand the basics of crypto and how to participate.

If you liked this story, and have comments or feedback, please reply below and I’ll get back to you.

You can find more of my articles by following me on my Steemit Blog.

This was a very helpful article, wish I'd found it sooner.

I don't know of you're still active on here, but I'm hoping you are and can answer my question.

I've been hearing about the high costs of bitcoin transactions when changing it to other coins or currencies and vice versa. Do those fees still apply when you do a peer to peer transfer or if you were to make a purchase with bitcoin?