Transactions Research: How Bitcoin found its niche in competition with Visa, Master Card and Paypal

In 2018 an average Bitcoin transaction volume was 450 times higher than Visa’s average, while the total of $3.4 trillion transferred with Bitcoin in 2018 is 5,8 times higher than such of PayPal.

2018 was quite bearish for the crypto market. Many projects lost more than 90% of their capitalization, while Bitcoin lost approximately 80% of its value. Nevertheless, the amount and volume of Bitcoin transaction are steadily increasing.

DataLight experts investigated Bitcoin as a payment system and compared it with the economic indicators of Visa, MasterCard and PayPal provided in their 2018 annual reports.

The results are very surprising.

Economic Indicators

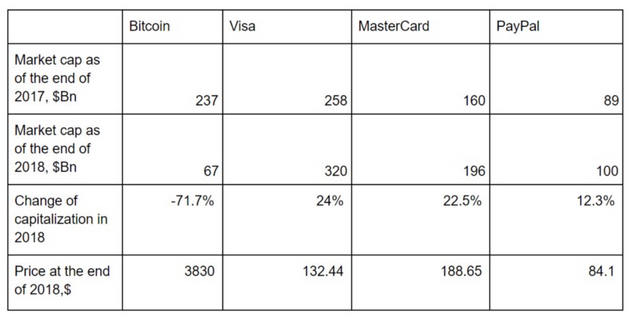

Let’s start with the traditional financial indicators: annual price change and yearly change in capitalization.

As we can see, classic payment systems have shown more than 10% growth, while Bitcoin’s price fell sharply.

Market capitalization change shows the same dynamics. However, Bitcoin’s capitalization at the end of 2017 was comparable to Visa’s. In 2017, Bitcoin’s capitalization increased almost tenfold in just half a year, climbing from $25 Bn to $240 Bn.

The crypto market is more volatile than traditional market assets.

Our research has confirmed that the average daily volatility of Bitcoin was more than 6% in 2018, which is almost 3 times higher than that of its competition.

Network Activity

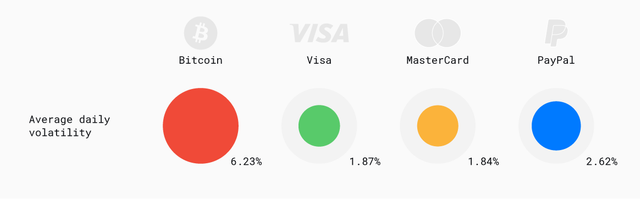

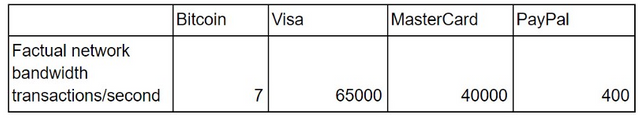

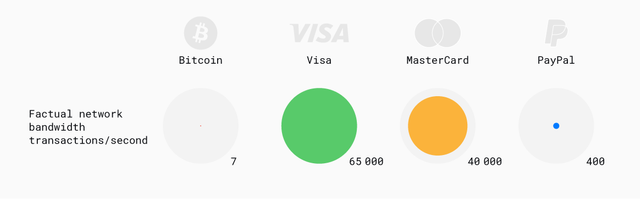

The key factor that characterizes the state of a payment network is its activity, calculated based on the number of transactions.

The capitalization/transaction parameter allows us to analyze network activity using market evaluation. That’s where classic payment systems have much lower indicators than Bitcoin. The lower this indicator is, the higher the activity index is.

Consider how identical this parameter is for Visa and MasterCard: this allows us to use such a parameter as a market standard.

.png)

Visa and MasterCard are veteran payment systems widely accepted worldwide. PayPal is a relatively young system (launched in 1998), but it’s not far behind: their indicators are 12 and 7 times higher, respectively.

As for Bitcoin, its bandwidth capacity lags behind even in 2018.

Payment statistics

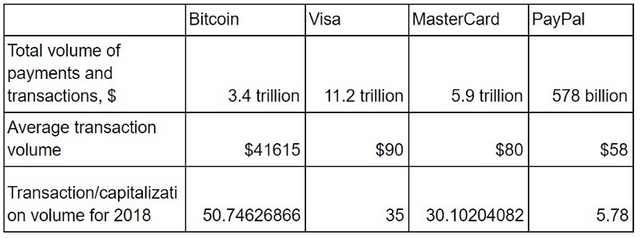

Bitcoin surpasses classic (centralized) payment systems in several parameters.

.png)

In terms of total transaction volume, Bitcoin overtakes PayPal and nears MasterCard. Having taken notice of this feature, we decided to calculate the average sum of a transaction.

Bitcoin is many thousands of times ahead of the competition in this aspect. Its $40000 is 450 times larger than Visa’s. This tells us that the Bitcoin’s network is more suitable for larger, probably international payments.

.png)

Transaction/capitalization indicator allows us to examine the network’s activity through the prism of market evaluation. In this case, Bitcoin’s indicator is higher, which leads us to the conclusion that the market evaluates Bitcoin higher than it does Visa and Master Card, both of which have values within the 30–35 range.

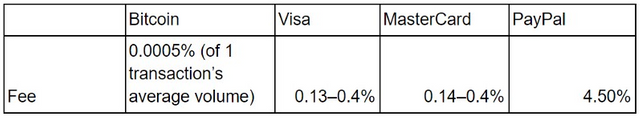

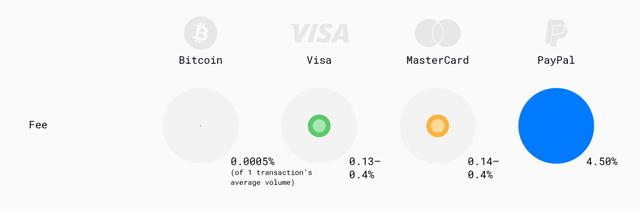

The next parameter that greatly influences the popularity of payment systems is the fee.

When transferring sums below $100, it is more reasonable to use Visa and MasterCard, but if the sum increases, Bitcoin begins to look better. Its $0.20 fee (as of the end of 2018) is the same for all transactions, even those worth millions of dollars. In this case, the fee percentage is even lower, especially compared to classic payment systems. That is why the average transaction volume differs so much: it is more profitable to transfer large sums with a fixed rate rather than a percentage of the transferred sum.

Community Statistics

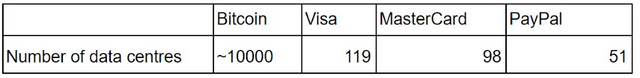

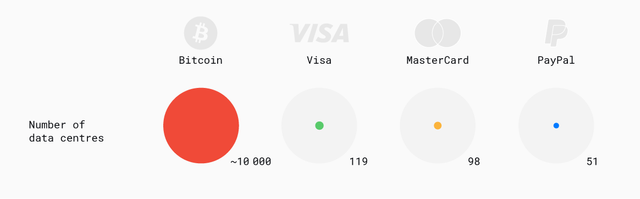

Each payment system has its own centres that allow it to process its transactions. Visa, MasterCard and PayPal have centralized data centres, whereas Bitcoin’s transactions are processed by its nodes. We compared their transactions’ quantity with the data centres of the other companies.

As we see, Bitcoin is ahead of the traditional payment systems in this aspect.

In 2018, the number of Bitcoin nodes remained steady at around 10000 despite a dip in its price and the increased cost of mining Bitcoin.

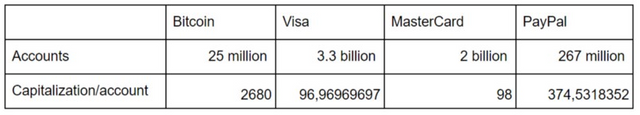

We cannot leave aside the number of accounts — one of the main indicators that show how widespread the network is. For Visa and MasterCard, this is the number of cards.

.png)

The number of accounts/capitalization is a compound indicator, which means it is defined by the market. It allows us to see the values between which the indicator is located. The values of this indicator displayed by Visa and MasterCard are quite close, which means they are market standards. Bitcoin’s values are significantly higher due to a low number of accounts.

With approximately 25 million accounts in 2018, Bitcoin loses not only to Visa and MasterCard, but also to PayPal.

2018 was a tough year for Bitcoin, as its capitalization fell fivefold, the price fell from $20000 to $3000 and the number of negative media impressions increased each month.

However, there are many good signs:

- The total volume of transactions is comparable to that of MasterCard

- Low commission for P2P and large sums, making it beneficial for international transactions

- A large number of nodes, nearing its historical maximum

- Decentralized nature

- No censorship

- Anonymity

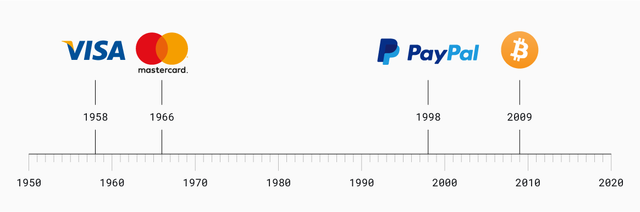

- Bitcoin competes with payment systems that were founded in

1958 — Visa

1966 — MasterCard

1998 — PayPal

Bitcoin was introduced only in 2009.

Join us and make accurate Precise Trading on our platform!

See the previous Researches

Top 5 Coins with Negative Correlation to BTC

Record-Breaking BTC and USDT trading Volumes

Amount of Trades and Exchanges' Hype

ROI since Exchange Listing

1 Year Crypto Asset Correlation Map

Bitcoin vs Altcoins

DataLight Tutorials

What is Hype Index on DataLight

Explaining DataLight indices

What is Buy Market on DataLight

DataLight News

DataLight is now open the ultimate crypto analytics tool is live and its absolutely free

All bitcoin blockchain data now available

Follow us:

Website: https://datalight.me

Twitter: https://twitter.com/datalightme

Telegram channel: https://t.me/datalightme

DataLight Blog: https://datalight.me/blog/

Medium Blog: https://medium.com/@datalightme

Steemit Blog: https://steemit.com/@datalight

LinkedIn: https://www.linkedin.com/company/datalightcandles

Facebook: https://www.facebook.com/datalightme/

This post is supported by @tipU upvote :)

@tipU voting service: instant upvotes | For investors.

How much time need, to write this post . Fantastic article

Posted using Partiko Android

Congratulations @datalight! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!